GBP/USD 1H

The pound/dollar pair was also adjusted against the trend supported by the downward channel, and then completely left it through the upper line. Thus, the trend for the GBP/USD pair has also changed to growth. However, the situation is much more complicated for this instrument than for the euro. Both technically and fundamentally. Firstly, quotes crossed the upward trend line a few days ago, so the upward movement is absolutely not obvious. Secondly, unlike the EUR/USD pair, there are no technical factors left that would support trading on the rise now. There is no growth channel, no upward trend line. Thus, the position of buyers is not that confident now. Nevertheless, we expect upward movement to continue in the framework of the general trend of the dollar's fall.

GBP/USD 15M

Both linear regression channels reversed their direction on the 15-minute timeframe. Thus, market participants have the right to count on continued upward movement today.

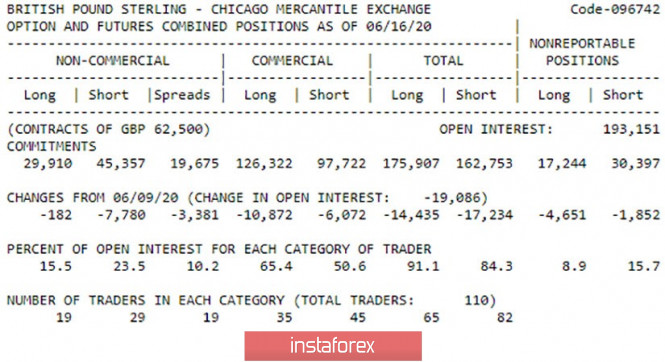

COT Report

The latest COT report, which covers the dates June 10-16, shows that during this time period, professional market players were busy closing sales contracts. That is, the picture for the reporting week was observed exactly the same as for the euro. Demand increased during the indicated period, but not because the pound or the euro became more expensive. On the contrary, demand for the dollar decreased, and traders closed Sell contracts, which led to the growth of European currencies. This is precisely what we told traders to focus their attention on earlier, since there were simply no special reasons to buy the euro and the pound in recent weeks. Nevertheless, both currencies rose. It is also worth noting that during the reporting week, speculators also closed purchase contracts, hedgers closed both types of contracts, and in general, the pound lost about 32,000 more contracts. Thus, banks, large companies, investment funds and others were engaged in closing all types of transactions during the reporting week, rather than opening contracts. However, this week the pair shows their desire to move up. The new COT report, which will be released on Friday, will show if demand for the pound has grown this time among professional traders.

The fundamental background for the GBP/USD pair continues to be more negative than positive. Market participants continue to push the pound/dollar pair, and not pull it down. If in the case of the euro, you can find enough reasons and grounds for strengthening the single currency. In the case of the pound, we recall all the problems of the British economy, which a priori cannot be correlated with the continued growth of the British currency. Of course, we understand that it's a sin not to use the chances of selling the dollar provided personally by US President Donald Trump, however, they look strange along with the pound. Everything is also strange in terms of macroeconomic statistics. Yesterday's index of business activity in the UK turned out to be much better than experts' forecasts, but, as we already said, US indexes were no weaker. As a result, the pound rose in price anyway. Thus, if traders pay attention to the foundation when opening trading positions now, then it is the negative fundamental background from the United States, and not the macroeconomics or no less negative background from the UK. Well, this is the decision of most market participants, and we recommend that you do not trade against the trend and do not try to guess the long-term movement of the pair.

There are two main scenarios as of June 24:

1) The initiative for the pound/dollar pair passed into the hands of buyers. Therefore, it is now recommended to resume trading on a fall but not before consolidating the pair below the critical Kijun-sen line (1.2450) and the support area of 1.2404-1.2424. In this case it will be possible to talk about a new potential movement to go down with a target of 1.2229. Potential Take Profit in this case will be about 150 points.

2) But buyers have every chance to implement their strategies. Thus, we advise you to buy the GBP/USD pair with targets at the resistance level of 1.2573 - Senkou Span B line (1.2632) - resistance area of 1.2719-1.2759 - resistance level of 1.2801. Overcoming each target will allow you to stay in longs. Potential Take Profit in this case will be from 80 to 250 points.

The material has been provided by InstaForex Company - www.instaforex.com