To open long positions on GBP/USD, you need:

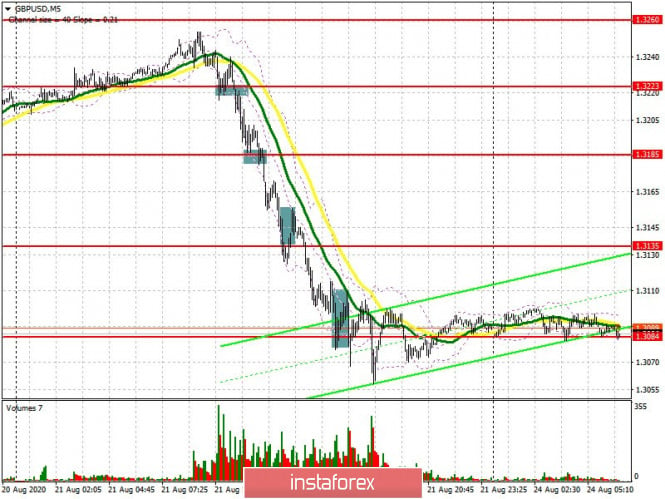

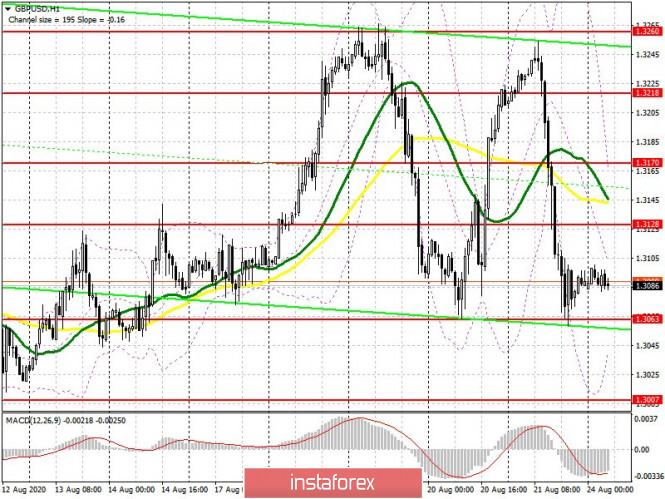

Even strong UK PMI data did not keep the pound from falling against the US dollar. After the first sell signal formed last Friday, which I paid attention to in my review, the pound continued to decline at a fairly rapid pace. On the 5 minute chart, you can see four entry points to the market : two for short positions and two for a rebound in long positions, based on corrections immediately from the levels at their first test. We are talking about the 1.3135 and 1.3084 ranges. Now the pound is locked in a fairly wide side channel. Given the fact that fundamental data will not be released today, we can expect that the pair will remain in the 1.3063-1.3128 channel. However, the main task of the bulls for today is to protect the 1.3063 range, since a lot depends on it. A false breakout there in the morning will be a signal to open long positions in anticipation of a breakout and also settling above the resistance of 1.3128. However, I recommend adding to purchases only after a top-down strength test of the 1.3128 level, which can lead to a repeated growth of GBP/USD already in the area of highs 1.3170 and 1.3218, where I recommend taking profits. In case the pair falls under the support of 1.3063, it is best to open long positions only after updating the low of 1.3007, or buy GBP/USD immediately on the rebound from the major support of 1.2916 based on a correction of 30-40 points within the day.

To open short positions on GBP/USD, you need:

The most optimal scenario for opening short positions today is forming a false breakout in the resistance area of 1.3128, where the moving averages also pass. It will be possible to sell the pound and wait for a breakout and consolidation below the support of 1.3063 only in this case, on which a lot depends. A break of 1.3063 will lead to a break in the upward trend and will also form a larger bearish momentum in anticipation of a decline to the 1.3007 level. A low of 1.2916 will be the long-term goal, where I recommend taking profits. In case the pair is not under pressure around the high of 1.3128, it is best to abandon short positions before updating the levels of 1.3170 and 1.3218 and open short positions from there immediately on the rebound based on a correction of 20-30 points within the day.

Indicator signals:

Moving averages

Trading is carried out below 30 and 50 moving averages, which speaks of the advantage of sellers of the pound.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakout of the lower border of the indicator around 1.3063 will increase the pressure on the pound. Growth will be limited by the upper level of the indicator in the area of 1.3128.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- The MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.