The financial world continues to discuss the Federal Reserve's unexpected decision to cut interest rates by 50 basis points. Yesterday morning, the market argued about whether the Fed would soften monetary policy at its March meeting or wait until April? To date, these conversations have lost their relevance: Powell slashed the rate, succumbing to political pressure and panic in society. Now traders are puzzled by another question - which central bank of the world will follow the examples of the Fed and the RBA? According to some experts, the Bank of Canada is next in line, which will hold its next meeting today.

But first, let's deal with the US currency's behavior from yesterday. The initial reaction is quite logical: the dollar sharply plunged throughout the market, responding to the unexpected and sudden decision of the Fed. But then the greenback won back some of the lost positions in almost all pairs, so the reaction of the dollar bulls to such a powerful move by the Fed turned out to be very wrinkled. Why did it happen? In my opinion, here traders were guided by the principle of "buy by rumor, sell by facts" - for example, the EUR/USD pair has been in demand for many days due to the dovish comments of members of the US regulator, which only increased the likelihood of a rate cut. But when the rumors became a reality, many traders took profits against the backdrop of multi-month price highs. As a result, the pair's upward impulse faded, as market participants chose to exit the game in anticipation of the next information drivers. A similar situation has developed in the remaining dollar pairs.

In addition, Jerome Powell at his unscheduled press conference tried to calm the markets. According to him, this is a necessary measure that will give an impetus to the US economy. He assured that the fundamentals of the US economy remain stable, but the coronavirus "brought new risks and problems." According to Powell, it is not yet known how long the epidemic will last - however, as soon as it wanes, key economic indicators will return to growth. In other words, the Fed chief made it clear that the measures taken are preventive and temporary. In general, Powell's rhetoric helped the US currency stay afloat - the dollar index even showed a slight correction.

Market participants have now switched to the possible action of the remaining central banks of the leading countries of the world. The European Central Bank is still keeping a wait-and-see attitude. Some members of the ECB said that there was no need for urgent measures to deal with the consequences of an outbreak of coronavirus. However, yesterday, Christine Lagarde issued a statement in which she voiced concern about the situation. She also added that the European regulator "is ready to take targeted measures commensurate with the main risks."

But the head of the Bank of Japan was more straightforward: Haruhiko Kuroda said that the central bank "will soon take the necessary steps to stabilize the markets." He added that the regulator will seek to stabilize markets by offering sufficient liquidity through market operations and asset purchases. This is a signal that the central bank will use all available tools to flood the market with money.

The Bank of Canada, which will hold its meeting today, is in the risk zone regarding possible actions of the dovish nature. I recall that at the previous meeting, the Canadian regulator removed the wording from the text of the accompanying statement that the current rate level is "appropriate to the situation". The regulator also pointed out that in determining the monetary policy, the central bank will find out whether the slowdown in the country's economy is "more stable than previously predicted".

The fact is that Canada's GDP indicator (on a monthly basis) for the first time in eight months has fallen into the negative region, reaching -0.1%. In annual terms, the indicator slowed down more than expected - up to 1.2%. The release structure suggests that 13 out of 20 sectors of the economy showed negative dynamics. In its accompanying statement, the Bank of Canada indicated that in the near future, the Canadian economy will "grow weaker than the central bank predicted at previous meetings." The regulator also criticized the growth rate of consumer confidence and expenses - according to the Bank of Canada, these indicators "turned out to be unexpectedly weak", as well as the volume of business investments.

At the final press conference, the head of the Central Bank made it clear that the members of the regulator discussed the need to ease monetary policy, but the balance of risks that was at that time made it possible to keep the rate at the same level – as Stephen Poloz put it, "at this stage". He specified that the weak inflation growth rates and signs of financial instability were primarily discussed. At the same time, the head of the central bank made it very clear that the balance of risks could shift in any direction - "in view of the new data."

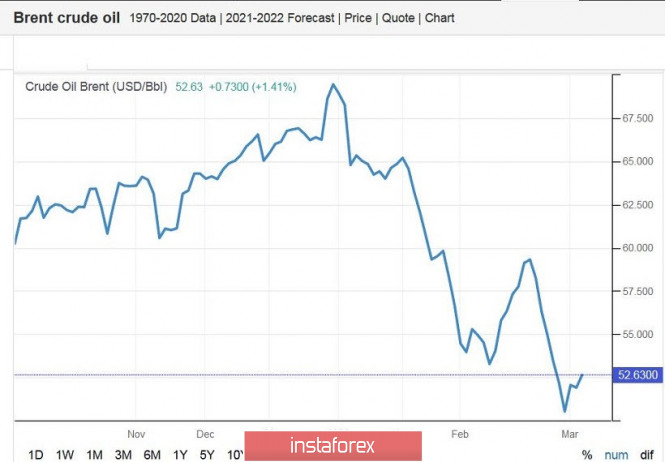

Obviously, since the last meeting of the Canadian regulator (that is, since January), the specified balance of risks has shifted to the negative side, despite the growth in labor market indicators and inflation. Macroeconomic reports in this case play a secondary role, since we are talking about a slowdown in the global economy and a decrease in the oil market. In particular, a barrel of WTI crude oil is now trading at $47; Brent has dipped to $52.

Therefore, given the previous rhetoric of Poloz, the negative consequences of the epidemic and the Fed's decision yesterday, it can be assumed that the Bank of Canada will take similar steps today. The only question is which strategy will the Canadian regulator choose for itself - more aggressive (decrease by 50 basis points) or a gentle one (decrease by 25 bp with a delay in the second decision). In any case, market participants lay a high probability of a rate cut at the March meeting - and the Bank of Canada is unlikely to act contrary to these expectations.

The material has been provided by InstaForex Company - www.instaforex.com