EUR/USD 1H

Buyers managed to pull out the EUR/USD pair from the downward channel on the hourly timeframe on June 23. The pair's quotes continued to grow after that, however, traders could not overcome the resistance area of 1.1326-1.1343 the first time. This area is not the first time that slows down the pair's movement and acts as support/resistance. Thus, at the moment, we can conclude that the bears lost the initiative, and the bulls took a serious step towards forming a new upward trend. Now, if they manage to overcome the 1.1326-1.1343 area as well, then chances of forming an upward trend will increase many times, and the first goal will be the resistance level of 1.1417, which was already reached earlier. It should also be noted that both upward trend lines continue to remain in force, thus, the bulls continue to dominate the market in the long term.

EUR/USD 15M

Both linear regression channels are directed upward on the 15-minute timeframe, so the trend has changed to an upward one in the short term and continues to be so.

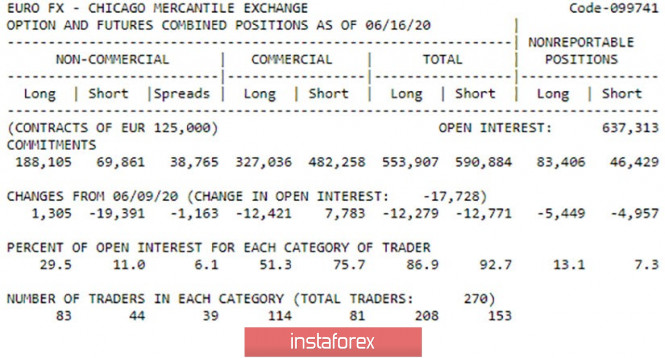

COT Report

The euro/dollar pair steadily rose until June 16 (the deadline, data for which is included in the latest COT report) and was only adjusted in recent days. According to the COT report, professional traders were busy during the entire reporting week not with opening purchase contracts, which could be assumed based on the direction the pair was moving, but with closing sale contracts. In just five days, professional traders closed almost 20,000 Sell contracts and at the same time opened 1,300 Long Euro contracts. Thus, the continued strengthening of the European currency at that time was absolutely logical. But for the second week in a row, we emphasize that large market players do not buy the euro, and therefore do not believe in the prospects of this currency. The euro grew for two weeks almost at the mere closure of contracts for sale by large speculators, which caused a skew of supply and demand for the euro. After a relatively small correction, the European currency resumed its upward movement, and the new COT report will answer the question whether the demand for the euro has increased this time, or is it going up again not because market participants buy it?

The general fundamental background for the EUR/USD pair did not change at all on Tuesday. From our point of view, it remains more neutral. However, traders continue to buy the EUR/USD pair (not the same as buying the euro), therefore, willy-nilly, but you have to think about the reasons for this kind of behavior of market participants. Yesterday, Markit business activity indices for Germany, France and the EU turned out to be significantly higher than forecasts and indeed allowed us to draw optimistic conclusions about the recovery of the production and services sectors. However, no less encouraging information came from overseas. Nevertheless, the euro has risen in price again, but the US dollar has not. Since the upward trend continues to remain in force (two upward trend lines), it seems that traders continue to look with skepticism towards everything that happens in the United States. In principle, the dream of US President Donald Trump came true. After all, from the very first day of his presidential term he dreamed that the dollar should be cheaper, which, at the very least, it would make it easier to service the US public debt. Now the dollar is falling not because of all the events that takes place in the country. We have already repeatedly described it in fundamental articles. Thus, we still recommend trading primarily on the basis of technical factors, which now speak in favor of continuing the pair's growth.

Based on the foregoing, we have two trading ideas for June 24:

1) Bears could not dominate for a longer period than one week. Now, in order for sellers to once again begin to show their presence in the market, they will have to wait until the price consolidates below the critical line and at least below the first upward trend line. In this case, we recommend selling the euro with targets at support levels of 1.1112 and 1.1047. Potential Take Profit is from 70 to 140 points.

2) But the buyers perked up and take the initiative in the market. Therefore, we advise you to wait for the 1.1326-1.1341 area to be overcome and buy the EUR/USD pair while aiming for the resistance level of 1.1417. Potential Take Profit in this case is about 70 points.

The material has been provided by InstaForex Company - www.instaforex.com