The fact that Bitcoin remains in a sideways channel makes it less attractive. This is evidenced by several indicators that are convenient to use in trading to determine the further direction of movement of the cryptocurrency.

Throughout this week, we observed a gradual outflow of bitcoin from key trading floors, which indicated that bullish sentiment remained after a slight correction of the world's first cryptocurrency from its historic highs.

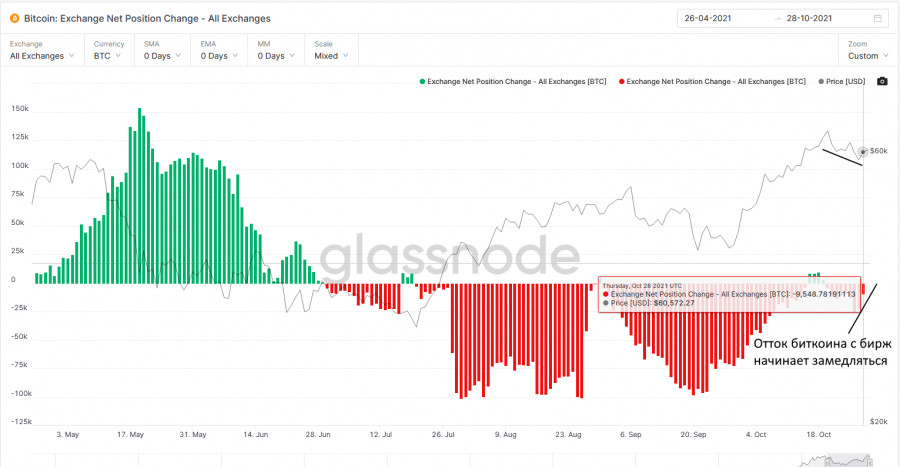

Exchange Net Position Change - All Exchanges chart

However, by the end of the week, after Bitcoin failed to continue its growth, the outflow of funds slowed down. Of course, this does not yet testify in favor of a market reversal and the formation of a bearish trend, however, it clearly indicates a slight increase in unrest among traders. Until this indicator remains in the negative zone, there is no reason to panic, but do not be surprised if we see another major downward correction in BTC over the weekend.

Another indication that the outflow of funds on global markets is ending is the data from Percent Balance on Exchanges. In the chart below, you can clearly see how a gradual reversal began after the decline to the 13.131% level, which so far indicates a slowdown in the outflow.

Well, the most interesting indicators are the Reserve Risk data: after the growth throughout the month, which testified to the attractiveness of bitcoin on the part of traders, a downward correction has been observed since October 20. The fact that Bitcoin does not react in any way indicates a rather delicate situation. Therefore, you can expect anything from this weekend. Speculators need to keep their fingers on the pulse.

As for the technical picture of Bitcoin

The head-and-shoulders model survived and so far the lower limit of $59,400 has coped with the task. The nearest support level has now shifted to $58,200. Only a breakthrough of this area can lead to a larger downward correction of the trading instrument to the $54,444 area, and then to the $50,900 low, but even in this case, nothing bad will happen with the upward trend. At the moment, the 200-day moving average is in the 45,000 area. It is possible to talk about a return of interest in bitcoin after going beyond $62,400, which will open a direct road to the historical maximum of around $66,500.

Australia prepares to launch Bitcoin ETF

Finally, I would like to talk about what the Australian Securities and Investments Commission (ASIC) has determined: Bitcoin and Ether meet the criteria as the corresponding underlying assets traded on the exchange. The ASIC released a guide on Friday for those wishing to offer cryptocurrency derivatives. Such a request was sent back in June this year.

The ASIC stated that a cryptocurrency can be a valid ETP asset only if five criteria are met: a high level of institutional support and recognition; reputable and experienced service providers to support products; mature spot market; regulated futures markets for derivatives trading and transparent pricing mechanisms.

Based on this, Bitcoin and Ether "seem to satisfy all five factors to be called the underlying asset for ETP," the ASIC said.

An ETF is expected to launch in Australia shortly, offering access to cryptocurrency products. The trailblazer will be ETF BetaShares, which plans to start trading in Australia in the near future.

Ether

Ether continues to grow and now traders are aiming at breaking through the next historic highs. The created supply shortage is pushing prices higher. ETH has hit a new all-time high on Friday as more Ethereum tokens have been burned than have been issued in the past 24 hours. Looking at the numbers since the beginning of this month, Ether is up 45% compared to Bitcoin's 40% gain.

As for the technical picture of the Ether

A downward movement from historical highs and then an instant return to them indicates a high demand from players. A return to $4,367 will most likely take place with a breakdown and an exit to new all-time highs around $4,420 and $4,485. In the case of a downward correction, you can count on support in the area of $4,114, or even lower – in the area of $3,885, where major players have actively shown themselves this week.

The material has been provided by InstaForex Company - www.instaforex.com