Huge politics in US economic issues expectedly still plays a vital role. Senate majority leader, Mr. M. McConell and Speaker of the House of Representatives, Ms. N. Pelosi, with the participation of Finance Minister S. Mnuchin, failed to agree again on the details of the stimulus package, which markets put their hopes on.

There is undoubtedly much more politics in these disputes than steady economic calculation. Earlier, we pointed out that Mr. D. Trump, together with his Republican representatives, will take revenge on the new President, Mr. J. Biden, due to the assumed "dirty" elections. However, there is a clear delay in resolving this issue, associated with the general government spending in the country, which must be resolved before December 11; otherwise, there will be a lockdown. This will most likely cause a lot of problems for the new administration, so it should be resolved before it brings much conflict to Biden's government, taking office in January.

So far, financial markets have not reacted enough to this news. Everyone is passionate about the beginning of the vaccination process in the UK, and it doesn't bother them even though the pandemic in the US breaks new records for both sick and dead. On the other hand, stock indices resumed their growth, which was due to investors' willingness to buy company stocks in the hope that the global economic recovery will be V-shaped, instead of the U-shaped predicted in the summer.

China's positive dynamics in the economy also adds optimism. The export data presented on Monday is impressive – a recorded growth of 21.1% in November against 11.4% a year earlier. The values for the Japanese economy were positive too. Japan's GDP for the 3rd quarter rose by 5.3% against a decline of 7.9% a quarter earlier. In annual-terms, the indicator surged by 22.9% against a fall of 28.1% a year earlier. So, while the overall growth has not yet reached pandemic levels, it is still encouraging, indicating a strong economic recovery in the country.

In the currency market, the pound remains a victim of the Brexit issue that has been prolonged for more than 4 years. The conflicting news coming from both parties (EU and Britain) hoping for a bright future, remains extremely controversial, which leads either to a sharp drop in the pound's rate or growth.

The Euro, in turn, continues to consolidate in anticipation of ECB's decision on monetary policy tomorrow. It is assumed that the regulator will expand incentive measures, however, is difficult to say how it will affect the euro rate. Thus, much still depends on the general situation in the markets. Meanwhile, commodity currencies have slightly recovered amid hopes for a global economic recovery, but still remain in a period of consolidation.

In general, a tense environment in the currency market is expected to continue. The dollar will remain under pressure due to markets' continuous demand for risky assets and investors' high expectations that new support measures in the US will be taken, which will give a new impulse to the growth of demand for risk amid the beginning of vaccination against COVID-19 in the West.

Forecast of the day:

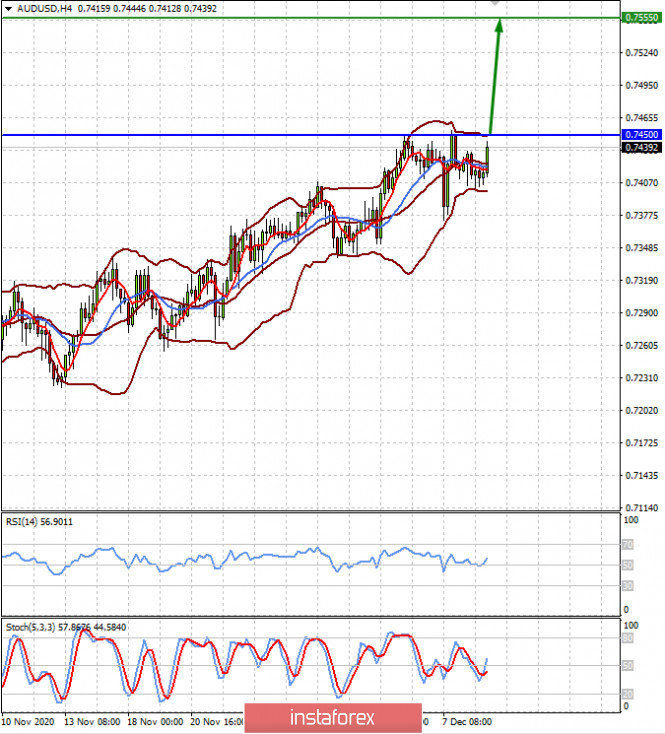

The AUD/USD pair is consolidating below 0.7450. If this level breaks down, the pair will further rise to the level of 0.7550.

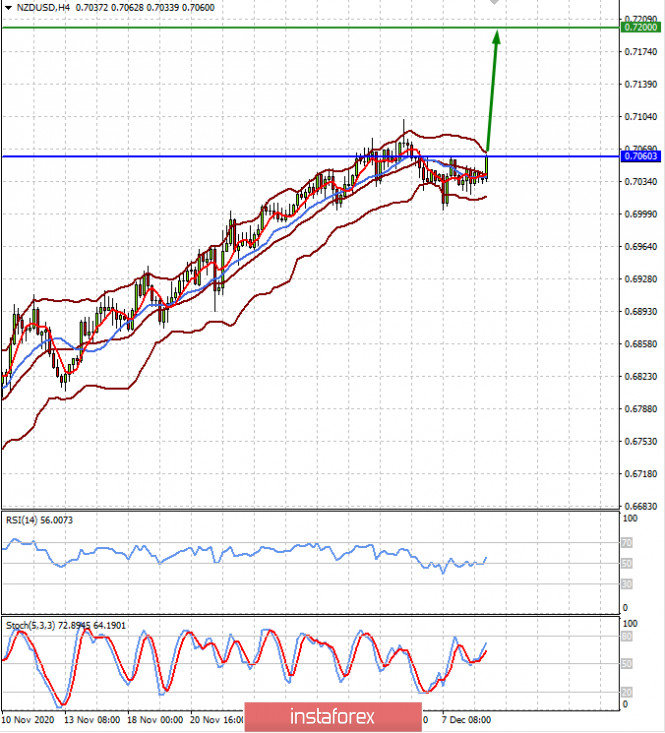

The NZD/USD pair is attempting to reverse upwards on the general wave of rising demand for risky assets and positivity.