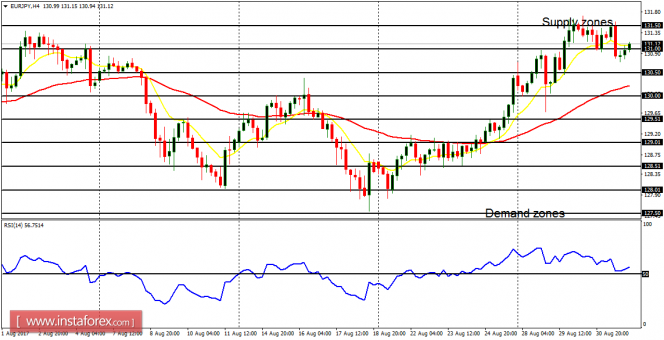

EUR/USD: After testing the resistance line at 1.2050, the price has pulled back by 190 pips, now below the resistance line at 1.1950. Another downwards movement of 150 pips to the downside would completely render the bullish bias invalid; whereas a rally from here would help restore the recent bullishness in the market. The EMA 11 is above the EMA 56, and the Williams' % Range period 20 is now rising from the overbought region.

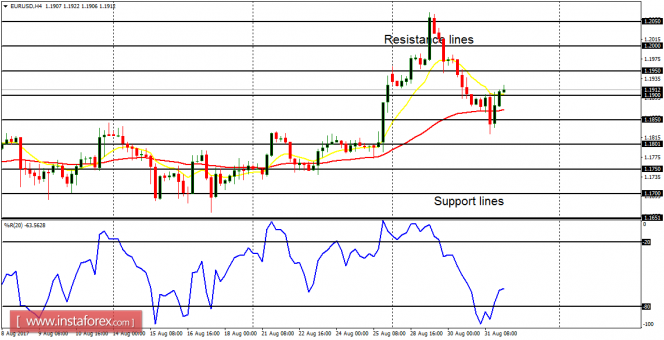

USD/CHF: The situation on the USD/CHF is currently dicey, the price went seriously upwards this week, but it could not lead to a clean bullish bias because it reversed as soon as it hit the resistance level at 0.9650. A movement above the resistance level at 0.9700 would help establish a bullish signal; while a movement below the support level at 0.9500 would bring about a new lease of a Bearish Confirmation Pattern in the market.

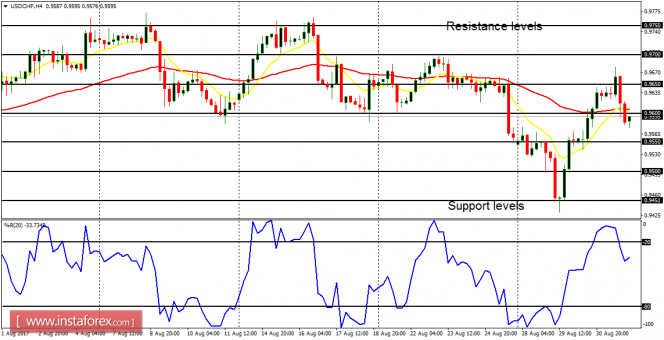

GBP/USD: The GBP/USD is still consolidating. However, a closer look at the market reveals a bull's intent, to push the price to the upside. The distribution territories at 1.2950 and 1.3000 would be the next targets. The possibility of a bullish breakout is currently strong, owing to what price is doing right now.

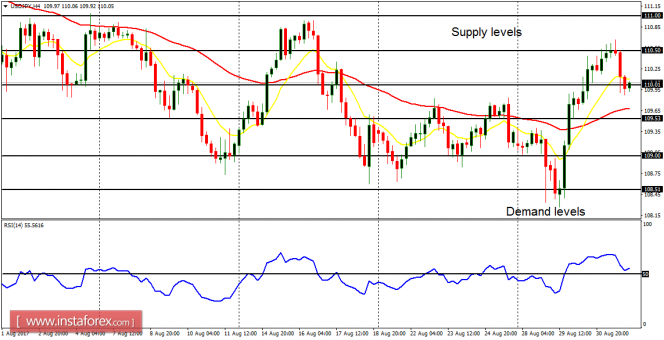

USD/JPY: A bullish signal was generated on the USD/JPY this week. After the supply level at 110.50 was tested, price pulled back a bit. However, the bias on the market remains bullish, and it is expected that the market would rise further here, reaching the supply level at 110.50 again, and then targeting another supply level at 111.50.

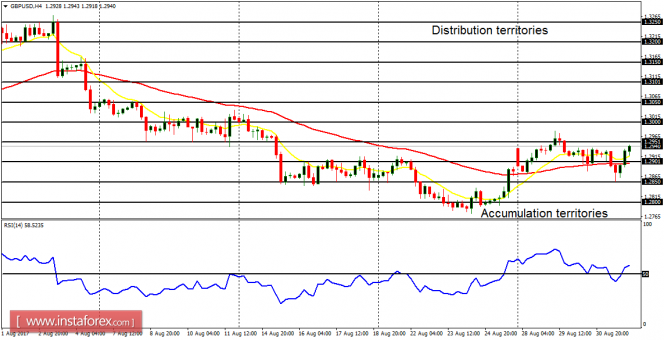

EUR/JPY: Despite the ongoing short-term consolidation, the EUR/JPY cross is still able to maintain the bullish signal on it. The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. There is a Bullish Confirmation Pattern in the market, and further upwards movement is expected. The next targets are the supply zones at 131.50 and 132.00.