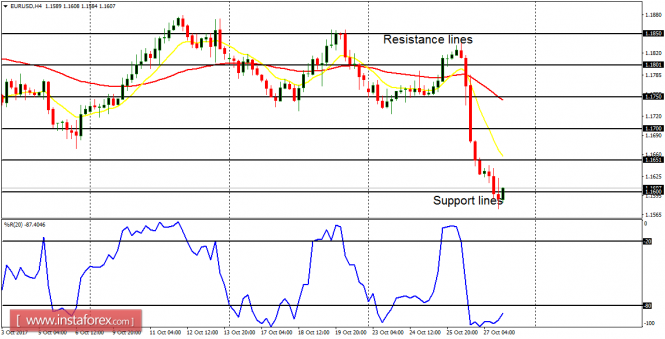

EUR/USD: This currency trading instrument consolidated from October 23 to 25, and then dropped about 230 pips on October 26 and 27. The support lines at 1.1550, 1.1500 and 1.1450 could be reached this week, as price drops further. The outlook on the market is bearish for this week, but bullish for November (the outlook on EUR pairs). So the price would eventually rally to gain at least 300 pips in November.

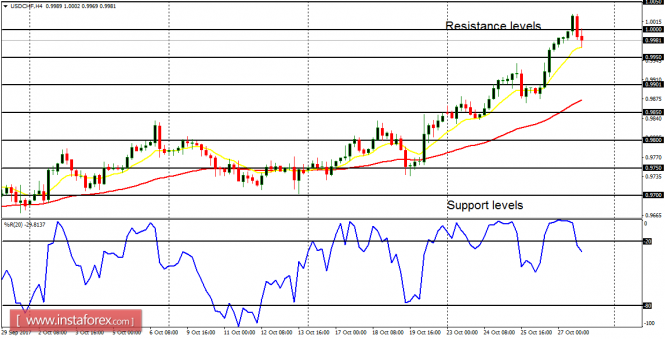

USD/CHF: The USD/CHF went upwards last week, gaining about 180 pips. Price went briefly above the strong resistance level at 1.0000 (as USD and CHF gained a momentary parity). The parity would be achieved again this week as the market goes towards the resistance levels at 1.0000, 1.0050 and 1.0100. However, the parity would be transient because an expected rise on EUR/USD would result in a selling pressure on the USD/CHF.

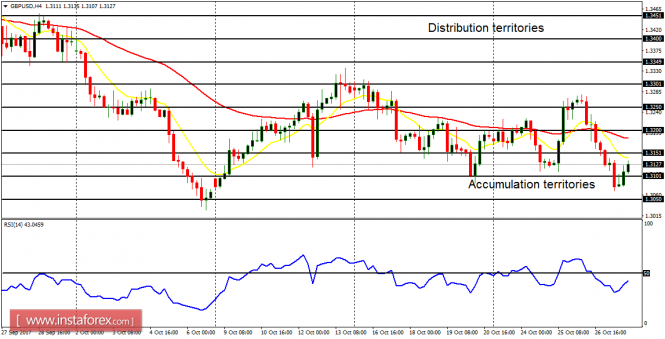

GBP/USD: The GBP/USD has been caught in short-term upswings and downswings. Soon, there would be a rise in volatility, which would propel price above the distribution territory at 1.3300 or below the accumulation territory at 1.3000. GBP pairs would undergo very strong movements in November, which would be bullish in most cases.

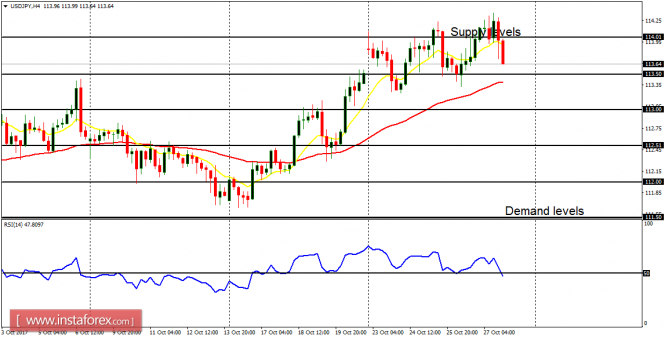

USD/JPY: This pair made a feint bullish effort last week, but it did not close above the supply level at 114.00. There is a lot of activity around that supply level, and the price would eventually close above it as it journeys further upwards this week because the outlook on certain JPY pairs is bullish for the week; plus USD is expected to retain some of the stamina in it.

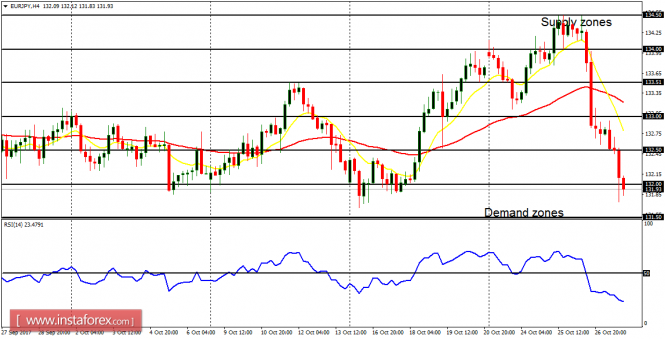

EUR/JPY: Most EUR pairs plummeted in the last few days of last week, and the EUR/JPY cross also was not spared. Price initially made some bullish effort on Monday to Wednesday, but the further bullish effort was rejected at the supply zone at 134.50 – a point from which price dropped 260 pips. While the demand zones at 131.50 and 131.00 could be tested before price rallies, the price could reach the stubborn supply zone at 134.50 again (which would be attained within the next few weeks).