The protracted period of growth of stock indices is over. The last correction which was two years ago have passed and since last year, the market has not grown much on real recovery indicators as opposed to expectations.

The reason for the fall, however, is quite rational and it lies in the fears about the rising cost of money. Over the past two years, the inflation rate has been moderate which has created the illusion of steadily stable economic growth. However, the Fed chose the path of outrunning growth rates, preferring to form market expectations, rather than follow them.

The Fed has used 3 ways to manage expectations. First, there are verbal interventions with a constant reference to the "Phillips curve" indicating that a steady decrease in unemployment leads to an increase in the average wage which automatically raises inflation. Both processes are known to accompany economic growth.

In fact, it is well known that in modern conditions, the Phillips rule does not work. For example, in Japan, the unemployment rate is significantly lower than in the US. In the first quarter, it fell to 2.8% but the growth rate of the average wage is consistently below 2% per year for many years. Thus, unemployment has no positive impact on inflation. Similarly in Switzerland, unemployment is at 3.3% and the annual inflation rate is - 0.8%.

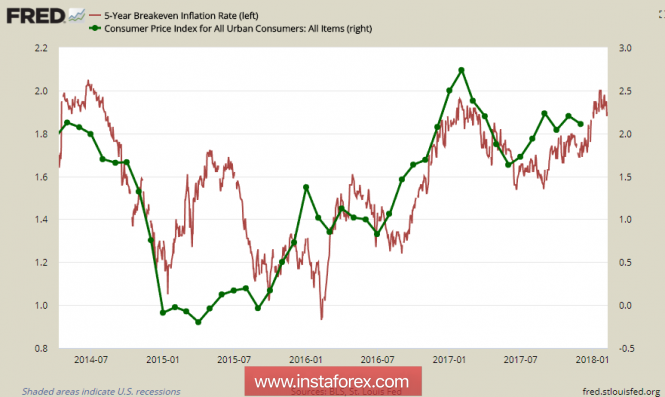

Nevertheless, this deception partly helped raise inflation expectations, which is clearly seen in the dynamics of the yields of 5-year bonds tips which was protected from inflation.

The second method consisted of a purposeful increase in the interest rate, which has been stable for the third consecutive year despite the low inflation. It is obvious that the Fed raises the stake according to the plan and not the real market indicators since corporate incomes were at a very low level only recently. Problems with the budget are increasing, which means that the economic recovery was not so strong in reality.

The third factor is the reduction in the balance of the Fed. The process itself has a clear propagandistic meaning and in the remainder it creates additional pressure on the budget as the Fed stops the practice of refinancing revenues and gets rid of Treasuries.

All these factors had to convince the market sooner or later that the recovery was proceeding at a high pace and finally, this moment came. And then a chain reaction is triggered: the markets are waiting for higher rates of rate growth on the part of the Fed, the yield on 10-year bonds is confidently approaching 3%, and all points to the fact that money will go up.

The rise in the price of money will occur against the backdrop of a sharp increase in the budget deficit as Trump's reforms reduce the income from taxes. Closing the deficit can either be a sharp increase in activity in the economy or the growth of public debt.

The first scenario is unlikely and the markets behave in strict accordance with this conclusion. The probability of four rate increases this year suddenly became topical for a reason. On January 31, Janet Yellen held her last meeting as chairman of the Fed and on February 6, Jerome Powell, who has the reputation of a hawk, officially joined the post. It was his inauguration that raised a wave of panic regarding four rate increases this year.

The head of the Federal Reserve Bank of New York supported these fears on Thursday, saying that "the US economy is growing faster than the trend."

So, the panic is a gap between the real growth rates of the US economy and fears that the rise in the price of money will lead to a decrease in economic activity. The rate of GDP growth will decline and if the inflation continues to grow against this background, the United States will cover another economic crisis.

On February 14, there will report on retail sales and consumer inflation for the month of January. The forecasts are neutral and any deviation from the forecast values can intensify the panic. The closing enthusiasm last Friday did not add any value. The trend of flight from the risk is increasing, which may well correspond to the plans of the US financial authorities, seeking to create conditions for the flow of capital into the country.

The chances of continuing the growth of the dollar under current conditions are minimal. Panic, of course, led to its strengthening but it is more likely to grow against the yen and the franc. The dollar index will probably remain stable with a downward trend on Monday.

The material has been provided by InstaForex Company - www.instaforex.com