4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

CCI: 32.0632

The EUR/USD currency pair continues to adjust at the beginning of a new trading week. Moreover, this correction is increasingly taking the form of a flat. At least now we can say with confidence that there is no trend movement since the pair is trading between the moving average line directed sideways and the Murray level of "1/8"-1.0864, that is, in the range of 30-40 points wide. Thus, in any case, to resume trading the pair, it is recommended to wait for the exit from this range. In general, the downward trend persists in the long term, as evidenced by two downward channels of linear regression.

A huge amount of macroeconomic information is planned for the third trading day of the week in the European Union and the United States. Thus, traders will clearly not be bored today. Another thing is that no important messages and figures are expected from the European Union, but really important information will be received from overseas. However, first things first. In the European Union, indicators that can only be interesting in general will be released today. But this interest will definitely not be reflected in the charts of the euro/dollar currency pair. For example, an indicator such as the index of economic sentiment, which is based on a survey of consumers, or the level of consumer confidence, which reflects consumer confidence in the current economic situation, or the business climate indicator, which assesses the conditions for doing business, or business optimism indices in the services and industry sectors, which reflect the mood of business leaders in these areas. It is easy to guess that by the end of April, all these indicators will collapse down, as well as many others. Nothing else can be expected here. And traders will most likely ignore these reports. Thus, you can not focus on these publications too much.

A little later, data on inflation for April will be received from Germany. These data are preliminary, but, nevertheless, they do not promise anything good. In April, a strong slowdown in the consumer price index is expected - to 0.6% in annual terms and to 0.0% in monthly terms. Most likely, a strong decline in inflation will be due to the fall in oil prices around the world and the accompanying cheapening of gasoline or other fuels. And in any case, in times of crisis, traders are not too interested in reducing or increasing prices. At a time when the economy is essentially stagnant and residents are in quarantine, it doesn't matter too much whether, for example, cars have become more expensive. No one is buying them now anyway. Thus, the inflation indicator turned from an extremely important one, which central banks relied on when adjusting their monetary policies, to a secondary one.

There will also be quite a lot of information coming in from overseas tomorrow. Everything starts with what is probably the most important report on GDP for the first quarter. According to experts' forecasts, the most important indicator of the state of the economy will lose 4% in the first quarter. Some forecasts predict a fall of 4.6-5.0%. However, in any case, there will be a decrease. But the figure by which the US economy will decline is not final. The first quarter has not yet been completed, which means that by the end of it and, according to the final calculations, there may be an even greater reduction. Also on Wednesday, April 29, the United States will publish indicators of the price index of GDP and personal consumption expenditures for the first quarter. However, this data is unlikely to interest the markets. Thus, before the evening meeting of the Fed, the most significant report of the day will be GDP. Moreover, this is the only indicator, from our point of view, that traders can react to. After all, in fact, market participants are now interested in only one question: how much will the US, EU, and global economies decline? This is what will now determine the confrontation of national currencies, as well as the United States themselves in the international arena. Accordingly, traders can react to the GDP data, although they previously ignored data on unemployment, Nonfarm Payrolls, inflation, retail sales, business activity, and orders for durable goods. Because it was clear that all these indicators would fall. GDP will obviously also fall, but the size of its fall will determine the duration of economic recovery in the future.

Steven Mnuchin and Donald Trump in one voice declare that in the near future, the economic borders of the United States will be opened, and the country will begin to return to normal life. According to Trump, there are obvious signs of improvement in the situation with the "coronavirus" epidemic. Therefore, the country's Finance Minister and President want to restart the economy as soon as possible. For example, from May 1, the state of Texas will be opened, its residents will be able to get out of home quarantine, shopping centers and cinemas will be opened (with some restrictions). It is obvious that far from the most affected by the pandemic, Texas will be a kind of "laboratory rat", which will have to answer the question about the possibility and probability of a second wave of the epidemic when removing quarantine measures. If the experiment with Texas is successful, then restrictions in other states will be gradually removed. The problem is different – at the moment, according to official information, the number of people infected with the COVID-2019 virus in the United States is one million people. Yale University Clinical Epidemiology Professor Robert Hecht, for example, believes that most infected people in the United States are not even aware that they are infected. As previously reported, the virus can be completely asymptomatic in many people with a strong immune system. It can take place in a very easy form, in which even a doctor's appointment is not required. Accordingly, these patients do not go to medical institutions, but still remain carriers of infection and can infect other people. It is also reported that in the United States, more than 5.5 million tests for "coronavirus" were conducted, but they were conducted only in those patients who went to hospitals. Studies on antibodies in random New Yorkers suggest that at least 2.7 million were infected in this city alone. The same opinion is shared by the Director-General of the World Health Organization, Tedros Adhanom Ghebreyesus, who said that the world is far from ending the pandemic. "We continue to strongly recommend that countries find, isolate, test, and process all cases and track every contact to ensure that the spread of the virus is further reduced." Thus, lifting the quarantine in one of the most infected countries – the United States – may turn into a second wave of the epidemic. The United States also leads the world in the number of "fatalities" – 56,000.

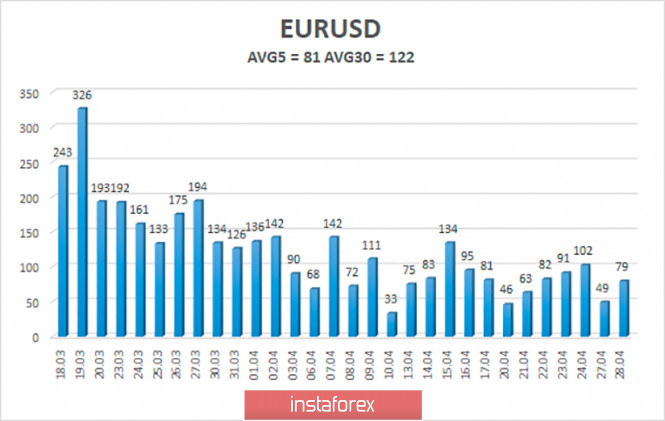

The volatility of the euro/dollar currency pair as of April 29 is 81 points. Volatility, therefore, remains average in strength, and there is no reason to expect a new wave of panic yet. Today, we expect the pair's quotes to move between the levels of 1.0750 and 1.0912. Turning the Heiken Ashi indicator down may signal the end of the upward correction cycle.

Nearest support levels:

S1 - 1.0742

S2 - 1.0620

S3 - 1.0498

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0986

R3 - 1.1108

Trading recommendations:

The EUR/USD pair continues to adjust against the downward trend. Thus, traders are recommended to trade down today with the goal of a volatility level of 1.0750, but after fixing the price below the moving average. It is recommended to consider buying the euro/dollar pair not before fixing the price above the Murray level of 1.0864 with the goals of 1.0912 and 1.0986.

The material has been provided by InstaForex Company - www.instaforex.com