4-hour timeframe

Technical details:

Higher linear regression channel: direction - sideways.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - downward.

CCI: -189.2552

Well, another disastrous day for the European currency has ended. If the pound (this time!) showed at least some signs of the beginning of a corrective movement on March 19, then the euro currency, after a short pause, fell down again. The "draconian measures" of the European Central Bank, which announced a new "Pandemic Emergency Purchase Program" worth 750 billion euros by the end of 2020 and the fact that US stock markets continue to collapse did not help. Traders still persist in buying the US dollar, continuing to consider it the safest currency in times of crisis. And no one doubts that the next crisis has come. Now the main thing is to figure out when it will end and when the economy will begin to recover. However, according to the general opinion of both medical experts and economic experts, it is too early to talk about this. While the pandemic was stopped in China, it continues to spread in Europe and the United States.

According to the latest data, the number of people infected with the COVID-2019 virus worldwide has reached 228,000 people. It is noteworthy that the growth of infected people has stopped not only in China but also in Italy. However, if the PRC has already declared a local victory over the virus, it is too early to draw the same conclusions for Italy. The Italian government is going to extend the strict quarantine and believe that even when the peak of the pandemic is overcome, it will not be possible to return to normal life immediately. "The government's measures, including suspending commercial activities and closing schools, will be extended as long as necessary," Italian Prime Minister Giuseppe Conte said. "The restrictions help to contain the spread of the coronavirus, Italy managed to avoid the collapse of the system," the Prime Minister said. As for other countries, in Spain, the number of infected reached 17,000, in Germany - 14,000, in France - 9,000.

The oil market is now extremely important for the whole world. Since it is not the least of all the source of panic in the stock and currency markets. Recall that oil of all brands fell to the lowest levels in the last 20 years on Wednesday. At the auction on Thursday, the quotes of "black gold" managed to recover a little, but this is not enough to talk about overcoming the crisis. It is obvious that the oil market collapsed due to the falling demand for oil due to the "coronavirus", as well as due to the failure of negotiations to stabilize oil prices between OPEC countries (in particular, Saudi Arabia) and Russia. On Thursday, the price of Brent and WTI crude oil rose to $ 25.9 and $ 23, respectively.

If the oil market shows any signs of recovery, the US stock market continues to collapse. All leading economists have no doubt that the world is on the verge of a new crisis, and the recession has already begun. At the opening of trading on Thursday, the key S&P 500 and Dow Jones Industrials indices fell again. The first by 0.35%, and the second by 0.19%. This is a tiny drop compared to the losses that the stock market has already suffered. However, the auction on March 19 has not yet been completed. As of now, both indices have lost more than 2%. At the same time, the US Senate continues to consider the proposal of Donald Trump and Treasury Secretary Steven Mnuchin to allocate $1 trillion to support the economy. This amount should go to help airlines, households, and ordinary citizens. At the same time, if in the case of business we are talking about cheap loans, then with ordinary citizens, most likely, the policy of "helicopter money" will be applied, which has already proved extremely well during the 2008 crisis. Approximately $1,000 will be allocated for each US citizen, but more precise amounts will depend on income and family size.

By the way, today's eye-catching report on the number of applications for unemployment benefits in the US for the week of March 13. If previously these reports almost never attracted attention, now the real number of applications was almost 281,000, with experts' forecasts of 220,000 and the previous value of 214,000. The impact of "coronavirus" on business (reduction of the number of jobs) and on employees (increase in unemployment) is also on the face.

Well, Donald Trump, who goes on the air almost every day, and his comments about the COVID-19 epidemic cause a great resonance among both economists and doctors, again wrote an "encouraging" post on Twitter. "We will win - sooner rather than later," Trump said. But the President of the European Central Bank, Christine Lagarde, said that the fight against the "coronavirus" could cost the European Union about 5% of economic growth. According to ECB estimates, the EU risks losing from 2% to 10%. Everything will now depend on how long the restrictions (quarantines) will be in effect. The ECB believes that in almost all countries they will be extended to three months. It is in this scenario that the European economy risks losing approximately 5%. The ECB also decided to allocate approximately 37 billion euros to the countries of the alliance to combat the consequences of the epidemic. It is expected that these funds will help to combat the lack of liquidity, as well as strengthen the medical sector.

On Friday, March 20, neither the European Union nor the United States is scheduled for any important macroeconomic publications. However, as we have repeatedly said, they are not needed now by market participants. Conservative traders can only wait for the daily collapses to pass in order to resume logical and reasonable trading. From a technical point of view, the downward movement continues, as evidenced by both the fastest indicator "Heiken Ashi" and the slower senior channel of linear regression. The CCI indicator is in the oversold zone, but it also does not have any effect on trading at the moment. When markets are in a panic, the best option is to stay out of the market. Or trade strictly on the trend.

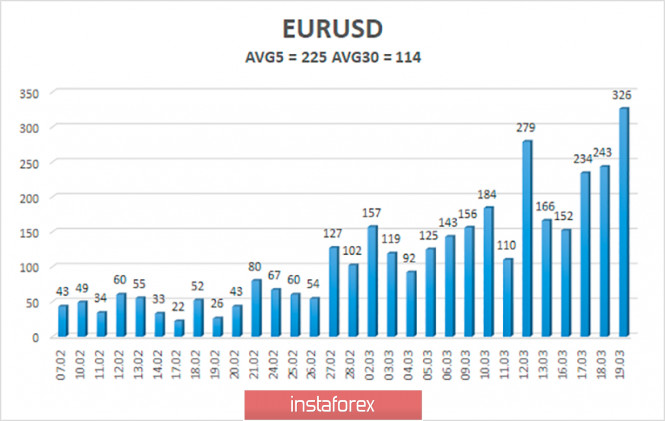

The average volatility of the euro/dollar currency pair remains at record values and continues to grow day by day. At the moment, the average value for the last 5 days is 225 points, and the last trading day turned out to be an absolute record – 326 points. Markets continue to be in an agitated state. There is no logic in the movement now, the markets just collapse and collapse every day. Thus, on Friday, we again expect a decrease in volatility and movement within the channel, limited to the levels of 1.0465 and 1.0915.

Nearest support levels:

S1 - 1.0620

S2 - 1.0498

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0864

R3 - 1.0986

Trading recommendations:

The euro/dollar pair continues its strong downward movement. Thus, traders are still recommended to sell the euro with the targets of 1.0620 and 1.0498 before the Heiken Ashi indicator turns up, which will indicate the beginning of an upward correction. It will be possible to buy a pair of EUR/USD no earlier than fixing the price above the moving average line with the first target Murray level of "4/8"-1.1230. When opening any positions, increased caution is recommended, since a frank panic reigns in the market now.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com