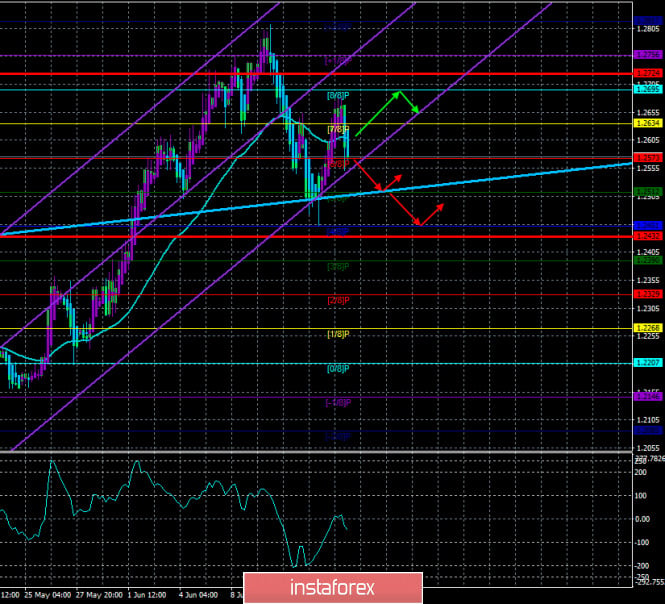

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -49.4481

Over the past two days, all traders and analysts have been discussing only one event – the continuation of the dialogue between the UK and the European Union regarding an agreement on further co-existence after December 31, 2020. It is the "sequel". And this "continuation" caused euphoria in the currency market. The British pound soared yesterday and it doesn't matter whether it is due to this information or not. All the media and experts immediately began to trumpet that the pound received market support due to the resumption of Brexit negotiations. However, the negotiations did not end and did not pause. The parties simply cannot agree on many of the key issues and nothing has changed in the past two days. All that has happened is a statement by both sides of the need to continue negotiations and speed them up a little.

We will now try to understand better everything that has happened in recent days. First, it should be noted at once that the pound sterling in recent years really likes to get more expensive on rumors. Therefore, yesterday's news could easily be interpreted as the willingness of both sides to make concessions, which will bring them much closer to the cherished agreement. However, as has happened in reality many times, such rumors are usually not confirmed by anything. Secondly, Boris Johnson and the EU leaders did not make any loud statements after the joint video conference. The official statement said that the parties agreed that "a new impetus is needed in the negotiations". London and Brussels also supported the plans of the negotiating groups of Michel Barnier and David Frost to intensify negotiations and create a favorable environment and conditions for signing a comprehensive agreement by the end of 2020. The meeting was attended by the head of the European Commission, Ursula von der Leyen, the head of the European Council, Charles Michel, the head of the European Parliament, David Sassoli, British Prime Minister Boris Johnson, and Michel Barnier. Earlier, Boris Johnson has repeatedly stated that London will not extend the duration of the "transition period", yesterday the parties officially announced this. Boris Johnson also reminded EU leaders that the UK is ready to leave the Alliance without any agreements. Thus, the first six months that were devoted to negotiations ended with little more than nothing. Of course, serious adjustments were made by "coronavirus", but if you remember the position of Boris Johnson before the epidemic, it becomes clear that COVID-2019 is absolutely nothing to do with it, and the outcome of the negotiations by June 16 would have been the same. Based on this, in fact, absolutely nothing positive has happened for the pound. The parties can negotiate for as long as they want, but until there are concrete concessions on both sides, there will be no progress. Well, what awaits the UK if an agreement is not reached, we have already written repeatedly. In short, it is another blow to the economy, a blow to the welfare of citizens, and a blow to the country. In any case, any budget deficits will be covered by ordinary Britons, not Boris Johnson, so the population of Albion will pay the bills anyway.

