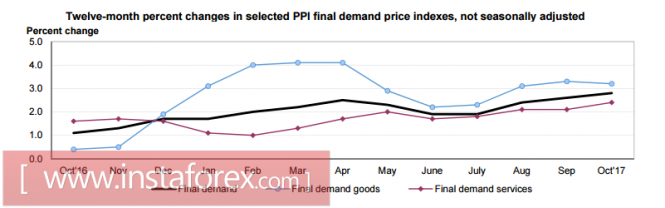

Producer prices rose 0.4% in October. The growth is similar to the September index and exceeded the forecasts of experts expecting an increase of + 0.2%. On an annual basis, growth was at 2.8% vs. 2.6% in September. This is the highest level since 2012.

A confident recovery in production prices shows the potential for growth in consumer inflation, which will affect the demand for the dollar in the near future.

Today, reports on consumer prices and retail sales will be published. Forecasts are more than cautious with sales being expected with zero dynamics relative to September. Inflation is expected to have - 0.1% growth versus 0.5% in October. Judging by the prices of the manufacturing sector, there may be a surprise in the direction of exceeding expectations, which, in turn, may well lead to pronounced dollar purchases.

The sharp increase in demand for defensive assets, primarily on the yen and the euro, is most likely short-term and is caused by a number of speculative factors. The immediate cause was the report of the American Petroleum Institute (API) who said that crude oil inventories rose by 6.51 million barrels in the reporting week. This is a record high in 9 months. Earlier, the International Energy Agency (IEA) predicted a decline in world oil demand in the coming months due to a warmer than previously expected weather according to its monthly report. These, as well as some other factors, such as preparations for the imposition of sanctions against Venezuela by the EU, led to the long-awaited fixation of profits in the oil market, which in turn, brought down commodity currencies.

At the same time, bare numbers indicate that the dollar remains the favorite across the entire spectrum of the market. Published on Monday, the CFTC report showed that investors are betting on its strengthening in the next few months. The analysis of the dynamics of yields of government bonds of the USA and eurozone countries, in particular Germany, in the last 2 months leads to a similar conclusion. If before September, the yield of 10-year bonds fluctuated almost synchronously, meaning that the spread between US and German bonds remained fairly stable, recently, there has been a clear trend for spread growth,which will inevitably create pressure on the euro in the near future.

As for the growth of the US economy, the expectations are quite positive. On Monday, the Federal Reserve Bank of Philadelphia published another quarterly review compiled by professional forecasters. In their view, US GDP in the 4th quarter will grow by 2.6%. This is better than the previous forecast of 2.3% which was revised upward along with the forecast for Q1 2018. Unemployment per 1 sq. km. for 2018 is expected at 4.1%, which again, is better than 4.2% compared to a quarter earlier. The pace of creation of new jobs has been significantly revised upwards.

Thus, the expectations are quite positive. Investors' fears, in essence, boil down to one question: will the rate increase in the US and the Fed's reduction in the balance of risk heighten as deteriorating financial conditions naturally occur during the growth phase of the economy? However, this could lead to a recession if growth is insufficient. Obviously, a skillful manipulation of expectations can change the mood of investors who do not see the risks for the dollar in the near future. The stress indices calculated by a number of regional offices of the Federal Reserve indicate a low level of fear. In particular, the Financial Stress Index from the Kansas Federal Reserve Bank is at a three-year low. A similar figure can be seen from the St. Louis Federal Reserve in the zone of historic lows indicating a tendency to decline.

The dollar is slowly but surely returning to its own initiative and as the FOMC meeting dates approach, the dollar index will grow. Rollback against the defensive currencies on Tuesday will be used by players to enter the market with more profitable levels.

The material has been provided by InstaForex Company - www.instaforex.com