Global macro overview for 30/10/2017:

The independence of the Catalans is not a strong argument for the decline of the euro, as the events of the weekend suggest that the politicians' decisions are met with resentment among the Catalans themselves. On Friday the parliament of Catalonia announced the declaration of independence, and then as expected the Senate of Spain launched art. 155 and took control of the regional government. Later, the Catalan parliament was dissolved, and new elections were scheduled for December 21. But Barcelona's opposition to Madrid is no longer so unequivocal. On the contrary, on Sunday, 300 000 opponents of independence have shown that the perception of the population is different than that of politicians. A poll for the newspaper El Mundo showed that support for the party for and against secession was balanced: 42.5% vs 43.4%. Uncertainty about the future of Spain will probably remain until December, but it is now crucial that things do not go towards the tragic finale. For the euro, it may be good news and a chance for a moment of pause from falling, but one can not forget that the disappointment of the ECB decision has not disappeared and it will be primarily sentiment to maintain the pressure on the currency.

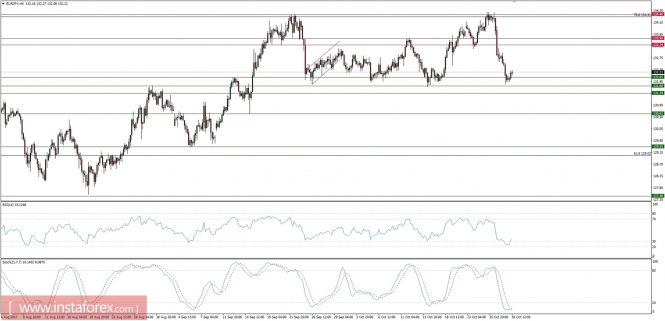

Let's now take a look at the EUR/JPY technical picture at the H4 time frame. The market has dropped towards the technical support at the level of 131.68 after a failure at the level of 134.40 resistance. Currently, the market conditions are oversold and the price is trying to bounce back towards the nearest technical resistance at the level of 132.57.