Billionaire investor Mike Novogratz warned that Federal Reserve Chairman Jerome Powell's actions could slow down the growth of the cryptocurrency market during his second term as head of the central bank. The CEO of Galaxy Digital spoke about his vision of how Powell can influence the cryptocurrency industry during his second term as chairman of the Federal Reserve System.

Last week, US President Joe Biden appointed Powell for a second term, who, in his opinion, did an excellent job of fulfilling his duties during the coronavirus pandemic. According to Novogratz, Powell's reappointment will allow him to "act more like a central bank than as a person who can make decisions as he pleases."

The point is that quite a lot now depends on the actions of the Fed. If inflation remains persistently high, it will have a bad effect on the future of the economy; it will slow down the growth of all assets; it will slow down the Nasdaq, as well as slow down the growth of the cryptocurrency market, which also grew due to stimulus programs carried out by the central bank.

A means of protection against inflation

It is also worth recalling that investors often consider cryptocurrency as a means of protection against inflation during a period of weak Fed policy. Any changes in the direction of higher interest rates will certainly force investors to reconsider their portfolios. A more attractive bond market will force major players to return to safer assets, and lower inflation will make this path faster. The redistribution of assets will clearly not benefit the cryptocurrency market, which is now partially used by investors to protect CPI.

Many traders and investors are now wondering how the cryptocurrency market will behave without additional support from the Fed. It is obvious that the decline in the stock markets, with which Bitcoin now correlates well enough, will pull the entire cryptocurrency segment down.

However, even despite these concerns, many leading experts, including Novogratz, are still optimistic about the prospects of the crypto industry. "Today, I spoke on the phone with one of the largest private investment funds in the world, and they decided to start investing money in cryptocurrency," said the CEO of Galaxy Digital. "I've had the same conversations with large pension funds in the United States."

Galaxy Digital recently announced a bond issue totaling $500 million. In the future, they can be exchanged for shares in a private placement. The maturity of the bonds with a 3% yield will come on December 15, 2026, if they are not exchanged, redeemed, or redeemed earlier. Galaxy Digital intends to use the raised capital to finance business development initiatives.

Microstrategy CEO Michael Saylor recently announced that he expects bitcoin to grow 100-fold to become a $100 trillion asset class. A study conducted by Digital Asset Management shows that 82% of institutional investors plan to increase their investments in cryptocurrencies as early as next year.

India does not give rest

Before going over the technical picture, I would like to say a few words about the fact that the central bank of Indonesia wants to actively resist the spread of cryptocurrencies by introducing its own digital rupee. This became clear from the speech of a government official in parliament. "CBDC will become one of the tools to combat cryptocurrency," the official said. "We assume that people will find CBDC more reliable than cryptocurrency. CBDC will be part of the effort to solve the problem of using cryptocurrencies in financial transactions."

Judging by the reviews of government officials, nothing good can be expected in relation to cryptocurrencies at the next session of parliament. Apparently, the government plans to seriously engage in this area, but does not yet know how. Either they know, but evade answers for a number of objective reasons. In any case, negative news on this issue will be reflected in the cryptocurrency market, acting negatively on it, since there are quite a large number of cryptocurrency users in India who are seriously afraid of an official ban from the authorities.

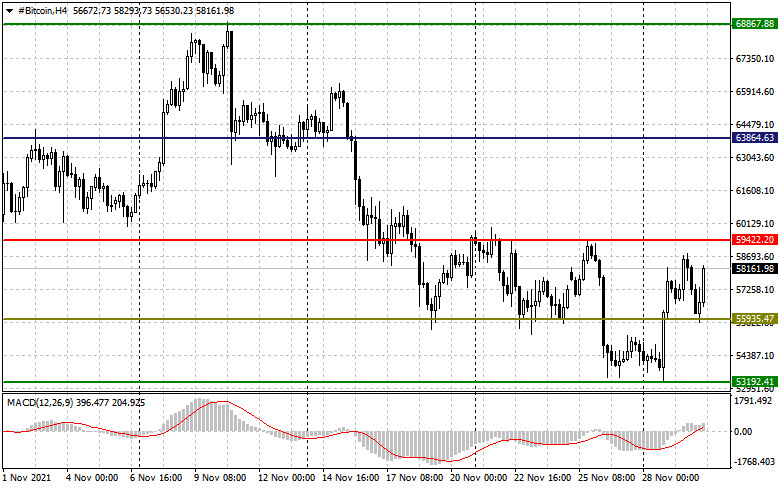

As for the technical picture of Bitcoin

BTC bounced off its lows around $54,000 and bounced back to $57,000 and is now aiming for a larger resistance at $59,422. Only after that will it be possible to count on more rapid growth to the $63,800 and $68,880 highs. It will be possible to talk about an increase in pressure only after the exchange rate returns under the support of $55,930. A breakdown of this level will quickly dump the trading instrument to $53,190 and open a direct road to $50,220.

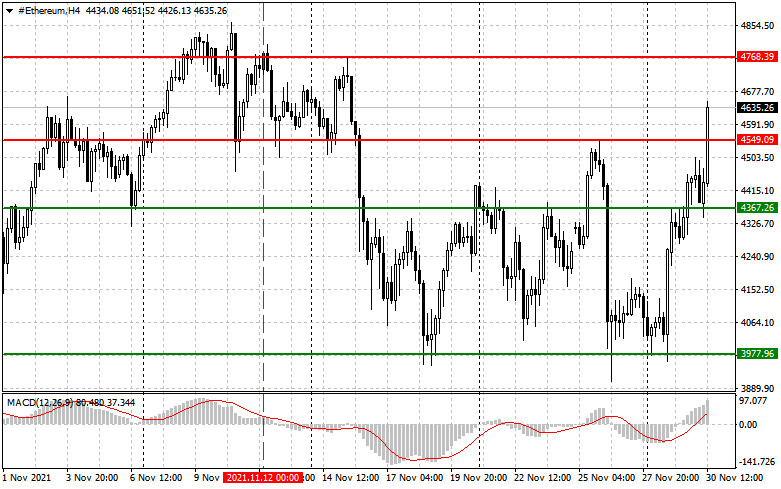

As for the technical picture of the ether

The bulls have already broken through the 4,549 level and are now aiming at another resistance at $4,768. Its break could completely change the technical picture towards buyers, which will resume the bullish trend towards the end of the year, clearly aimed at going beyond the $5,000 level. It will be possible to talk about serious problems for ether buyers only after a breakout of $3,970, which will push the trading instrument to the lows of $3,682 and $3,405.

The material has been provided by InstaForex Company - www.instaforex.com