4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 84.2328

The British pound started to adjust again on Thursday, July 23. And in order to describe all the news of this day, you will need several articles. In the fundamental review of the EUR/USD pair, we have already said that the upward trend does not raise any questions at this time. The only question is, how long will it last based on the negative fundamental background from the US, which is currently available? Approximately the same question applies to the pound/dollar pair, since, from our point of view, the pound sterling has recently become more expensive not because everything is good in the UK, and Boris Johnson has already taken out a pen to sign trade agreements with the US and the European Union. Everything is exactly the opposite. Agreements with the European Union and the United States do not even smell, and the British economy will continue to experience serious problems because of Brexit, because of the absence of these agreements and because of the "coronavirus" crisis. Based on all of the above, we do not believe that the pound sterling (as well as the euro) is able to continue forming a strong upward trend at this time. The current levels reached by the euro and the dollar look like the maximum or limit in the current conditions. Once again, we are not saying that both upward trends will end tomorrow, but we are warning that they may do so in the near future and we need to be prepared for this.

Meanwhile, Donald Trump continues to work to suppress rallies and protests in American cities. No sooner did we assume that the governors and mayors who belong to the Democratic Party are deliberately not in a hurry to suppress the riots, than Trump confirmed our hypothesis with his intentions and statements. According to the head of the White House, he is going to send significant federal forces to American cities as part of operation legend. Trump said that he has no choice. "In order to quell the mass riots that have caused a surge in crime across the country and, in particular, in its largest cities, we need decisive actions that the Democrats are not capable of," the head of the White House believes. Meanwhile, the very same Democrats who run states and cities say they will not tolerate interference by federal military forces and special forces, as was the case in Portland. "We are open to a real partnership, but we do not accept dictatorship," said Chicago Mayor Laurie Lightfoot. However, Trump can no longer be stopped. At a regular press conference, he said: "This uncontrolled increase in crime and violence leads to devastating consequences. Residents of the entire country have the right to security." If this is not the war we discussed in the EUR/USD article, then what is it? By the way, all democratic governors and mayors can also be understood. The rallies and protests themselves are mostly completely peaceful. And the increase in crime, which is not proven, but only voiced by Trump, who benefits from resorting to the services of special forces, can only be a consequence of these rallies. And peaceful rallies are not banned in the United States, so as long as the protesters do not carry out any illegal actions, there is nothing to arrest and disperse them for.

At the same time, Donald Trump said at a press conference that other consulates and embassies of China may be closed in the United States. The American President repeated the suspicions of some media that employees of the Chinese Consulate in Houston started a fire when they burned secret papers and documents. However, it is not clear what happened first, the closure of the Consulate or the fire? In any case, the official version of Washington is "to protect the intellectual property and personal data of Americans". However, we did not have to wait long for a response from China. Beijing, according to insider information, intends to close the American Consulate in Wuhan, as well as the Consulate in Chengdu. It is reported that the Consulate in Chengdu is strategically important for the United States, as it is the only one in the South-Western provinces. In general, it does not matter which Consulate will be closed. China will respond with mirror measures in any case.

But the UK continues to suffer losses from its decision to leave the EU. It is reported that investors are increasingly avoiding investments in the British economy. Shares in the British FTSE stock index lost 17% in 2020. Bank of America calculated in the latest survey that the UK is the most unattractive region for investors. Bank of America reports that the pound sterling because of Brexit has become similar to the currency of developing countries, and the fluctuations of the pound in the foreign exchange market called "neurotic". Also, as previously reported, in 2020, the UK's GDP may lose 14%, which is much more than in any European country, in the European Union as a whole, and in America shaken by four crises. This goes back to the question of whose economy still looks more stable and confident, and which currency should dominate the pound/dollar pair.

At the same time, relations between the UK and Scotland, which wants to remain in the European Union and leave the United Kingdom, continue to heat up. Prime Minister Johnson arrived in Scotland on a business visit and first Minister of Scotland Nicola Sturgeon "met" him with a scathing tweet: "I welcome the Prime Minister to Scotland. One of the key arguments for independence is that Scotland can make its own decisions, rather than live in a future defined by politicians we didn't vote for and who lead us down a path we didn't choose. His presence emphasizes this." However, experts believe that Johnson arrived in the region just to reduce some of the tension over Scottish independence. "The only reason Boris Johnson came here is because he is in full-scale panic mode amid growing support for Scottish independence," said Scottish nationalist leader Keith Brown.

As a result, we can say that as long as the price is located below the moving average line,the upward trend remains in the medium term. Especially with the support of two of the channels linear regression is directed upwards. On Friday, July 24, the UK will publish retail sales for June, which may grow by 8% compared to May. Also on this day, it is planned to publish preliminary values of the index of business activity in the services and manufacturing sectors of Britain, which is likely to exceed the level of 50.0. Similar business activity indices will be published in the US, also with forecasts above 50.0.

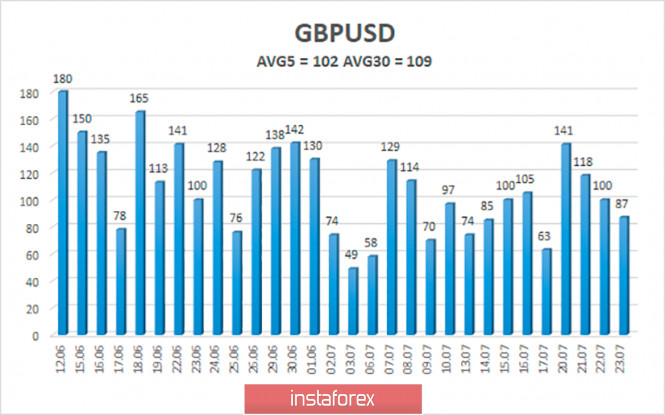

The average volatility of the GBP/USD pair continues to remain stable and is currently 102 points per day. For the pound/dollar pair, this value is "high". On Friday, July 24, thus, we expect movement within the channel, limited by the levels of 1.2633 and 1.2837. Turning the Heiken Ashi indicator downward will indicate a new round of downward correction.

Nearest support levels:

S1 – 1.2695

S2 – 1.2634

S3 – 1.2573

Nearest resistance levels:

R1 – 1.2756

R2 – 1.2817

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe is trying to continue moving up, but can not overcome the Murray level of "+1/8" - 1.2756. Thus, it is recommended to continue trading for an increase with the goals of 1.2817 and 1.2837 (the level of volatility), but for new longs, it is recommended to wait until the level of 1.2756 is overcome. Short positions can be considered after fixing the price below the moving average with the goals of 1.2573 and 1.2512.

The material has been provided by InstaForex Company - www.instaforex.com