US stock indices showed an impressive growth again on Tuesday in response to a stronger-than-expected retail sales report in May. Growth amounted to 17.7% with a forecast of 8%, and the markets regarded this result as a direct indication that consumer spending will also grow at a higher rate, which means that a strong decline in GDP in the 2nd quarter will likely be avoided.

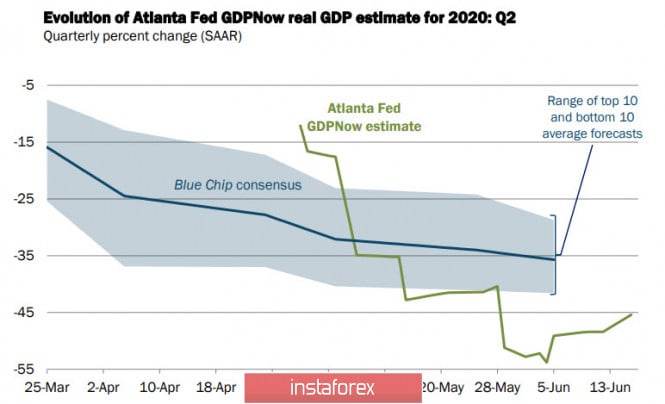

The latter conclusion is more than controversial. In any case, the Atlanta Federal Reserve Bank adjusted its forecast for GDP by only 3%, and expects a decline of not 48.4%, but 45.4%. Small difference isn't it?

It is logical that the growth amid encouraging retail data will be won back very quickly, since completely different factors must be taken into account. The Trump administration, in the framework of supporting the economy, is preparing the next $ 1 trillion investment project, which is reported to be directed to infrastructure projects. This news contributed to the growth of optimism, because together with the measures taken earlier, it will support the stock market.

At the same time, it is completely unclear who will ultimately bear the obligation to repay the rapidly growing debt. As we know, the US Federal Reserve has announced that it is ready to provide unlimited liquidity. The Congressional Budget Committee examined the first 4 laws that were passed in response to the coronavirus pandemic and summarized their impact on federal spending, income, and deficits. Usually, it is customary to consider only expenses, but the CBO went further and considered such a factor as lost revenue from the adoption of laws.

The result is disappointing – 4 laws of March 6, 18, 27 and April 24 added a total of 2.404 trillion dollars to the budget deficit. If we add new measures, it is clear that there is no chance of an increase in the rate in the coming years, otherwise, the US budget will not be able to service the public debt.

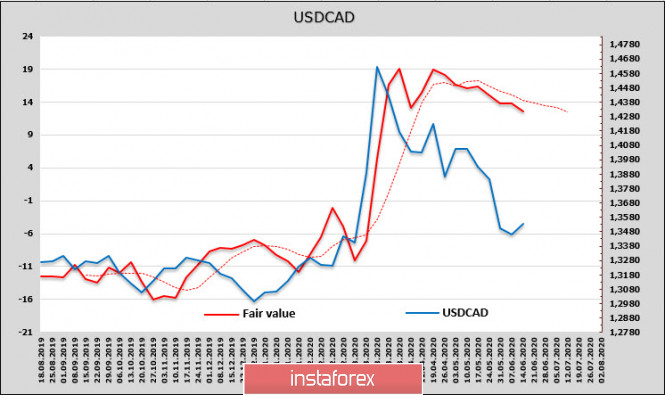

USD/CAD

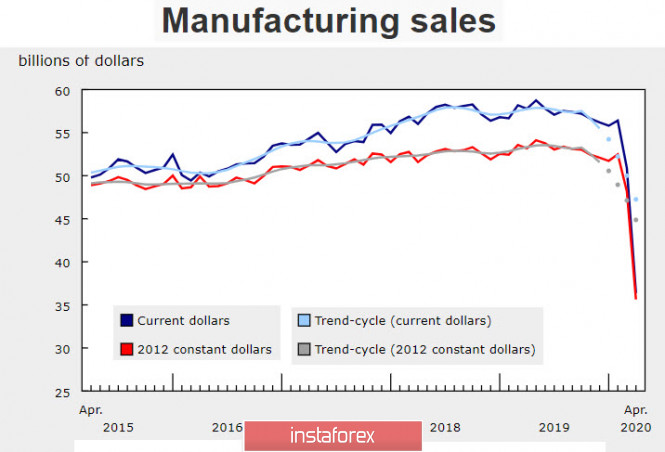

Canadian manufacturing sales declined by 28.5% in April after falling 9.8% in March. April marked the first full month of physical distance measures in connection with COVID-19, and manufacturing plants operated at limited capacity or completely ceased operations.

Obviously, May will show an even deeper decline, so for now, making long-term forecasts is early. If the likely second wave of coronavirus does not force restrictive measures to be reintroduced, it can be assumed that the fall of the Canadian economy has gone to the bottom, and against the backdrop of global growth of optimism, this will also affect the growth of the Canadian dollar.

Today, data on consumer inflation in May will be published. The forecast is positive, if it is true, then USD/CAD will receive an additional impulse to decline.

The Canadian dollar is significantly lower than the estimated price, which gives reason to expect USD/CAD to grow, but since the estimated price is directed down and below the trend line, any growth should be considered corrective.

As a result, the movement of USD/CAD to a minimum of 1.3310 within the boundaries of the medium-term downward channel with a goal at 1.3150 looks more reasonable. Growth is limited by the upper boundary of the channel 1.3720/40, the current market situation suggests a further decline.

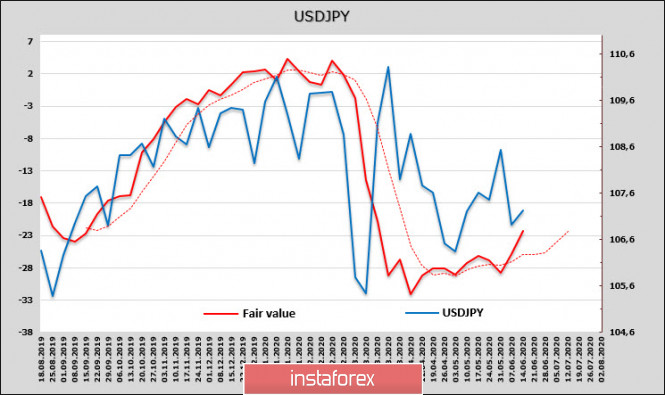

USD/JPY

According to the results of the meeting ended on June 16, the Bank of Japan kept the interest rate at 0.1% and confirmed the main parameters of the super soft policy adopted at previous meetings. Additionally, measures to support small and medium-sized businesses will be expanded from 75 to 110 trillion. yen in the form of interest-free loans. Obviously, this is a necessary measure - import and export declined in May by 26.2% and 28.3%, industrial production was at a peak, and emergency measures could not be avoided.

The yen is experiencing a slight decline in demand amid growing optimism. The estimated price is directed upwards, which corresponds to the position of large speculators who reduce the long position on the yen.

There is a high probability that support at 106.56 will not be updated and the current decline can be used to buy in order to test the current maximum 109.85 for strength.

The material has been provided by InstaForex Company - www.instaforex.com