4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 93.5062

The British pound also resumed its upward movement yesterday, also failing to overcome the moving average line. And although we still believe that both euro currencies are not growing quite fairly at the moment, nevertheless, the upward trends for both major pairs remain. Therefore, it is necessary to continue trading on the increase now. All doubts about the validity of the growth of the European currency apply to the British pound. To the British currency even more. If things have been relatively calm and good in the European Union recently, there has been no reason to be happy in the UK. Yes, the British economy is unlikely to suffer as much from the "coronavirus" as the American one, however, it will be the most affected among all EU countries. According to experts, the GDP indicator for the second quarter, which will be published next week, will decrease by 20.4% q/q. This is quite enough for the British pound to start experiencing serious pressure on itself. However, while traders frankly ignore this fundamental background, preferring to continue to believe that everything is bad in the United States, in the UK - it does not matter how things are, and continue to get rid of the American currency.

On Wednesday, August 5, the UK published the index of business activity in the service sector, which, as in most European countries, was worse than the forecast value, but significantly higher than the 50.0 mark. Thus, this report did not bring much pessimism to the mood of traders. But the statistics from overseas were completely disappointing. The ADP report on changes in the number of people employed in the private sector showed that in June, their number increased by only 167 thousand, instead of the projected 1.5 million. Thus, the report was extremely weak and could cause additional sales of the dollar, which by the time the report was published had already begun a new round of decline. Indices of business activity in the US services sector no longer played a special role.

Meanwhile, more and more traders are focusing their attention on the Bank of England meeting, the results of which will be known today. According to market expectations, the Bank of England will not change the key parameters of monetary policy. If so, the meeting risks becoming a "walk-through". And only the speech of BA head Andrew Bailey can give traders important information on the basis of which it will be possible to trade and adjust their strategies. Meanwhile, experts from other banks believe that the Bank of England will not make any "body movements" until the beginning of autumn. In the autumn, the second "wave" of the epidemic may begin in the UK, respectively, a new economic downturn will follow, followed by a new increase in unemployment. In addition, in the second half of 2020 and in the first half of 2021, the British economy will face such a problem as a complete break of all trade ties and existing agreements with the European Union. Consequently, this will put additional pressure on the economy, businesses, workers and consumers, and the Bank of England will also be under additional pressure. Thus, in the autumn, according to most bankers, the British regulator may announce the expansion of the asset purchase program by another 100 billion pounds and even lower the key rate.

Many economists also express serious concerns about the "V-shaped" recovery of the British economy. The reason for this is possible new waves of "coronavirus", possible new quarantine restrictions that will again reduce business and economic activity in the country. This can be stated today by the monetary committee of the Bank of England, which can seriously reduce the attractiveness of the pound in the eyes of investors. If additional doubts and concerns about the future of the economy come out of the accompanying statement or from the mouth of Andrew Bailey, this may cause the British pound to fall. The Bank of England's forecasts for GDP, inflation and unemployment for 2020-2021 will also be of great importance. If they are lowered, it will also be bearish factors for the pound.

In America, only the report on applications for unemployment benefits is scheduled for publication today, which in the light of recent weeks, when a high number of new coronavirus diseases were recorded, is again becoming quite important. According to forecasts, the number of initial applications will grow in the week to July 31 by 1.415 million. The number of secondary applications for the week to July 24 will be 16.839 million. Thus, if these forecasts come true, we can conclude that the unemployment rate is slowly decreasing. However, the complex epidemiological situation in the United States may cause a new increase in unemployment in America. Not to mention a new economic downturn.

What do we have in the end? The fundamental picture does not change. Only today, when the results of the Bank of England meeting will be known, it will be possible to hope that the mood of traders will change slightly. However, at the moment, the upward trend has resumed, as evidenced by all technical indicators. The outlook for the currency pair is as follows. We still believe that the upward movement may continue for some time for a banal reason: traders continue to buy the pound and sell the dollar. This cause could theoretically bring a few wherever you go. But if we are realistic, the problematic pound cannot grow against the US dollar on the same fundamental factors for so long and so much. Thus, you need to be ready for the end of the upward trend at any time, but do not try to act ahead of the curve, but wait for specific technical signals.

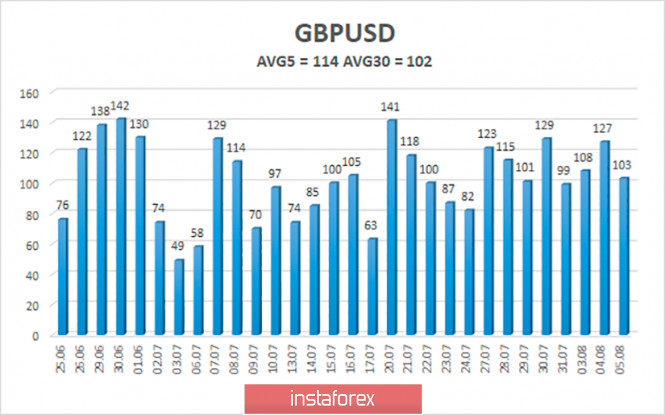

The average volatility of the GBP/USD pair continues to remain stable and is currently 114 points per day. For the pound/dollar pair, this value is "high". On Thursday, August 6, thus, we expect movement within the channel, limited by the levels of 1.3004 and 1.3232. Turning the Heiken Ashi indicator downward will indicate the beginning of a new round of corrective movement.

Nearest support levels:

S1 – 1.3062

S2 – 1.3000

S3 – 1.2939

Nearest resistance levels:

R1 – 1.3123

R2 – 1.3184

R3 – 1.3245

Trading recommendations:

The GBP/USD pair resumed its upward movement on the 4-hour timeframe, which may end near the level of 1.3169. Thus, today it is recommended to stay in the longs with the goals of 1.3184 and 1.3232 while the Heiken Ashi indicator is directed upwards. Or close longs around the 1.3169 level. Short positions can be considered no earlier than fixing the price below the moving average with the first goals of 1.2939 and 1.2878.

The material has been provided by InstaForex Company - www.instaforex.com