To open long positions on EUR/USD, you need:

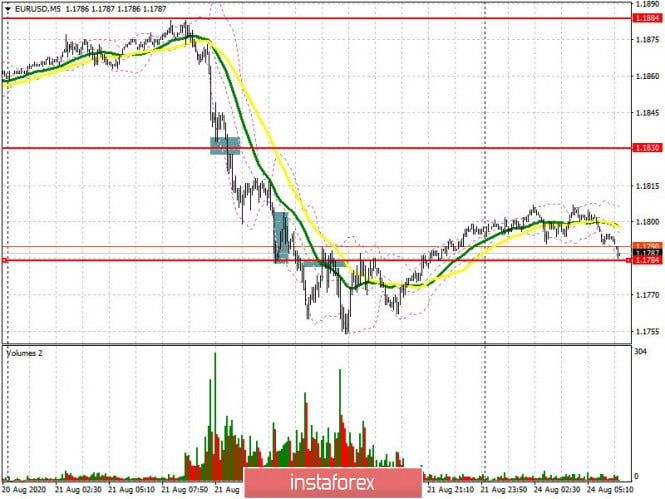

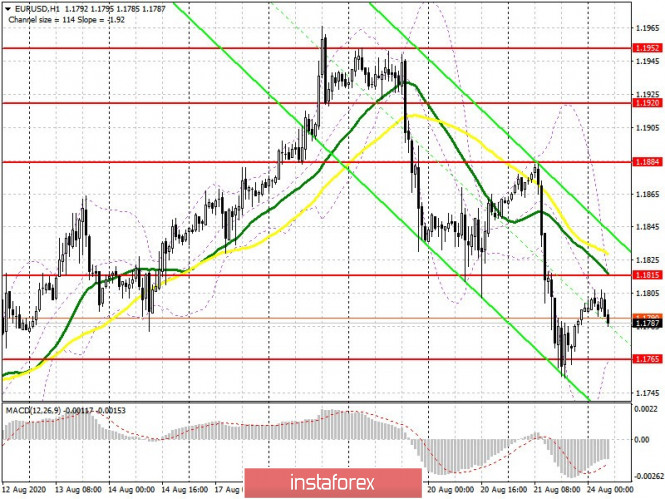

Several market entry signals were formed last Friday afternoon. After the release of the simply awful data on the eurozone PMI, the euro fell below the 1.1830 level. If you look at the 5-minute chart, you will see that after settling under the area below 1.1830, a sell signal formed for the euro, which led to an instant sale in the 1.1784 area, where I recommended opening long positions immediately on the rebound, which happened. On the first test of 1.1784 support, the pair sharply moved up by 20 points. Trade is currently conducted in a side channel, and given that the economic calendar is empty today, it is unlikely that anything will change. Bulls will try to regain the resistance of 1.1815, settling above it will form a signal to buy the euro in the hope of returning to Friday's high in the 1.1884 area, where I recommend taking profits. Protecting the 1.1765 support will also be an important task. After updating the previous week's low, a divergence could form on the MACD indicator, which will be an additional signal to open long positions. Buy EUR/USD immediately on the rebound, I recommend doing so only from the larger area of 1.1714 based on a correction of 25-30 points within the day.

To open short positions on EUR/USD, you need:

Sellers will try to break below the 1.1765 support, but it is not safe to open short positions under this level. It is best to wait for the pair to settle under this range and sell in the expectation of a further downward correction to the area of 1.1714 and 1.1648, where I recommend taking the profit. It will also be necessary to exclude divergence, which I mentioned earlier. A more optimal scenario for selling EUR/USD will be an upward correction and a false breakout in the resistance area of 1.1815, where there are also moving averages that play on the sellers' side. I recommend opening short positions immediately for a rebound from the larger high of 1.1884, based on a correction of 20-30 points within the day.

Indicator signals:

Moving averages

Trading is carried out below 30 and 50 moving averages, which indicates a high probability of continuing the downward correction.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakout of the lower border of the indicator around 1.1765 will increase pressure on the euro. A breakout of the upper border of the indicator in the area of 1.1815 will lead to an upward correction.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- The MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.