By the end of the third week, after investors realized the consequences of the influence of the corona virus on the global economy, almost all of the world Central Banks had already distinguished themselves by taking measures and starting their implementation aimed at supporting their national economies.

At the end of the week, we can say that the ECB, the Central Bank of Japan and Switzerland, headed by the Federal Reserve, chose a "proven" way to deal with crisis phenomena by pumping up the financial system of their countries by all possible means. On Thursday, the Bank of England joined this club of fighters with the consequences of the coronavirus, which cut the key interest rate to 0.1% from 0.25% and expanded incentive measures, that is, the repurchase of assets to 645 billion pounds. The growth amounted to 445 billion from the previous volume of 200 billion. By the way, the Reserve Bank of Australia also launched a quantitative easing program today in the amount of 5 billion Australian dollars.

On Thursday, the situation calmed down somewhat in the markets. Oil quotes almost leveled their landslide decline on Wednesday and continue to rise on Friday. Today, Asian stock indexes are in the green zone, which are growing after the positive dynamics on Thursday of US and European stock indexes. At the same time, futures for US and European stock indexes also show upward momentum before the opening of trading in Europe.

The expected depreciation of the US dollar, higher gold prices, as well as the weakening of the yen and the franc against the dollar can be noted in the currency market, against the backdrop of a slight decrease in market tensions.

It seems that investors began to seriously digest the massive measures taken by the world Central Banks aimed at supporting the economies of their countries, stabilizing financial systems that they had never seen at close range, being influenced by panic. However, despite a slight shift in sentiment, it is still too early to say that all the worst in the markets has already happened. In our opinion, the remaining time until the end of March may become decisive, when either the pandemic situation in Europe and the United States will still be taken under control or not.

Assessing the general situation, we believe that a decrease in panic in the markets will lead to a weakening of the US dollar and an increase in the overall, although cautious demand for risky assets.

Forecast of the day:

Gold receives support amid a weakening dollar. We believe that a decrease in panic moods, as well as breaking through the level of 1500.00, can lead to its recovery to 1554.00.

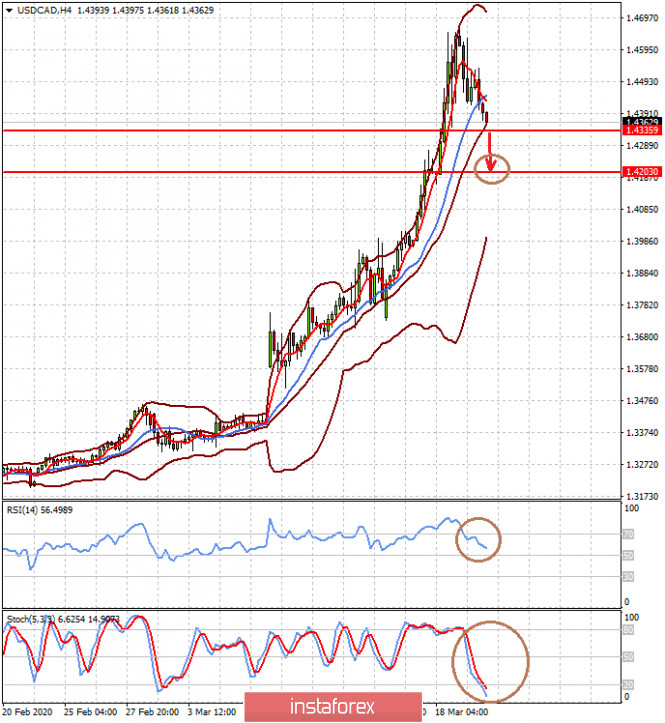

The USD/CAD pair continues to adjust downward in the wake of a rise in crude oil prices, as well as a weakening US dollar. We believe that it can decline to our target of 1.4335 yesterday, and then continue to decline to the level of 1.4200, if positive mood in the markets continues.