Wave pattern

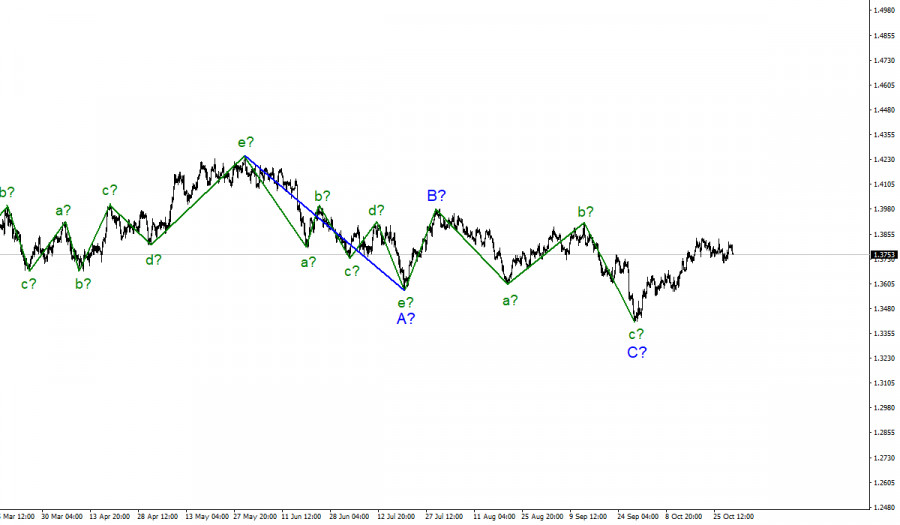

The wave counting for the Pound/Dollar instrument continues to look quite complicated due to deep corrective waves as part of the correction section of the trend. The instrument made a successful attempt to break through the low of the previous waves a and e. Thus, adjustments were made to the wave pattern, and now it has acquired the appearance of a downward trend section. Nevertheless, this downward section may already be completed, or it may acquire a much longer appearance.

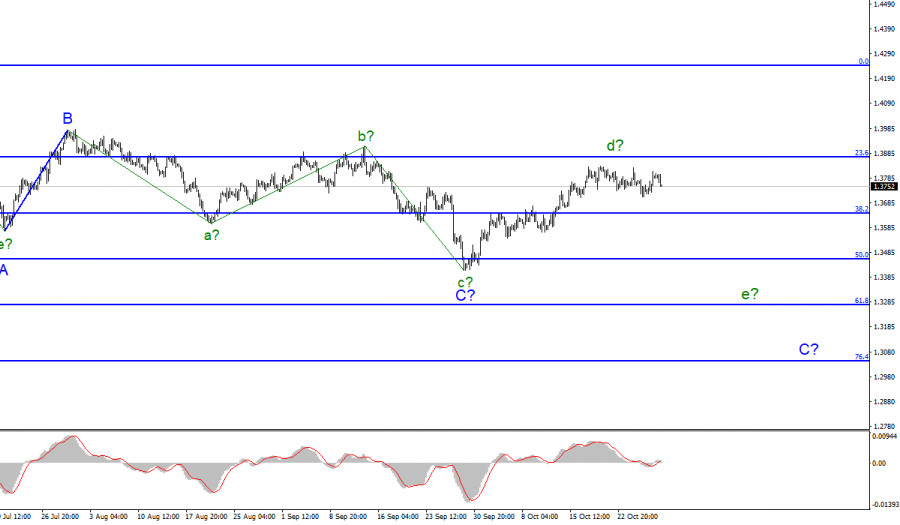

The picture above shows that the last wave C can already be completed if it has taken a three-wave form. If it takes a five-wave form, then after the completion of the current wave d, the decline in the quotes of the instrument within the wave e may resume. And this wave d can already be completed. If this assumption is correct, then the decline of the instrument will continue with targets located near the minimum of wave c around the 34th figure. A successful attempt to break through the peak of wave b will lead to the need to introduce new refinements to the current wave counting.

The decline in the growth of the US economy prevented the dollar from continuing to strengthen.

The exchange rate of the Pound/Dollar instrument dropped by 35 pips on Friday, and the amplitude of movements was weak again. There were no important events and reports in the UK. Therefore, the markets turned their eyes to the US. And there were a few reasons for optimism here. The level of income of the population decreased by 1% in September, and expenses increased by 0.6%. Recall that the heads of central banks have repeatedly mentioned that demand growing faster than supply is one of the reasons for accelerating inflation. As you can see, this assumption is absolutely true, and in America, not only inflation is rising, but the growth rate of the economy is also falling. Thus, with such a news background, it will be difficult for the US currency to continue to increase within the wave e.

However, the current wave counting has not been canceled yet. There is also no positive news coming from the UK now and this may support the dollar. The crisis of staff shortage continues in the UK, and the European Union and Britain itself, continue to talk about the terrible consequences of Brexit for the British economy. Also, London and Brussels cannot agree on the Northern Ireland protocol. Not to mention the high incidence of coronavirus in recent weeks and months. Thus, there are no special reasons for the Briton to be in high demand either. Anyway, until the peak of the expected wave b in C is updated, there are high chances of a decline in the instrument.

General conclusions

The wave pattern continues to raise some questions, although it looks quite convincing so far. It received a downward view, but not an impulsive one. The expected wave d has completed its construction, so I advise you to sell the instrument based on the construction of the expected wave e in C with targets located near the level of 1.3270.

Starting from January 6, the construction of a new downward trend section began, which can turn out to be almost any size and any length. At this time, I'm still counting on building another downward wave, since wave A turned out to be a five-wave one. However, wave C may already be completed. Everything will depend on a successful or unsuccessful attempt to break through the peak of wave b in C.

The material has been provided by InstaForex Company - www.instaforex.com