As expected, at his speech yesterday in Jackson Hole, US Federal Reserve Chairman Jerome Powell announced a review of the monetary policy strategy. The main point of this revision is the presence of a strong labor market, which will not affect the growth of inflation in the country. Powell believes that the rate of inflation remains high, despite the July decline to 10.2%. As for inflation, its target level will remain around 2% in the long term. However, in the near future, the head of the Fed does not rule out higher inflationary growth as compensation for lower inflation, which was observed before. According to the Chairman of the Federal Reserve, this revision of the monetary policy strategy should support the labor market and help strengthen the American economy.

In my opinion, this is a rather unusual decision, which reflected a minimum of specifics. This conclusion is also indicated by the ambiguous reaction of the market, which we will see on the price charts of the main currency pair.

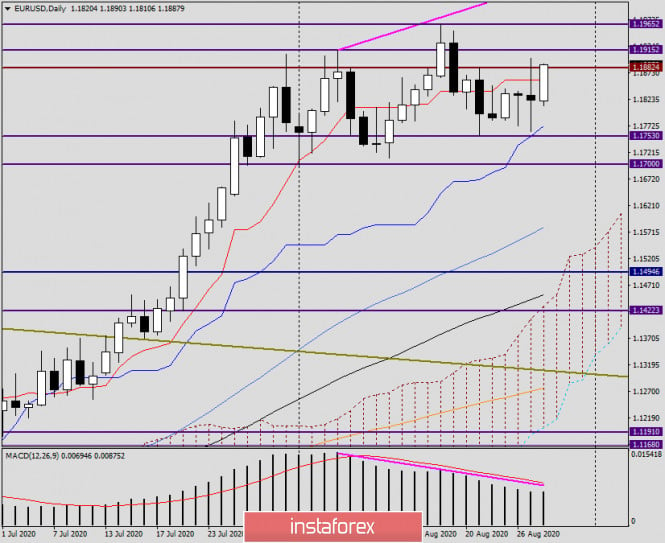

Daily

Following the results of yesterday's trading, a "Rickshaw" candle appeared on the daily chart, with approximately equidistant shadows and a small bearish body. Does this not indicate the uncertainty that reigned in the ranks of investors? In addition, yesterday's expectations of high volatility were fully confirmed. The pair soared to 1.1900 and fell to 1.1762, but in the end, the trading closed at 1.1820, which is quite a good result for the euro bulls.

After yesterday's speech by Powell, the market today is growing and the pair is trading near 1.1863. From the technical nuances, it is worth noting that yesterday the euro bulls again failed to close trading above the Tenkan line of the Ichimoku indicator, as well as a strong rebound that occurred from the significant level of 1.1900. It is also worth paying attention to the failed breakdown of the sellers' resistance at 1.1882. This level was only punctured, but not breached. I believe that players on the rise today need to close trading above yesterday's highs of 1.1900, and it is even better for the euro bulls to end today and the week's sessions above the falsely broken resistance of 1.1915. The primary task of bears for the pair will be to break through the strong support zone of 1.1773-1.1753, where the Kijun line of the Ichimoku indicator passes. Yesterday's lows and the minimum trading values were marked on August 21. Judging by market sentiment, the most likely scenario is an upward trend and another attempt to gain a foothold above the important mark of 1.1900.

H4

The four-hour chart shows even better what happened during the Fed Chairman's speech in Jackson Hole. The market was tossing from side to side, not knowing how to react to the presented changes in the monetary policy of the US Central Bank. At today's Asian trading, the euro/dollar currency pair showed strong growth, during which the simple moving average and the middle line (dotted) of the ascending channel were broken through 50. After that, a pullback was given to the dotted line and an opportunity to open purchases, after which the quote again rushed up.

Trading recommendations for today suggest buying the instrument. Risky from current prices, less risky after the actual breakdown of sellers' resistance at 1.1882 (this is what is happening now), on a pullback to this level. At the same time, I do not recommend setting large goals, however, it will be limited to the price area of 1.1900-1.1915.

The material has been provided by InstaForex Company - www.instaforex.com