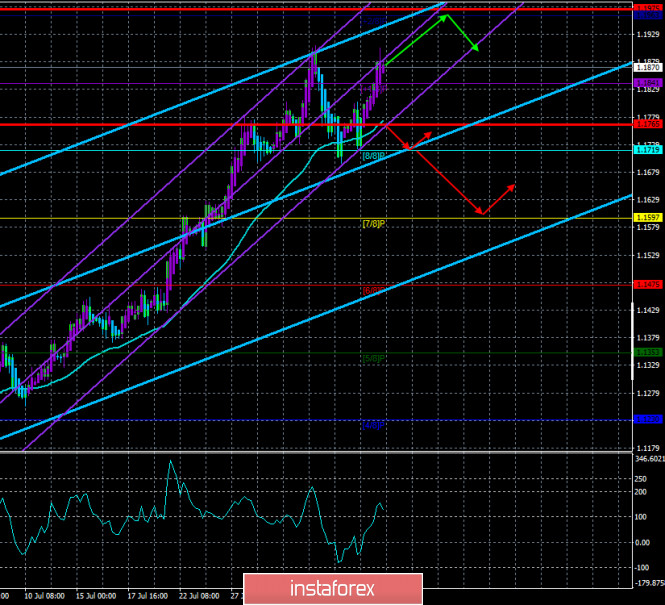

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 122.8411

Two attempts to overcome the moving average line were not enough for traders of the EUR/USD currency pair. Two rebounds and as a result – the resumption of the upward trend. Thus, the US currency is again in the risk zone, despite the fact that it has already fallen quite significantly in the last three months. But since the sellers of the pair are now extremely weak and have not been able to break through the moving, the upward trend continues. We are still very skeptical about the further growth of quotes, as we believe that only one of the currencies can not constantly become cheaper. And oddly enough, at this time, this judgment applies specifically to the dollar. The main factors that we have already listed several times can not always put pressure on the US currency, since in this case, in a couple of months, we will see a pair around the level of $ 1.5. Thus, we still believe that the hike to the top is nearing its end, as there is no new information from the US that could greatly disappoint traders. However, as before, we warn that any hypotheses must be supported by specific signals and technical analysis. While this is not the case, you can assume anything.

On Wednesday, August 5, a lot of different macroeconomic information was published in the European Union and the United States. Although most of the reports are still ignored by market participants, however, we cannot pass these reports by. Quite unexpectedly, the indices of business activity in the services sectors of the EU countries were worse than the forecast values, but all showed values much higher than 50.0 points. Thus, even if market participants expected more, this data is still not weak. Yes, in the current conditions, they are not important, since the service sector is the most affected area in each country due to the "coronavirus crisis". It is logical that with the lifting of the quarantine, this area began to recover quickly, so business activity has grown significantly. Retail sales in the Eurozone increased by 1.3% m/m in June and, although this value is higher than experts' forecasts, we still believe that this value is too low, since before that sales fell by 9.2%, 19.6% and 5.1%, and now we see a recovery of only 1.3%. This is very small. So the seemingly optimistic report is, in fact, extremely weak. Thus, in general, we can draw the following conclusion: statistics from the Eurozone could not support the euro currency, but it still grew after it failed to overcome the moving average. That is, technical factors are at work.

Meanwhile, the leader of the United States Donald Trump has made another "amazing" statement. This time, the President said that the explosion in the Lebanese capital, Beirut, could have been an attack. Trump offered his condolences and said: "I have met with some of our great generals, they believe that this was not a production explosion. They seem to think it was an attack, some kind of bomb." That is, the American President, referring to "some generals", with whom it is unknown when the US leader had time to talk, says that "someone's bomb" exploded in Beirut. Most experts immediately concluded that in this way, Trump is trying to distract the attention of Americans from what is happening in America itself. The logic of Trump is simple, and we just recently wrote that as soon as there is some discouraging event in the United States that is unfavorable to Trump and his political ratings, then Trump himself makes a loud statement. So it seems that Trump's comments about Beirut are just out of this opera. Well, the most interesting were the statements of representatives of the Pentagon, which denied the "suspicions" of Trump, saying that they do not understand what the President was talking about. Defense Ministry officials said there were no signs of a targeted attack on Beirut. Moreover, if there were such signs, then American troops would immediately be raised in the region to protect US property, which again is not observed.

In general, there was little news on Wednesday, August 5. No important information has been received from the European Union for a long time, although all market participants are waiting for the end of the European Parliament's reluctance to approve the budget for 2021-2027, which was agreed at the EU summit, as well as the 750 billion euro economic recovery fund. It seems that the European Parliament is currently negotiating with the European Commission and the European Council to make the necessary changes to the document. There is also little news from America recently. Most of them concern "coronavirus" again. No sooner had the US President declared that "the virus began to recede" than the virus began to advance again. Yesterday, more than 60 thousand cases of diseases were again recorded in America. There was no information about rallies and protests in American cities that have been going on for several months, but there was information about new rallies, this time among teachers who refuse to reopen schools in September, as Trump wants. Teachers believe that with the current "uncontrolled" spread of the epidemic, it is impossible to return students to school, and require that classes be held remotely.

In general, the situation in the United States does not change, and only worsens. In the Eurozone, everything is quiet and calm and traders do not even have anything to analyze now. The euro/dollar currency pair resumed its upward movement, and now sellers can only wait for the price to fix below the moving average line. All trend indicators at this time continue to be directed upwards, so there are no signs of a trend change on the 4-hour timeframe. Lower timeframes gave certain signals to the beginning of a downward trend, but, as we can see, they turned out to be false for the most part. Despite the fact that it is quite dangerous to buy the euro around the two-year highs, we have to admit that the upward trend persists, which means that purchases should be considered at this time. The latest COT report showed a new strengthening of the upward mood among professional traders, perhaps the situation will change slightly in favor of bears this Friday, when the new COT report is released.

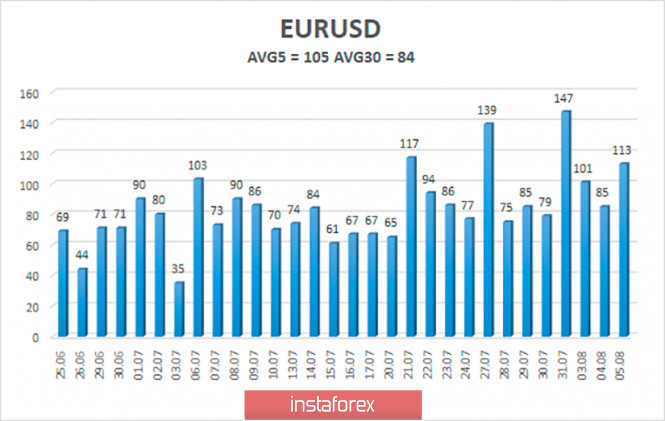

The volatility of the euro/dollar currency pair as of August 6 is 105 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1765 and 1.1975. The reversal of the Heiken Ashi indicator downwards signals a new round of downward correction within the framework of the still continuing upward trend.

Nearest support levels:

S1 – 1.1841

S2 – 1.1719

S3 – 1.1597

Nearest resistance levels:

R1 – 1.1963

Trading recommendations:

The EUR/USD pair resumed its upward movement. Thus, at this time, it is recommended to continue to stay in long positions with the goals of 1.1963 and 1.1975 until the Heiken Ashi indicator turns downward. The pair may also bounce back from the previous high of 1.1909. It is recommended to open sell orders no earlier than when the pair is fixed below the moving average line with the first target of 1.1597.

The material has been provided by InstaForex Company - www.instaforex.com