Eurozone

The euro makes weak attempts to stay above 1.22, but success is possible only if the wave of panic in the stock and debt markets goes down, taking the form of correction, although deeper.

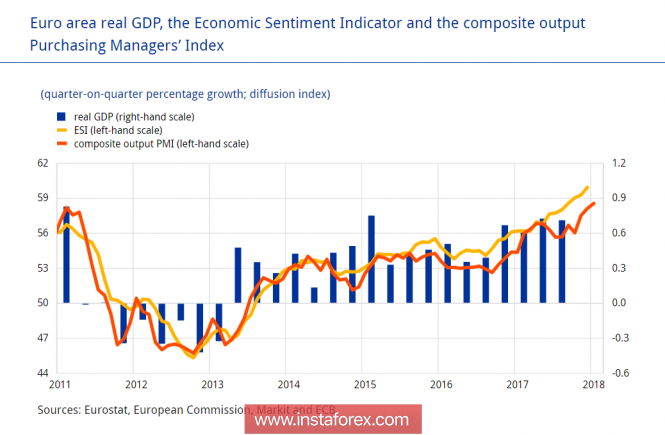

On Wednesday, the consumer inflation index will be published in Germany in January. It is expected to show a decline from 1.6% to 1.4% relative to December, but according to the forecast, the HICP index should remain unchanged at 1.4%. Also on Wednesday, Eurostat will publish an estimate of the eurozone's GDP in the fourth quarter, and there are no reasons for concern either - the PMI Markit and ESI economic activity indicators calculated by the European Commission are growing at a record pace, which, given the high correlation between PMI and GDP, which makes it possible to look at economic growth with optimism.

The problem for the eurozone is something different - the growing surplus of foreign trade leads to the need to seek the use of surplus capital. At the same time, the growth of inflation in the eurozone is not sufficient to force the ECB to begin the unwinding of its monetary policy. The spread between the yields of European and American securities is growing, and the capital from the eurozone will be in demand by investors in the US if rates in US banks continue to grow, especially since the threat of four rate hikes in the current year suddenly became real.

Monetary authorities of the eurozone will not prevent the outflow of excess capital, since this process will allow the euro to be controlled, but if the panic in the markets continues and it comes to a serious crisis, the euro may significantly weaken. Correction of the EUR USD pair is not yet completed, it is possible to decrease to 1.21, but the chances to stay above this support are still high. On Monday, the euro could return to zone 1.2305 / 20, further dynamics will be determined by whether a wave of panic that has covered the markets will develop.

United Kingdom

The pound last week has undergone multidirectional pressure. On Wednesday, the Bank of England supported the pound, leaving the rate unchanged and at the same time hinting that it could accelerate the process of raising rates due to higher economic growth rates.

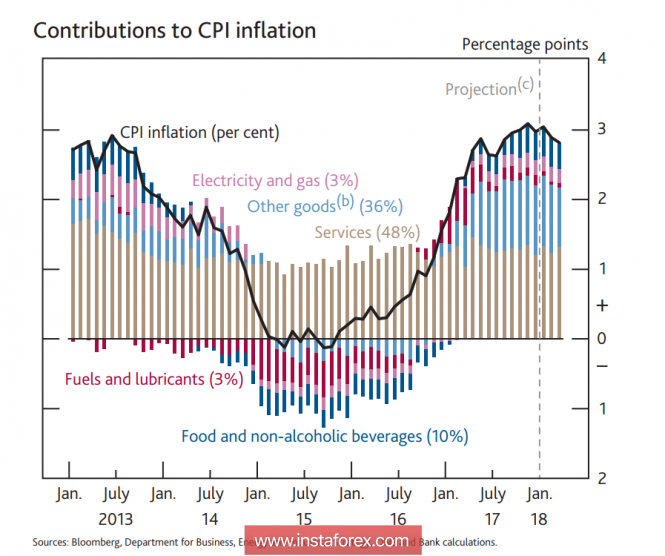

Updated forecasts suggest GDP growth in 2018 at 1.8%, which, however, is below the growth rates in the US and the euro area, the equilibrium unemployment rate is reduced from 4.5% to 4.25%, and inflation by 2020 will be 2.2%, which is higher than the target 2%, which means an increase in the rate is required.

At the same time, as can be seen from the report, the growth of inflation occurred due to other goods, that is, most likely due to imports. The strengthening of the pound eliminates this factor in the coming months.

However, on Friday, the pound's declined resumed after the EU negotiator Michel Barnier stated that the Brexit agreement might not be reached. It is obvious that Brexit still remains the main factor of influence on the pound rate.

On Tuesday, data for January on retail sales and consumer inflation will be published. The forecasts are neutral and meet the expectations of the Bank of England. Determining the dynamics of the pound will continue to be based statements on Brexit, as well as the development of the situation with sales in the stock and debt markets. At the level of 1.3700/30 is the key support level, the pound has a chance to stay higher, the breakdown will worsen the technical picture and will contribute to a rapid decline on the background of flight from risk.

Oil

The weakening of oil looks like a rout, which is expected, based on the development of the situation in the markets. Oil reacts to the threat of slowing the growth of global GDP and the development of a full-scale crisis, and this is the main driver of decline.

Another factor contributing to the decline is the production growth in the US. In addition, Baker Hughes reported a sharp increase in the number of drilling last week by 29 pcs, which indicates an increase in investment in the industry.

Support for Brent resisted until 60.98, the channel is still up, so growth attempts after the formation of the bottom are not ruled out.

The material has been provided by InstaForex Company - www.instaforex.com