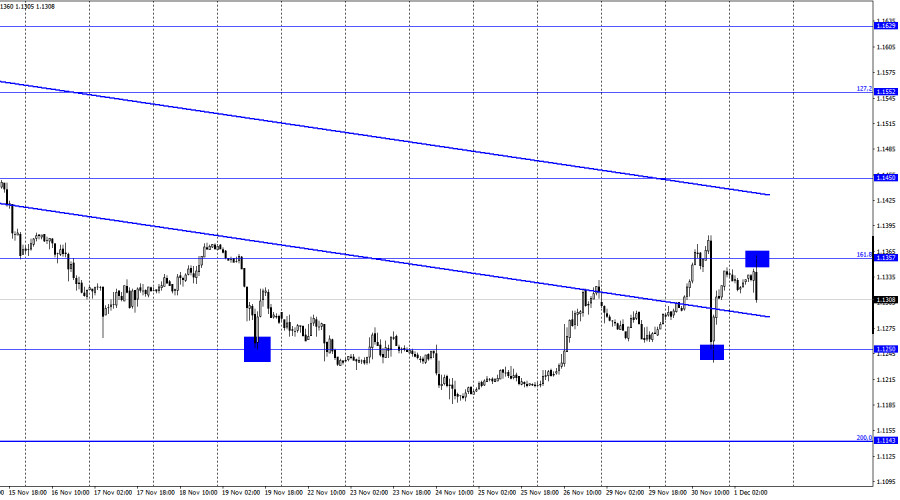

EUR/USD – 1H.

The EUR/USD pair performed an increase to the corrective level of 161.8% (1.1357) on Tuesday, anchoring above it, falling by 140 points to the level of 1.1250, rebounding from it, and returning to the level of 161.8%. And all this in less than a day. The last rebound from the level of 1.1357 allows us to count on the resumption of the fall of quotes in the direction of the level of 1.1250. However, there is no need to talk about any calm in the market right now. Until Jerome Powell's performance last night, everything was going according to plan. In the morning, the Eurozone inflation report for November was published. This indicator rose to 4.9%, which caused new purchases of the European currency and fairly strong growth. Moreover, traders seem to have expected a strong increase in inflation and started buying euros in advance. But in the evening, Powell simply stunned traders by saying that it was time to abandon the concept of "temporarily high inflation" since it was not so temporary and threatened to turn into permanently high inflation. Jerome Powell acknowledged that inflation is not slowing down as the Fed expected, and it will have to be dealt with tougher measures since it is unlikely to begin to decline in the near future.

It is noteworthy that this statement was made, as they say, out of the blue. After all, before that, Powell had repeatedly repeated that next year inflation would begin to slow down, and the problem with supply chains would be resolved. And after a series of similar statements, he suddenly says that at the next meeting, which will take place this month, the regulator will consider accelerating the winding down of the incentive program to counteract further growth in consumer prices. The Fed president made it clear to traders that the probability of a new tightening of monetary policy in December is very high. Earlier, several FOMC members also spoke in favor of an earlier interest rate hike and a faster winding down of the stimulus program. Thus, these decisions can be approved by a majority vote. And this means that the PEPP will become more "rigid" faster than previously planned. Against this background, the dollar may resume growth.

