4-hour timeframe

Amplitude of the last 5 days (high-low): 104p - 108p - 87p - 194p - 111p.

Average volatility over the past 5 days: 121p (high).

The British pound was trading as if there were no news and events today, March 3. There were no planned macroeconomic publications in the United Kingdom and the United States. The pound/dollar pair quietly began to adjust in the morning. However, then trailers began to receive various kinds of messages and news that simply could not be ignored. The first thing that should be noted is the rumors that all the largest central banks of the world will lower key rates in the fight against the consequences of the coronavirus. The central bank of Australia and the US Federal Reserve have already done so. However, the pound almost did not react either to the rumors themselves, or to the negative expectations of most traders, or to the speech of Mark Carney, who almost openly declared his readiness to soften monetary policy, nor the Fed's decision to reduce the key rate by 50 basis points !!! And after all, if there were now more important topics for the British currency, such as negotiations between Britain and the EU on trade relations after 2020, one could understand this behavior of the pound/dollar pair. However, nothing of the kind happened. Traders of the pound simply missed the information about the sharp, unexpected rate cut by the US central bank. Even the GBP/USD volatility has not changed during the day. There was no surge of emotion, nothing. We talked in a neighboring review that the euro is paired with the US dollar is now devoid of logic in motion. It turns out that the pound sterling does not differ by this logic and validity either.

In the morning, Bank of England Chairman Mark Carney said that the regulator was ready to take all necessary measures to help the British economy cope with the consequences of the coronavirus. Earlier, Carney said that despite the fact that there are still quite a few sick and dead in the world, the quarantines imposed on many countries still have a negative effect on the British economy. The head of the British regulator also said that the monetary committee is now considering the consequences of the Covid-2019 virus and possible measures that it can take. At the same time, most likely, Carney will not be able to solve the problems of the coronavirus and its impact on Great Britain's economy, since he is set to leave his post on March 15.

Also today, the G7 countries have declared their readiness to use fiscal measures in case the situation with the epidemic worsens. Unfortunately, no specifics about the future actions of governments, ministries of finance and central banks were made available to traders. In fact, it was an emergency meeting of top officials of the G-7 countries, after which a statement was made in the style of: "the situation is under control, the governments of all countries of the world are in close cooperation to timely combat the spreading virus." The following message was posted on the US Treasury website: "Given the potential impact of Covid-19 on global economic growth, we consider it necessary to use all available tools to achieve strong, sustainable growth and protection against risks. Along with increasing medical efforts, G7 finance ministers are ready to take any action, including fiscal measures, to help counter the virus and support the economy at this stage." All other statements by officials from other countries were about the same. Thus, at the moment we can expect a softening of the monetary policies of the ECB and the BoE. In the current conditions, it's even hard to imagine what the market reaction to these events might be, how many key points key rates will be lowered, what consequences of the coronavirus all countries of the world will face in the near and more distant future. One thing is for sure, panic can take over markets. And if panic seizes the markets, then there is no need to talk about any reasonable trade. So far, we hope that the markets calm down a bit and trading returns to normal. But the situation in the world now is such that you cannot be sure of anything.

From a technical point of view, the pound/dollar has corrected today to the Kijun-sen critical line. Thus, since the fundamental and macroeconomic backgrounds do not currently have a special effect on the pair, technical factors remain the most important and significant. Based on this, a rebound in the price from the Kijun-sen line could trigger a resumption of the downward movement. Bollinger Bands and other trend indicators are also pointing down. If the BoE lowers its key rate in the near future, then the British pound may begin to feel more serious pressure from market participants.

Trading recommendations:

The GBP/USD pair continues the upward correction. Thus, it will be possible to sell the British pound again with targets at 1.2686 and 1.2647, after the completion of the current correction (MACD indicator turns down or rebounds from the Kijun-sen line). We recommend that you buy the pair with targets at the level of 1.2889 and the Senkou Span B line in small lots if the bulls are able to gain a foothold above the Kijun-sen line. The fundamental background now has practically no effect on the movement of the pair. This is alarming.

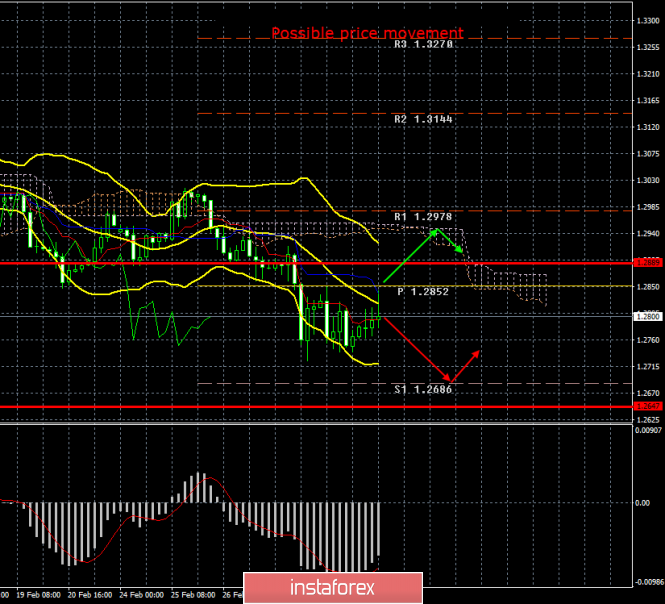

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dashed lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com