Technical outlook:

The EUR/USD pair is likely to rally intraday towards 1.1960/75 levels before reversing sharply lower again. An hourly chart has been depicted here which indicates an impulsive drop from 1.2070 levels earlier, labelled as 1 here. The most probable wave structure from here is a 3-wave counter trend a-b-c. The pair seems to have produced waves a and b, while wave c is still underway. It is expected to terminate around 1.1960/75 levels, which is converging with the fibonacci 0.618 levels as well. Strong resistance is seen at 1.2070 levels , while interim support is at 1.1730/40 levels respectively. The short-term strategy that suggested to go long yesterday is coming to a termination today. So, traders should be looking to re-enter short positions for a target lasting upto 1.1500 levels going forward.

Trading plan:

Conservative traders, please remain short with stop above 1.2070 levels targeting 1.1500 at least. Aggressive traders who went long should consider taking profits around 1.1960/70 levels and then turn short again.

GBPUSD chart setups:

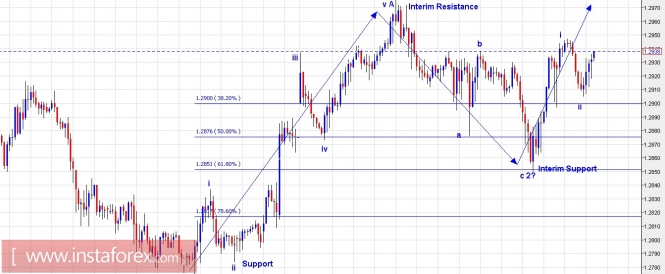

Technical outlook:

The GBP/USD pair is broadly into a counter trend since 1.2770 levels A-B-C as depicted here. It is probably into its last leg at the moment (wave C), which is expected to terminate through 1.3050 levels at least before reversing. The overall corrective rally is taking shape of a zigzag (5-3-5) structure, which is into its last wave C expected to sub divide into 5 waves. Please note that waves i and ii within wave C look to be already produced and a wave iii rally is expected to accelerate higher from here. Besides, note that wave B terminated into fibonacci 0.618 support yesterday and bounced sharply higher. Furthermore, please note that the overall down trend is expected to resume from 1.3050/70 levels (expected to be wave C termination). Interim resistance is seen at 1.2975 levels while interim support is at 1.2850 levels for now.

Trading plan:

Please remain short for a larger downtrend target at 1.2600 and lower with stop at 1.3270 levels. Aggressive traders who went long yesterday, please look to turn lower again around 1.3050 levels.

Fundamental outlook:

Please watch out for USD strength today after NFP numbers out at 08:30 AM EST.

Good luck!

The material has been provided by InstaForex Company - www.instaforex.com