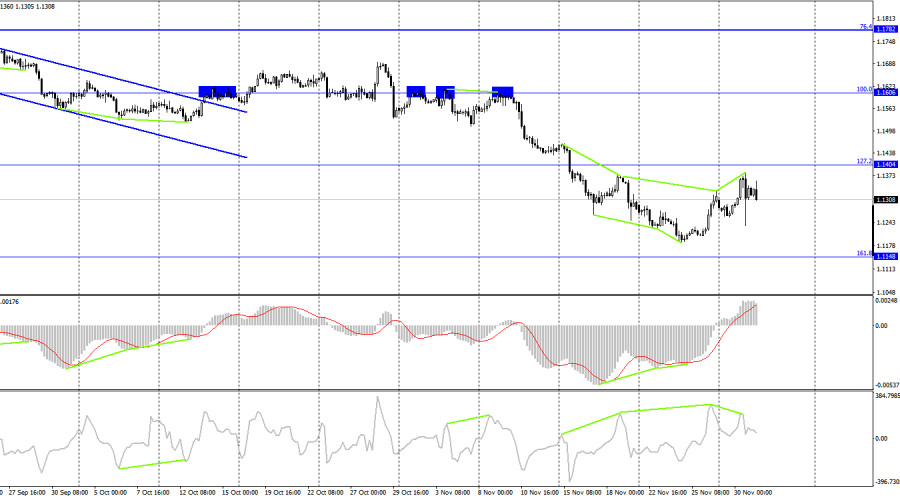

EUR/USD - 4H

On the 4-hour chart, yesterday can not be analyzed, since it was entirely influenced by the information background. Nevertheless, after the formation of a new bearish divergence at the CCI indicator, the pair performed a reversal in favor of the US currency and began the process of falling in the direction of the corrective level of 161.8% (1.1148). But I now recommend paying more attention to the hourly schedule.

News calendar for the USA and the European Union:

EU - index of business activity in the manufacturing sector (09:00 UTC).

US - Change in the number of employees from ADP (13:15 UTC).

US - ISM manufacturing index (15:00 UTC).

US - Chairman of the Fed Board of Governors Jerome Powell will deliver a speech (15:00 UTC).

US - Treasury Secretary Janet Yellen will deliver a speech (15:00 UTC).

On December 1, there will be almost no news and reports in the European Union, and two important reports will be released in the USA, and the calendar of economic events again contains speeches by Janet Yellen and Jerome Powell. Thus, the information background may be strong again today.

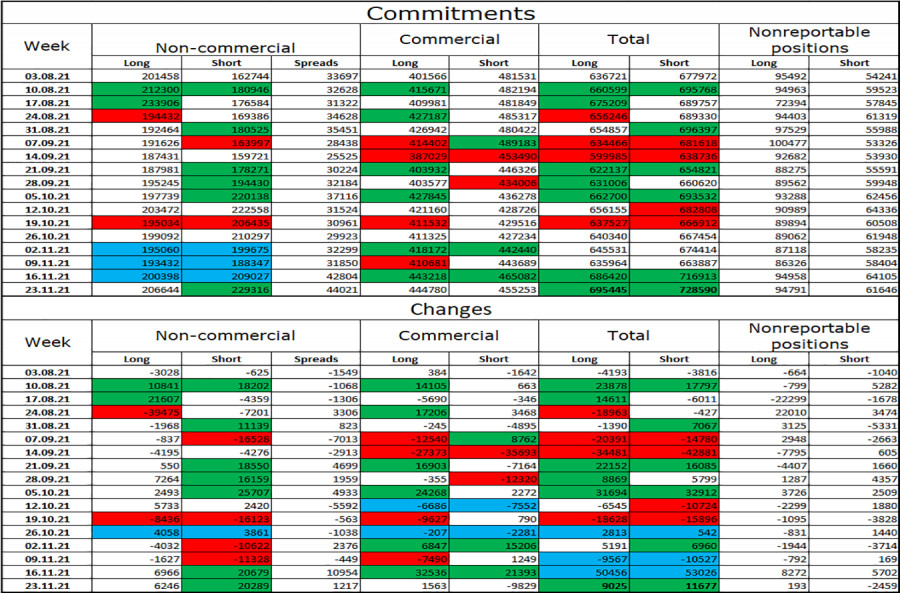

COT (Commitments of Traders) report:

A new COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders became much more "bearish". Speculators have opened 6246 long contracts on the euro currency and 20289 short contracts. Thus, the total number of long contracts in the hands of speculators has grown to 206 thousand, and the total number of short contracts - to 229 thousand. Over the past two weeks, speculators have opened more than 40 thousand short contracts. Thus, the "bearish" mood among the most important category of traders continues to strengthen. Consequently, the European currency may resume falling in the near future. According to COT reports, there are no signs of possible long-term growth of the euro yet.

Forecast for EUR/USD and recommendations to traders:

I do not recommend new sales of the pair yet, since the euro is set for a correction. I recommend buying the euro currency with a new rebound from the 1.1250 level on the hourly chart with a target of 1.1357.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com