4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 121.3540

From our point of view, the situation that has developed at this time for the EUR/USD currency pair is very ambiguous. On the one hand, everything is very simple and clear. There is a pronounced upward trend that is visible to the naked eye. It would seem that what else do traders need, who are always advised to trade according to the trend? Just buy the Euro currency and enjoy life, counting the profit every day. On the other hand, every trader should also be an analyst. At least a little. And here the question arises, and on the basis of what is the euro currency growing at all? If you look at the 24-hour timeframe, you can clearly see that after the markets calmed down after the March and April panic, the euro currency has already grown by 800 points, or 8 cents against the dollar. For the entire 2019 year, the euro currency fell by 2 cents against the US dollar with the undeniable superiority of the US economy. So what is the reason? At first glance, the reason lies in the European Union itself. Europe does not conflict with China, has successfully suppressed the spread of the "coronavirus" and now, by the decisions taken by the European Commission and at the EU summit, has prepared itself an excellent springboard for further recovery. On the other hand, the current state of the European economy is not good. And it is certainly no better than the state of the American one. Yes, the United States has a large public debt that continues to grow. But it was last year and the year before. The most interesting thing is that the euro currency continues to grow, without paying much attention to the fundamental background from Europe itself. That is, for example, the ECB meeting was held not so long ago. The meeting is absolutely passing, but nevertheless, there was no reaction. Although Christine Lagarde recently poured left and right pessimistic forecasts, according to which -8.7% of GDP in 2020 – this is still an optimistic scenario for the European Union. Okay. The next important event was the EU summit, where the budget for 2021-2027 and the fund for economic recovery after the pandemic were to be agreed. On Monday, no decision was made, although the summit was supposed to end on Saturday. But the markets again showed remarkable calm and did not start selling off the euro currency. After it became known that the EU countries managed to agree on a package of assistance and its distribution among the most needy countries – the euro also continued to grow. Yesterday morning it became known that the European Parliament does not fit the current version of the seven-year budget and it requires adjustments, threatening to block this project altogether – the euro still continued to grow. Naturally, when we say that the euro is constantly growing, we do not mean that there has not been a single correction or pullback during all this time, we are talking about a general upward trend that does not stop. And this trend indicates that there is a more important, more permanent fundamental background, which forces market participants to trade for an increase in the EUR/USD pair almost every day. And in our humble opinion, this background comes from overseas. And all the seemingly positive background from the European Union only complements the negative coming from the US and pushing the pair up.

We have repeatedly stated that the United States is now facing four types of crisis, and we have repeatedly listed the problems that the country has already faced and may face. We also believe that there is a war going on in America at this time. Not in the literal sense of the word, but this is war. "The war against Donald Trump" or "the war for the US presidency". We like the first wording better, since Joe Biden takes almost no part in the fighting. And during the "coronavirus epidemic", when the government, political forces and the president must show their unity, since human lives, the future of the country and the nation are at stake, all participants in the fighting continue to fight for power. In short, without going into details, the situation looks like this. Democrats are ready to do anything to remove Trump from the position of President, not to allow him to be re-elected. They are ready to initiate a new impeachment, to do nothing in the United States and cities that they control, where rallies and protests are held that prevent Trump from restoring his political ratings, they are ready to criticize the US President for "coronavirus", for exceeding power, for violating democratic principles, for a trade war with China. But Donald Trump himself is no better. He is even more critical of the Democrats, constantly makes contradictory statements about the "coronavirus" that can confuse anyone, and all his actions show that the main thing for him is to be re-elected in November, and not to stop the epidemic and save the lives of the American population. And outside the United States at any time, the current government can be attacked by China, which also does not like Donald Trump for quite objective reasons. As a result, we have continuous rallies and protests in at least 140 cities of the country, which are not always suppressed. We have 60-70 thousand new cases every day. We have a major political crisis. And all this against the background of the economic crisis caused by the same "coronavirus" and "lockdown". And the main question here is, how long are market participants ready to get rid of the US currency based on the above factors? In other words, what values can the euro grow to if the situation in the US remains the same and does not continue to deteriorate? We believe that if the euro has not yet fully exhausted its potential, it is approaching it. The US dollar has become more expensive since the beginning of 2018 and has grown by 19 cents during this time, despite the fact that its economy was much stronger than the European one. Now, in just 2 months, the euro currency has grown by 8 cents due to the crisis in the US, however, it can not be said that the US economy has become weaker than the European one. And for investors and traders, the question of the state of the economy is the most important one. Based on all of the above, we recommend that traders continue to trade on the trend, but do not expect the strong growth of the euro currency to continue. Technical indicators clearly show that the trend is not yet complete. Therefore, long positions remain relevant. However, you do not need to wait for the euro around the levels of $ 1.20 - $ 1.25$. This is unlikely to happen in the coming months.

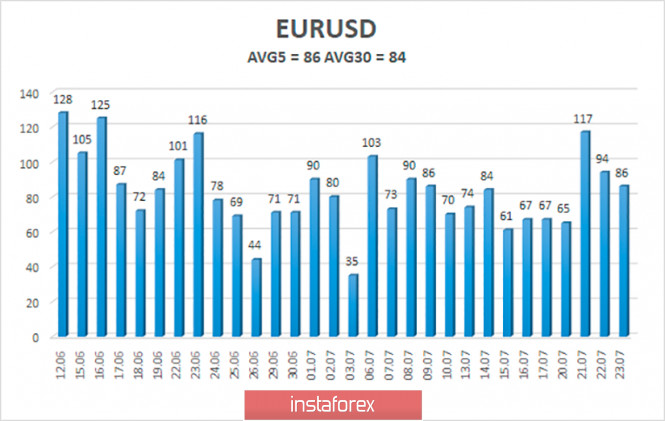

The volatility of the euro/dollar currency pair as of July 24 is 86 points and is still characterized as "average". Thus, we expect the pair to move today between the levels of 1.1516 and 1.1688. The reversal of the Heiken Ashi indicator downwards signals a turn of a downward correction within the framework of an upward trend.

Nearest support levels:

S1 – 1.1597

S2 – 1.1475

S3 – 1.1353

Nearest resistance levels:

R1 – 1.1719

R2 – 1.1841

R3 – 1.1963

Trading recommendations:

The EUR/USD pair continues to strengthen its upward movement. Thus, it is now recommended to stay in purchases of the euro currency with the goals of 1.1688 and 1.1719, until the Heiken Ashi indicator turns downward (1-2 bars of blue color). It is recommended to open sell orders no earlier than when the pair is fixed below the moving average line with the first targets of 1.1353 and 1.1230.

The material has been provided by InstaForex Company - www.instaforex.com