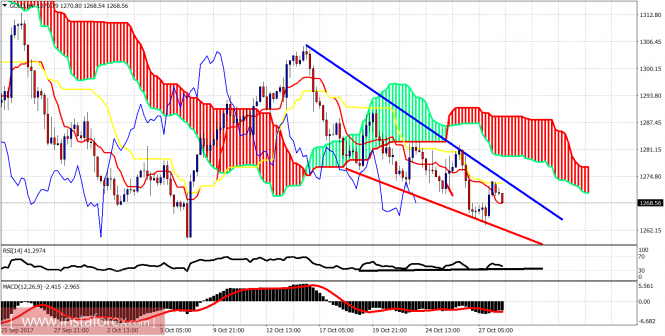

The Gold price remains in a bearish trend at least in the short-term. Price continues to make lower lows and lower highs below the Kumo (cloud). A move towards $1,260-50 is not out of the question as long as we trade below $1,283.

Blue line - resistance

Red line - support

The Gold price is trading below both the tenkan- and kijun-sen indicators inside a downward sloping wedge pattern. Resistance is at $1,275 and next and more important at $1,283. At $1,290 we have the resistance that if broken we have a confirmation of short-term trend change to bullish. Until then the trend is bearish.

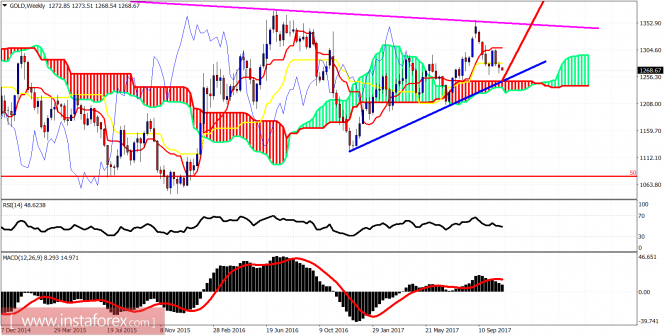

Blue line - long-term support

Magenta line - long-term resistance

Red line - expectation

Gold price is heading towards the weekly Kumo (cloud) and the blue trend line support. There are a lot of chances we go towards that area of support before resuming the uptrend. This scenario is valid as long as we trade below $1,283. If $1,283 is broken upwards then we could say that the decline is most probably over. Only above $1,315, we can be sure that we will not see a lower low.

The material has been provided by InstaForex Company - www.instaforex.com