Macroeconomic data from a number of G10 countries published on Tuesday are entirely in the green zone, which added to the optimism of players and contributed to the growth of stock indexes and overall confidence that the global economy has started a recovery cycle.

The largest positive contribution was made by the Markit report on the PMI of the eurozone countries, which showed a significant excess of forecasts. The risks of an escalation of the trade war between the United States and China declined after Trump's quick explanation of Navarro's inconvenient comments.

The dollar is under pressure, partly partly due to rising positivity, partly due to uncertainty about the expected introduction of another stimulus program, partly due to the fact that the US economy may be under pressure due to the threat of another wave of coronavirus - in more than 30 states, R0 is greater than unity, which, in turn, increases uncertainty.

NZD/USD

Today, as expected, RBNZ left the rate at 0.25% and did not increase the QE program. The accompanying statement emphasizes that despite some positive changes in the near future, "significant economic problems remain" and the risks are still firmly inclined downward. The RBNZ reminded the markets that, if necessary, it has additional tricks. What kind of tricks? We will learn from the results of the meeting in August, at which, as expected, the QE program will be increased from 60 to 90 billion.

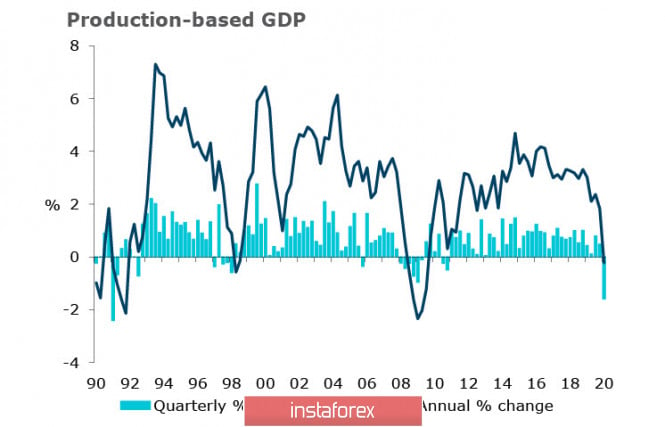

The tone of the accompanying statement was distinctly dovish, the main threats were expected to be regarded as a consequence of the coronavirus epidemic, but is it really a matter of coronavirus? Just look at the graph of GDP growth rates to see that the peak of recovery after the 2008/09 crisis occurred in the 1st quarter of 2015, after which the GDP growth rate has steadily declined.

It is clear that the economy has suffered significantly due to the fact that international tourism was completely blocked. But does everything else work? New Zealand lifted quarantine restrictions earlier than other countries, prices for dairy products are stable, the industry is fully operational. The growth of NZD, of course, worsens the overall picture, but this is a natural payment for the fact that coronavirus essentially bypassed the country. Nevertheless, the RBNZ emphasized that a high exchange rate is a constraining factor, as one of the measures it is supposed to increase the purchase of assets abroad.

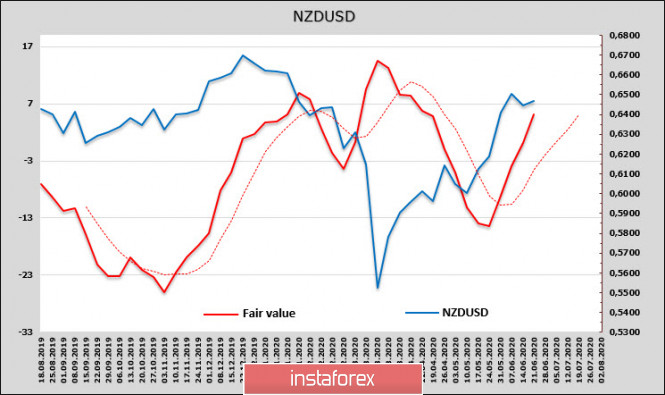

In general, it is understood that the situation in the economy of New Zealand is completely under control, the RBNZ is preparing a number of additional incentive measures that will ultimately have a beneficial effect on the overall investment climate. The decline in inflation is uncritical, and according to the latest CFTC report, investors are very favorable towards the NZD - the total short position declined by 608 million and almost went to zero, the dynamics are positive, and the estimated fair price is confidently looking up.

The NZD/USD pair is trading near highs in the side range, the exit from which is highly likely to take place up. Purchases from current levels with a target of 0.6750 are logical, with a pullback to support 0.6375/90, you can add to purchases, canceling this scenario will go below the lower limit of the range with a simultaneous increase in panic in global markets in general.

AUD/USD

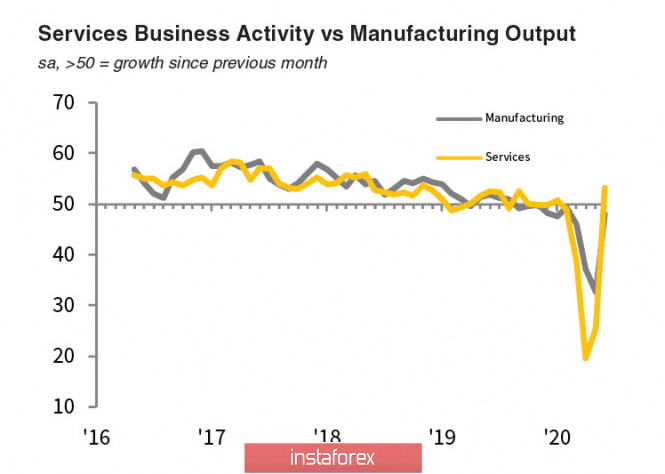

Australia is one of the first to enter the growth trajectory, which clearly follows from the high PMI levels in June. The manufacturing index came close to the growth zone, showing 49.8, the service sector went even higher at 53.2 p, and the composite index 52.6 p.

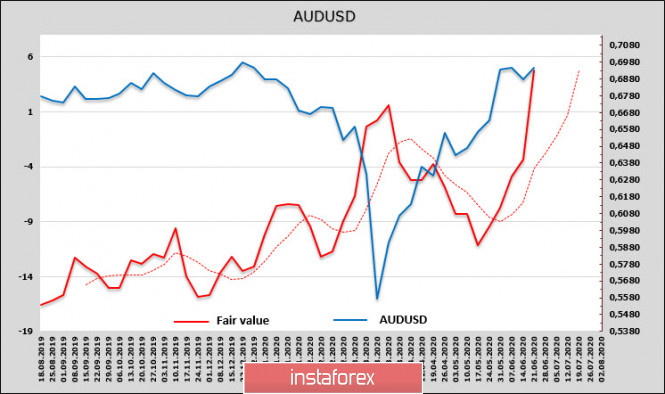

A sharp decline in the short position in AUD led to a strong increase in the estimated price, the chances of continued growth look very convincing.

We should expect a test of the strength of the maximum of June 10, 0.7064, and an attempt to increase to 0.7207. The recovery of the Australian currency from the March 15 low of 0.5507 looks rapid, especially on the weekly chart, and this increases the probability of a correction, but still not in the coming days. Meanwhile, investors are very positive, and AUD supports the confident recovery of China, whose economy was significantly more stable than what was expected in January-February.

The material has been provided by InstaForex Company - www.instaforex.com