Overview :

The EUR/USD pair is neutral-to-bearish in the near-term and could move alongside the EUR/USD during the upcoming thinned sessions. The one-hour chart shows that it's trading around a moderate bearish 100 SMA. The RSI indicators are directionless just below their midlines.

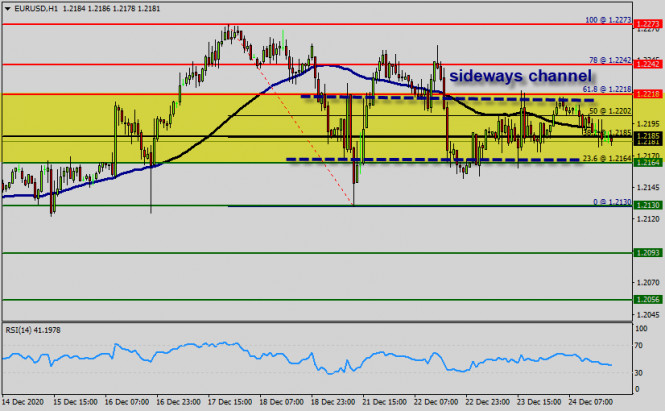

The EUR/USD pair movement was debatable as it took place in a narrow sideways channel for a while. The market showed signs of instability (but we guess a bearish market in coming hours).

Amid the previous events, the price is still moving between the levels of 1.2218 and 1.2164. The daily resistance and support are seen at the levels of 1.2218 and 1.2164 respectively.

In consequence, it is recommended to be cautious while placing orders in this area. Thus, we should wait until the sideways channel has completed.

On the H1 chart, the price spot of 1.2218 remains a significant resistance zone. Therefore, there is a possibility that the EUR/USD pair will move to the downside and the fall structure does not look corrective.

Resistance is seen at the level of 1.2218 today. So, sell below 1.2218 with the first target at 1.2164.

In overall, we still prefer the bearish scenario as long as the price is below the level of 1.2218. Furthermore, if the EUR/USD pair is able to break out the first support at 1.2164, the market will decline further to 1.2130 to test yesterday's bottom.

However, it would also be sage to consider where to place a stop loss; this should be set above the second resistance of 1.2218.

The material has been provided by InstaForex Company - www.instaforex.com