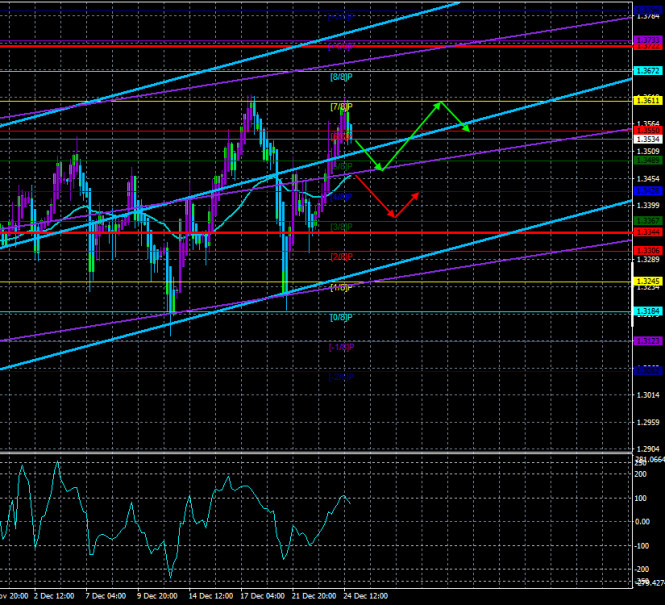

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 71.2214

The British currency paired with the US dollar continued its upward movement on Thursday, December 24. Although the holidays have come, half the world will celebrate Catholic Christmas today, and the euro/dollar pair has been standing still for the past day, the pound sterling has not stood still and did not suffer from a lack of news. The fact is that while half the world was preparing for the celebration, the UK and the EU continued to negotiate a trade agreement that will allow them to trade without duties and tariffs after December 31, when the "transition period" ends. And yesterday, late in the evening, it became known that the parties still managed to reach a consensus. During the day, when it was not even known about the deal, the pound sterling continued to rise in price and reached the Murray level of "7/8"-1.3611, which was already working out a few days ago. Thus, the pair's quotes once again came close to the maximum for 2.5 years, but this time they did not break it and did not update it. By and large, the pound should have exhausted its growth potential long ago. Over the past few months, the British currency has only been growing on market expectations of a trade agreement. The deal was concluded (though not yet ratified) on December 24. All this time, the pound has been growing. And if the deal was concluded in March 2021, we would catch the pound around 1.42 and say that this is a well-founded rate? We believe that the pound has long been overbought, so even if there is a deal, it should now fall. However, as before, we draw the attention of traders to the fact that any fundamental hypothesis must be confirmed by technical signals. As long as the quotes continue to be above the moving average, the upward trend remains. Another thing is that in recent weeks the pair has been trading in a "high-volatility swing" mode. Thus, the upward trend is visible to the naked eye, however, it was extremely difficult to trade it.

"A deal has been reached," Boris Johnson wrote on Twitter. "It's been a long road, but we have a lot to show. This is a fair and well-balanced deal for both sides," said Ursula von der Leyen. The head of the European Commission also said that the UK will now remain a trading partner of the European Union and will continue to cooperate with it in many areas such as climate change, energy, security, and transport. Also, the parties managed to reach an agreement on the "fish issue", at least for the next five and a half years, as stated by Ursula von der Leyen. "The agreement is fantastic news for all British families and businesses. We have signed the first free trade agreement based on zero tariffs and quotas that has ever been reached with the EU," the British government said. It is also reported that it was London that made serious concessions on the issue of fishing in the last 48 hours of negotiations. Initially, London wanted to retain full sovereignty over its waters, and the EU sought the right to fish in British waters.

However, the problems of the EU and the UK do not end there, as many might think. The fact is that now the European Parliament and the British Parliament must approve the deal. MEPs last week said that if they do not receive the text of the document before Sunday, December 20, they will not have time to study and vote for it. The same thing was done by the legal service of the European Council (the highest body of the EU), stating that if the agreement is not available for study on December 25, then there can be no question of any approval of this agreement before January 1, even "retroactively". Thus, today, while everyone is celebrating Christmas, and the foreign exchange market is generally closed, the European Parliament and the European Council will work hard to study the document, for which they will be able to vote on December 28.

Unfortunately, we won't be able to see the full market reaction to this event until next Monday, December 28. Thus, during the new year's week, very active trading of the pound/dollar pair can be conducted. If the pound starts to fall these days, it will be possible to talk again about the beginning of the formation of a new downward trend, as buyers could already exhaust their insistence on waiting for a trade deal. The pound has already worked out a trade deal several times, which has not even been ratified yet. Therefore, we will not be at all surprised if the pound sterling starts falling right on New year's eve.

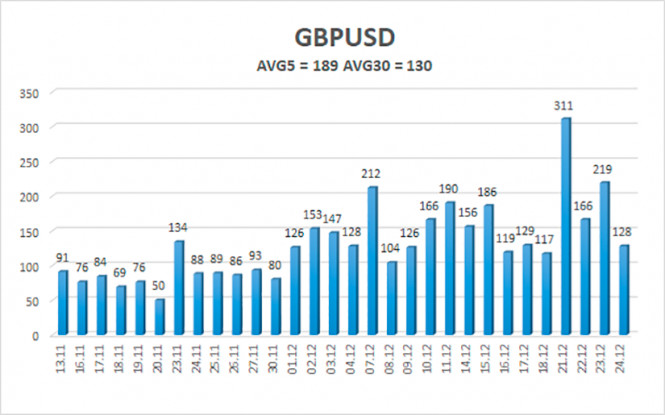

The average volatility of the GBP/USD pair is currently 189 points per day. For the pound/dollar pair, this value is "high". On Monday, December 28, thus, we expect movement inside the channel, limited by the levels of 1.3344 and 1.3722. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe is now in a new round of upward movement. Thus, today it is recommended to keep long positions open with targets of 1.3611 and 1.3672 until the Heiken Ashi indicator turns down. It is recommended to trade the pair down again with the targets of 1.3367 and 1.3344 if the price is fixed below the moving average line. In general, the "swing" continues now. Not a good time to trade.

The material has been provided by InstaForex Company - www.instaforex.com