However, the British Prime Minister still expressed hope that the parties will be able to reach an agreement before the end of this year. And this statement looks like a mockery, especially after the statements of Michel Barnier that London is not very keen to conclude an agreement, and sometimes openly delays the negotiation process. Also, Boris Johnson initially intended to withdraw the country from the bloc without any agreements, but this option was strictly blocked by the Parliament, and everything ended in a serious political crisis and re-elections. From our point of view, a new political crisis may now begin in Britain. The population of the country is dissatisfied with the actions of the authorities in the fight against COVID-2019. The British are dissatisfied with the fact that there will be no deal with the EU, as they fear the supply of many medicines that are produced in the EU. In times of global pandemics, you will agree that this is a rather serious issue. As a result, the political ratings of Johnson and the Conservative party began to decline, and the ratings of the Labor party began to grow. Of course, such a crisis as in the United States and the UK is still far away, but certain makings are already visible.

Yesterday, some fairly important reports were published in the UK. Most surprising was the unemployment report, which remained unchanged at 3.9% in April. And this is despite the fact that by the end of the same April, 856 thousand applications for unemployment benefits were submitted in the country. And at the end of May, there were still 370 thousand such applications. How, at the same time, unemployment in Britain has not increased by half a point, is unclear. However, we have already witnessed a paradoxical decline in unemployment in the US, where instead of rising to 20%, unemployment has managed to fall in the midst of the pandemic crisis. After this data, the wage report was no longer of interest to anyone. Well, the pound did not react to these data. But with pleasure, I reacted with a fall to Jerome Powell's speech in Congress.

Today, June 17, the UK will publish the inflation rate for May, which, according to experts, will slow down to 0.5% y/y. However, as we said earlier, at this time, inflation is almost irrelevant. And in general, macroeconomic statistics are often simply ignored by traders. Thus, we would recommend paying much more attention to Jerome Powell's second speech to the US Congress and to technical factors.

And the technical factors are now such that it is unclear whether traders are going to resume the formation of an upward trend or are preparing for mass sales. We are inclined to the second option, but it requires fixing the price below the moving average line. Both channels of linear regression are currently directed upwards, but we still do not see any serious and compelling reasons for the pound to continue to rise in price at such a difficult time for the UK.

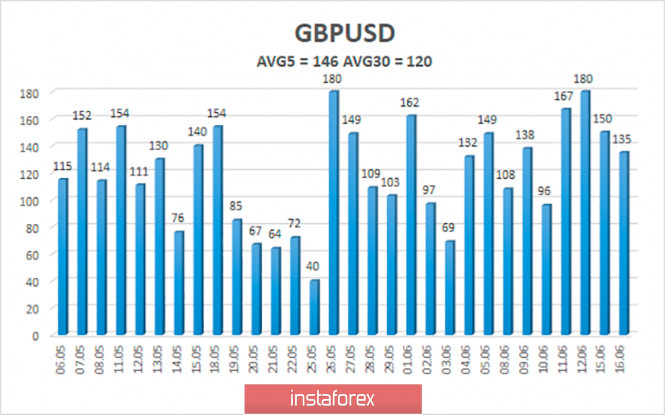

The average volatility of the GBP/USD pair continues to remain stable and is currently 146 points. For the pound/dollar pair, this indicator is "high". On Wednesday, June 17, thus, we expect movement within the channel, limited by the levels of 1.2432 and 1.2724. A reversal of the Heiken Ashi indicator upward will indicate a possible new round of upward movement.

Nearest support levels:

S1 – 1.2573

S2 – 1.2512

S3 – 1.2451

Nearest resistance levels:

R1 – 1.2634

R2 – 1.2695

R3 – 1.2756

Trading recommendations:

The GBP/USD pair resumed its downward movement on the 4-hour timeframe, anchoring below the moving average line. Thus, today it is recommended to trade the pound/dollar pair for a decrease with the goals of 1.2512 and 1.2451. It is recommended to buy the pound/dollar pair when traders manage to return to the area above the moving average, with the first targets of 1.2695 and 1.2724. It is recommended to be extremely careful with purchases of the pair now.

The material has been provided by InstaForex Company - www.instaforex.com