24-hour timeframe

The British pound sterling also began an upward movement on the 24-hour timeframe, followed by the euro currency, which was a fairly strong one. Similar to the euro's case, there was no particular reason to start such a movement. However, traders may still object that such an event as the Federal Reserve rate cut could and should have been worked out properly. Thus, at least, there were formal reasons for the pound/dollar to start getting more expensive. The growth of the British currency has been going on for four days, but the overall picture of the "swing" remains, which is especially visible on the 24-hour timeframe. The downward trend remains in force, but frequent and strong (relative to the trend movement) corrections make it very difficult for traders to work for a decrease. At the moment, the pair's quotes are consolidated above the critical Kijun-sen line, so further downward movement is called into question. However, we believe that at the beginning of next week we may witness a new round of downward movement. As for the fundamental background, it generally remains the same as for the EUR/USD pair. Emergency Fed rate cut, coronavirus, fall, recovery, and a new decline in the US stock market. In addition, the UK has Brexit and trade negotiations with the European Union. Questions to the markets remain the same as in the case of the euro/dollar pair. We do not believe that the pound's strong growth is justified macroeconomically.

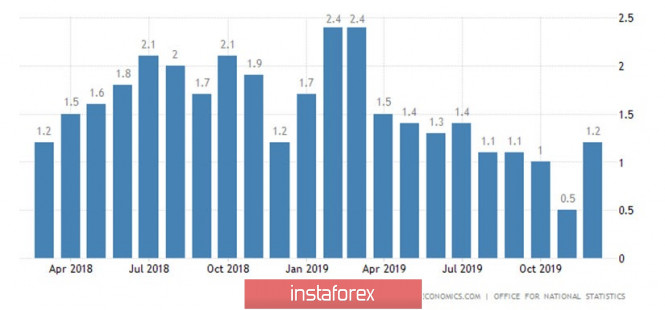

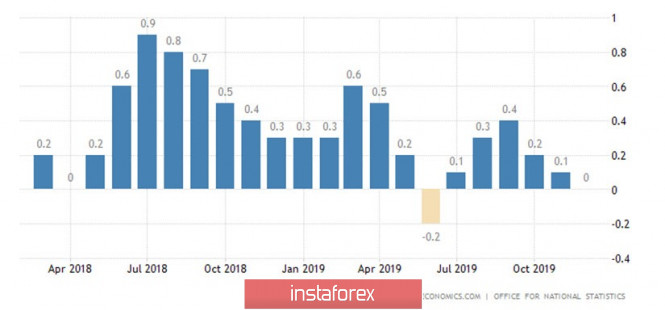

An important macroeconomic report from Great Britain or the United States will not be released on Monday, Tuesday, Thursday and Friday. Thus, traders will have to wait for Wednesday to receive and analyze new data from the US and Britain. First, the UK GDP data for January will be known, according to estimates by the Office of National Statistics and the National Institute for Economic and Social Research (NIESR). The first indicator is expected to decrease from 1.2% to 0.8% - 0.9% in annual terms and from 0.3% to 0.1% - 0.2% in monthly terms.

The second indicator is expected with an increase of 0.1%, which is already not bad, considering the value of the previous month was 0%. It should also be noted that more important indicators of GDP, quarterly, will not be published this time. However, even by these indicators, we can say that there was no acceleration of the British economy in January.

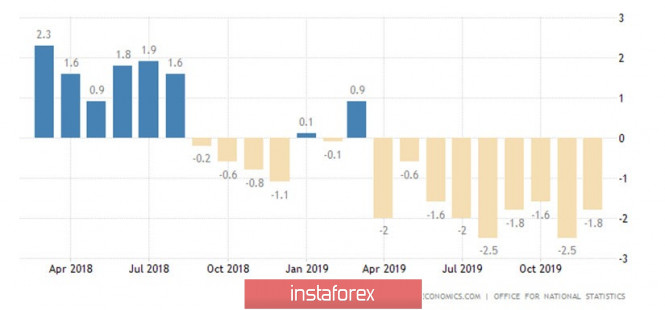

A report on the UK industrial production for January will also be released on Wednesday, and the forecasts are disappointing. It is expected that the indicator will decrease by another 2.3% in annual terms, and will add 0.4% on a monthly basis. However, if you look at the chart above, it becomes obvious that the indicator has not had any positive changes for more than a year and a half. And that's all the planned news in Great Britain for this week.

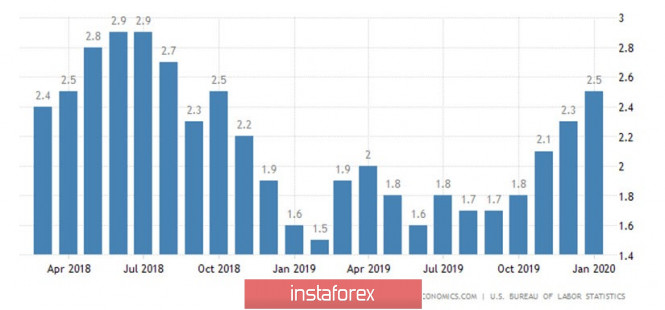

The most interesting data on the United States will also be released on Wednesday. There is only one report in the EU – inflation. In recent months, the core consumer price index accelerated to 2.3% - 2.4% y/y and consistently showed this value. Recall that core inflation is an indicator that does not take into account changes in prices for volatile goods, such as food and energy. According to the results of February, the value of this indicator, most likely, will not change and will amount to 2.3%.

The main indicator of inflation has accelerated from 1.7% in August to 2.5% in January, and it is expected to slow down to 2.3% in February. This is not critical for the United States. Recall that the target inflation rate of the Fed coincides with the ECB and is equal to 2%. However, if the European Central Bank fails not only to reach a stable +2%, but also to reach this level in principle, then, as we can see, things are going much better overseas with rising prices. Plus, we should not forget that the Fed's decision to lower the key rate should boost the economy. Loans have become cheaper, and economic activity should grow. Thus ,the decline to 2.3% (if it takes place and is recorded in February) may indeed be temporary.

In fact, at this time, traders do not need any news or messages at all. The dollar is selling on almost all market fronts. Thus, for more logical trades, we are waiting for panic to leave the markets. Based on this, there may be a strong trend movement on all days, despite the fact that statistics will only be available on Wednesday. The statistics of the third trading day of the week can be easily ignored by the markets. Traders should be prepared for this development.

From a technical point of view, the pound/dollar pair has crossed the critical line, so now the pair has an upward trend. However, we do not yet believe that the bulls are able to form a full-fledged upward trend. Moreover, there is another strong barrier waiting for traders from above in the form of the Senkou span b line. Moreover, the Bollinger bands are directed down (at the moment), which means that the chances of resuming the downward trend remain. The key now in the market is the concept of panic, which leads to illogical trading in our opinion.

Recommendations for short positions:

On the 24-hour timeframe, the pound/dollar pair should return to the area below the critical line, so that short positions become relevant again with the first goal of the support level of 1.2626.

Recommendations for long positions:

Formally, you can buy the British pound with the goal of resistance level 1.3100, however, in small lots, since the Golden Cross has not yet formed, and the price is located below the Ichimoku cloud. On the 4-hour chart, the movement is recoilless, so a downward pullback is possible next week.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

The material has been provided by InstaForex Company - www.instaforex.com