Eurozone

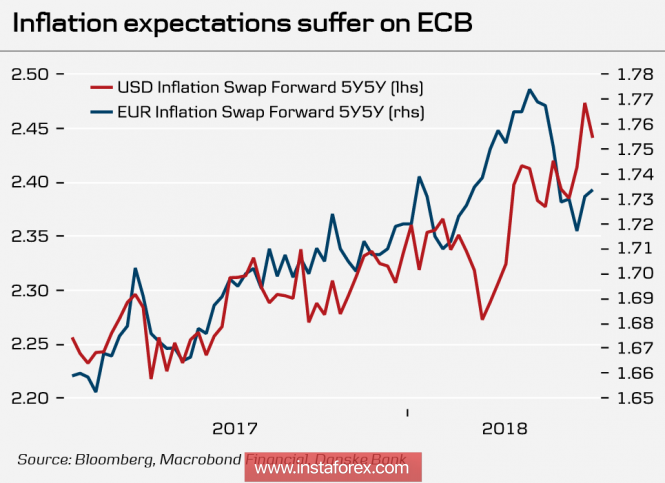

The euro finally has a driver to stop growth - inflation expectations in the eurozone are falling behind the US, which allows the bears to seize the initiative, as expectations on the aggressive policy of the ECB may somewhat weaken.

The euro has been growing steadily for several weeks, as it received strong support from a number of macroeconomic indicators that were too strong for the ECB to ignore, but a weak inflation report in January brought down the bullish sentiment.

At the moment, the market has a steady view that the period between the end of the asset repurchase program and the first rate increase will not be too short, and the first rate increase of 10 basis points will take place no earlier than Q1 2019. This year there will be many events, among which are the first results of the tax reform in the US and at least three interest rate increases by the Fed, which can significantly change the balance of power.

Bulls supports the belief that the US Federal Reserve and the US Treasury will consistently seek to weaken the dollar, because otherwise serious problems will arise with a budget reduction. This is the strongest argument in favor of the growth of the euro. At the same time, for the European economy in such a scenario is extremely negative, when the ECB in fact does not have time to do anything, and a number of eurozone countries will have overseas profitability.

The euro remains in the upward trend. The momentum has not yet been fully developed, however, the movement with a high probability will slow down and the formation of the top will begin, the trade will go in the range of 1.2335/2537.

United Kingdom

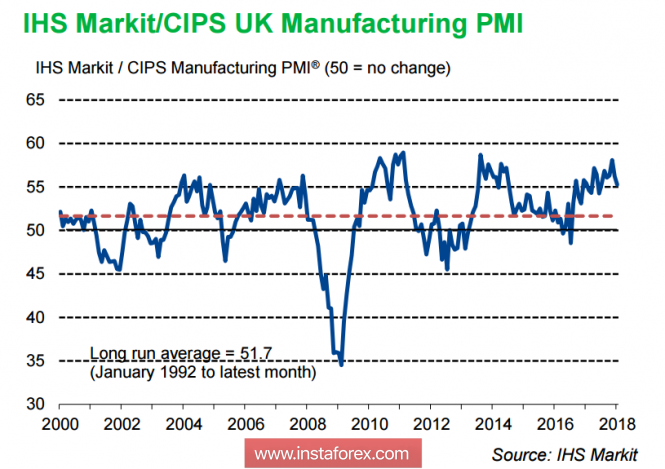

On Thursday, February 8, a key meeting of the Bank of England will be held, which will be accompanied by the publication of updated macroeconomic forecasts. Markets assess the likelihood of a rate hike as low, but the results of the meeting may have a serious impact on the prospects for a rate hike in May.

The latest macroeconomic publications were bearish for the pound, as the production PMI in January showed a slowdown instead of the expected growth, while activity in the construction sector fell to 50.2p, being in stagnation for 4 years in a row.

Nevertheless, the pound continues its growth, not paying attention to such trifles. Obviously, the main reason is that the Brexit situation continues to develop in a positive way, there are no unpleasant news, negotiations are going on as usual and by May, when the next meeting of the Bank of England is held, there is a high probability of concluding a transitional agreement.

The relationship is like this- the higher the probability of successful negotiations, the higher the chances of a rate increase, the more bullish sentiment on the pound. The Bank of England, apparently, on Wednesday will give its commentary on the course of negotiations and their prospects. While the pound remains in the growing channel, the likelihood of another attempt to test the high of 1.4344 remains high, but until Thursday, trading will most likely be in the lateral range.

Oil

Oil could not stay away, reacting to the synchronous decline with the stock markets, but managed to hold above the low of the week. Attempts to rebound followed immediately, which may indicate the unbelief of the markets at a higher rate of rate increase than previously thought.

The extramural battle between the United States and Russia continues for the title of the largest oil producer. Throughout the week, the markets have commented on record growth in production in the US, the shale industry is experiencing a rebirth and is ready to increase the volume. However, all these bearish factors do not yet have a significant impact on quotes.

OPEC+ continues to adhere to the chosen strategy, which brings more revenues with lower costs and another contract can be extended for six months. OPEC+ does not seek a record growth, the level of +/- $ 70 per barrel suits everyone, including the US, and therefore the probability of a collapse of quotations remains low.

The material has been provided by InstaForex Company - www.instaforex.com