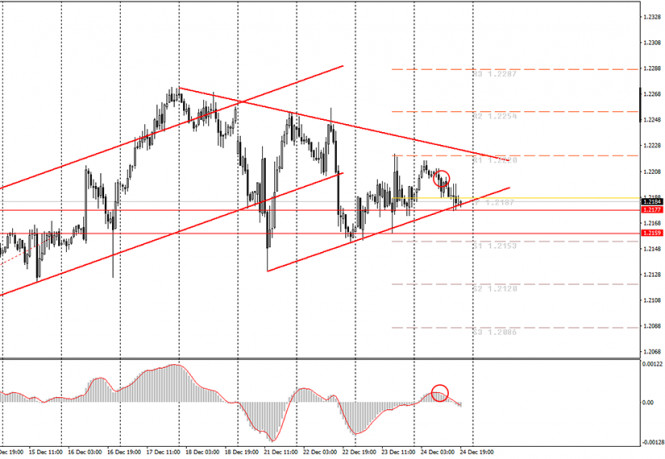

Hourly chart of the EUR/USD pair

The EUR/USD pair began a new round of downward movement on Thursday and once again fell to the upward trend line. We still believe that the downtrend line is the stronger one, therefore, we advised you to consider trading down. A new sell signal was formed during the day, which had been discharged quite well before. Therefore, the signal was strong. However, given the festive status, volatility was very weak on Thursday. Thus, by the end of the day, the quotes reached out the second trend line, which made it possible for novice traders to earn no more than 10 points on short positions. We recommend closing this position before Christmas and the weekend. In general, bounding from the lower trend line can provoke a turn of upward movement. In general, the euro/dollar pair continues to trade in a fairly narrow range. Going beyond the two trend lines will allow you to determine the trend for the next couple of days. However, if there is a flat next week and the price, thanks to it, leaves the range of two trend lines, this will not be considered a strong signal.

No macroeconomic report from the European Union and the United States on Thursday. And, in principle, there was no news, which is evident from the same volatility of the currency pair. Therefore, novice traders could trade exclusively on technique, but in any case they could not earn much. Now you need to wait for the following week, New Year's week, which might be flat, and it could pass in quite volatile trading. The market is called "thin" on such days, as there are very few traders on it, so a sharp price reversal or strong movement requires less action than during normal times. Thus, we advise you to be very careful next week or not trade at all.

Possible scenarios:

1) Long positions are currently irrelevant, since there is a downward trend line. Thus, we would recommend opening long deals only when the price has settled above this trend line with targets at the resistance levels of 1.2254 and 1.2287. Take note that the price should confidently surpass this line, and not a gradual exit from it through the flat.

2) Trading down looks more appropriate right now. However, you should have closed the short positions that you opened and go quietly on the weekend. If the pair eventually rebounds off the upward trend line, then you will have to wait for a new sell signal from MACD or a rebound from the upper trendline. If the lower trend line is crossed, the sell orders will remain relevant with targets at the support levels of 1.2153 and 1.2120.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

The material has been provided by InstaForex Company - www.instaforex.com