Before the publication of the FOMC minutes, the markets continued to recover confidently, which was facilitated especially by positive macroeconomic data. So, inflation in the UK in July unexpectedly turned out to be noticeably higher than forecasts, the pound reacted with growth, pulling the entire range of currencies with it, the eurozone reported a growing current account surplus. In Canada, the growth of retail sales in July significantly exceeded the forecast, which gave reason to expect a continuation of the recovery in consumer demand. The S&P 500 added about 10p. to a record close on Tuesday, and Apple made history by becoming the first public company with a capitalization of over $ 2 trillion.

However, after the publication of the minutes, the markets turned around - the S&P 500 declined by half a percent, the yield on bonds increased, and the dollar also reacted with growth. The reversal is based on several factors at once, including rather gloomy forecasts for the economy. FOMC members focused on the health crisis, which they believe will have a strong impact on employment, inflation and economic activity.

Another clearly negative point is skepticism about the effectiveness of bond purchases as a tool to control the yield curve. Japan was the first in world practice to take this path, and the accumulated experience allows us to conclude that along with positive results, such as filling the budget and controlling profitability. There are also clearly negative ones, which are expressed in a complete lack of interest in Japanese GKOs from foreign investors and the increasingly slow rate of repatriation of capital of Japanese investors, which ultimately leads to the formation of a vicious circle.

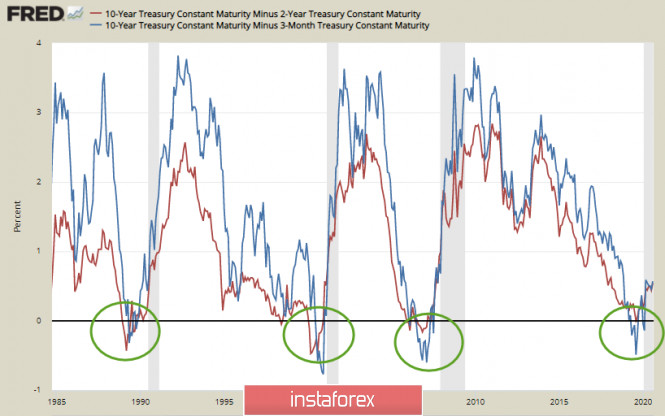

Moreover, yield inversion has most likely already occurred. The graph of the difference between short-term and long-term securities exactly repeats similar movements in the other three crises since 1980, the recession has already begun, and the only question is how deep it will turn out to be.

The main conclusion to be drawn from the minutes is that it does not contain any promises regarding additional liquidity supplied to the market. The Fed has long hinted that tax incentives will not be the most effective tools to generate liquidity from central banks, but this is precisely the issue where Republicans and Democrats clinched in Congress and are still far from compromise.

As a consequence, the markets conclude that liquidity will be limited on both sides – by the Fed and by Congress. The situation is developing negatively for the bears on the dollar. The limitation of liquidity will inevitably lead to an increase in USD.

Thus, the main result of the publication of the minutes is the growing probability of the dollar strengthening across the entire spectrum of currencies.

EUR/USD

Markets' positive mood at the beginning of the week encouraged renewed growth in the euro, but the resistance at 1.1950 held out. The pullback on Wednesday was a reaction to the publication of minutes and profit taking, but the probability of a bearish reversal is rising.

Consumer inflation declined by 0.4% in July, which turned out to be worse than forecasted, the core index also fell by 0.3%, and the recovery in consumer demand is not proceeding as actively as forecast.

PMI data for the eurozone countries will be published on Friday. There are no serious domestic impulses that are expected to change the moods in the next 24 hours.

Technically, the impulse has not yet been worked out and the probability to overcome 1.1950 and go above 1.20 remains, however, fundamental factors insist on a reversal. We expect a decline to the support zone 1.1700/50.

GBP/USD

Good inflation data is counterbalanced by reports of new difficulties in negotiations with the EU. The market is still hoping that major agreements will be reached in September, but the chances of a positive outcome are diminishing every day.

Strong inflation data allow us to revise the forecasts for the Bank of England's rate, but, obviously, the first move will be made by the FOMC on September 16-17. This event is key for the entire currency market, and the pound will not fall out of the general trends. The pound reached the annual maximum of 1.3270, but failed to break through it. The pullback to 1.30 on Thursday morning looks reasonable. The end of the week will be marked by the revaluation of the dollar's prospects, which will lead to bulls' profit-taking and a deep correctional wave. We expect a decline to 1.30 and continue further to 1.2810, where consolidation may start.

The material has been provided by InstaForex Company - www.instaforex.com