The weekend turned out to be truly winter for the cryptocurrency market. In less than 5 hours, Bitcoin made one of the largest falls in the current year. The price of the asset dropped 20%, reaching an alarming mark at $42,000. The cryptocurrency market has followed BTC and updated the local low over the past three months. The Fear and Greed Index instantly moved into the "extreme fear" area, and there was talk of the beginning of the crypto winter.

Liquidations as a result of the fall amounted to $2.3 billion, which is one of the largest falls of 2021. About $950 million were liquidations of transactions paired with Bitcoin and $563 million paired with Ethereum. Most of the liquidated positions were long, which indicates a lot of excitement around the likely growth of the cryptocurrency. This is where the main reason for the collapse lies, which, in my opinion, exceeded the expectations of the "whales."

Over the past two weeks, there has been an increased demand for longs among market players. However, at the same time, the futures market practically froze in place, while options set local demand highs. At the same time, BTC's on-chain activity remained at medium positions. This divergence could not be considered healthy and spoke of an overheated market.

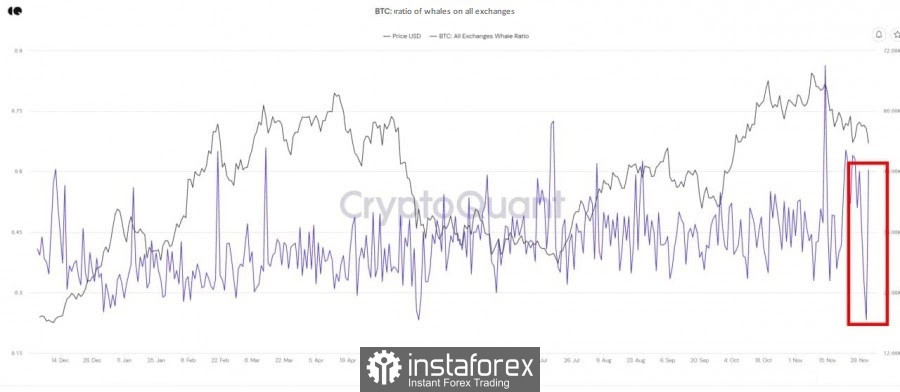

The final chord of the fall was the long-term collection of liquidity from the range of $55,000-$59,000. The correction in this area was aggravated due to the manipulative actions of large capital, which, according to the data of Santiment and CryptoQuant, moved more than 15,000 BTC to the exchanges. Thus, the institutional investors fueled the interest of the rest of the Bitcoin audience and delayed the collection of liquidity.

When the market sentiment was as bullish as possible (expressed in a local record for the number of longs), institutional investors played against the mood of the crowd, which resulted in a powerful squiz. This can be seen in the All Exchanges Whale Ratio indicator, which shows that "whales" significantly profited from the fall of the first cryptocurrency.

However, I assume that the final target of large capital was the $49,000-$53,000 area, and the further fall in price was caused by panic moods in the market. However, the fall turned out to be more serious, due to which the trend line from $40,000 was merged.

As of December 6, the bulls managed to buy back the fall, thanks to which the weekly candle closed near $50,000. But the price drop still looks significant and in the next few days, we should expect price stabilization and sideways movement in the range of $46,000-$49,000.

On the daily chart, we see that Bitcoin has made a powerful impulse movement to the level of $41,890. Subsequently, buyers managed to make a powerful buyback, thanks to which the candle closed above $49,000. However, after that, an uncertain green Doji candle was formed on the chart, which indicated the weakness of buyers.

As we can see, the fall further worsened, and the price broke through the Fibo level of 0.236, which is a bearish sign.

Taking into account the fact that Bitcoin continues to trade below $48.200, where the Fibo level of 0.236 passes, I believe that we will be able to form a double or even triple bottom below $45,000. This scenario is canceled if the cryptocurrency manages to go beyond $48,000 in the next few days, and ideally gain a foothold above $50,000.

I assume a scenario in which the price will be able to recover above $50,000, but subsequently, fall below $45,000 again. This assumption is based on the manipulative capabilities of large investors who broke the main jackpot by lowering the price below $58,000 positions, where a large number of orders are concentrated. A similar option is possible here, as below $45,000, the 365 EMA passes at $44,800, where a powerful support zone passes. If the "whales" want to collect liquidity there, then we should expect the formation of a double bottom.

The material has been provided by InstaForex Company - www.instaforex.com