24-hour timeframe

The new trading week for the EUR/USD currency pair will be extremely interesting. In addition to all the fundamental background that is now available, the macroeconomic news calendar contains a lot of potentially important reports. Unfortunately, at this moment we can state a fact: market participants continue to ignore all incoming statistics, and it does not matter where it comes from, the United States or the European Union. Nevertheless, we are sure that, firstly, this cannot go on forever, and secondly, the euro/dollar pair now needs a downward correction after so much growth. Thus, the general recommendations to traders as a whole remain the same: we believe that we should not try to guess a strong trend reversal down; Do not open short positions on an upward trend; and even more so, not a single person in the world can now predict when the panic in all markets associated with the spreading coronavirus will end. Thus, all the economic information planned for the current week may well not cause any market reaction. Despite the fact that with a high degree of probability, this information will again not be in favor of the euro currency ...

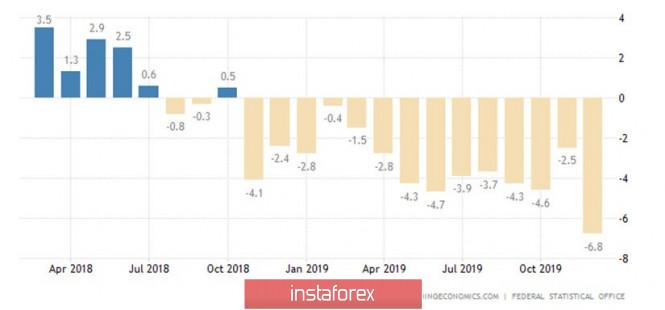

The trading week will begin cautiously with the release of the industrial production report in Germany. A negative was recorded for this indicator last month. At -6.8% in annual terms - this is exactly how much the fall in industrial production amounted to. Forecasts for the month of January are slightly better. Only a -4.5% y/y is expected and even +1.5% in monthly terms. However, a small increase after the strongest contraction (in monthly terms the indicator lost 3.5% in December) is hardly a sign of a recovery in the industry.

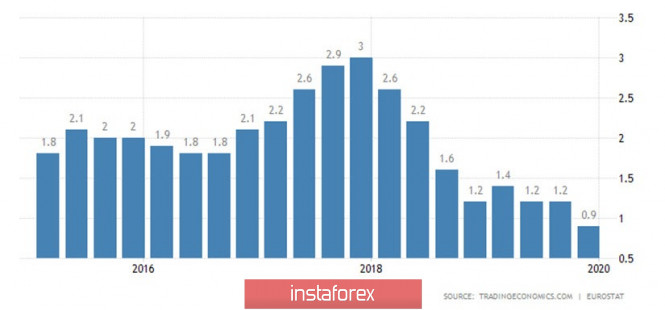

The EU will publish the fourth quarter GDP indicator on Tuesday, the final value. Here, too, traders are unlikely to find something optimistic for themselves. According to experts, GDP will decline in growth rates from 1.2% in the third quarter to 0.9% y/y in the fourth. Thus, euro-bulls cannot expect anything optimistic in advance and on Tuesday. In general, the GDP indicator in the EU has only slowed down over the past two years and the mark of 0% is not far off.

The inflation rate for February will be published in the United States on Wednesday (more detailed macroeconomic statistics from the US will be discussed in the GBP/USD article). The EU will release another important indicator on Thursday - industrial production for January. Given that another reduction is expected in the locomotive of the European economy of Germany, the picture does not differ as much in the EU. Forecasts indicate a decrease of another 3.4% in annual terms and an increase of 1.2% in monthly terms. However, as in the case of Germany, December was a failure in monthly terms, and an increase of 1.2% in January will not be able to offset these losses. The most interesting event of the day will be the ECB meeting, within which a decision can be made to lower the key rate. We do not believe that the rate in the EU should be reduced right now. In this matter, you should immediately find out why it can lower the ECB deposit rate? To fight the coronavirus, which hits the supply chain, on tourism? Or because macroeconomic statistics in the EU continue to slow down and worsen even without the influence of the coronavirus, despite all the previous manipulations of the central bank? Anyway, not all experts are certain that the ECB Monetary Committee will take this step in March. Forecasts predict either no changes, or a decrease of 0.1% to -0.6%. However, in almost any case, the ECB should not expect any hawkish actions or rhetoric. After the meeting, a press conference with the head of state, Christine Lagarde, will traditionally take place, and it is also unlikely that Lagarde will be optimistic during this event. Based on all of the above, euro buyers are unlikely to be lucky with the data on Thursday.

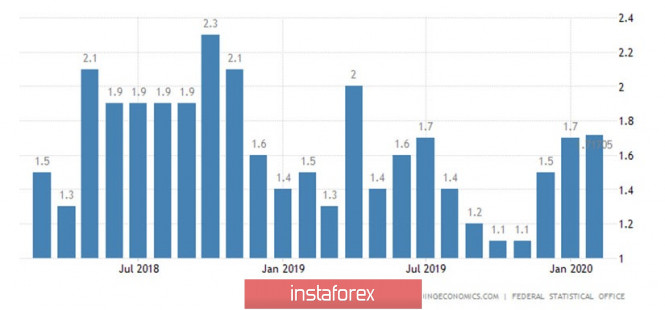

The last trading day of the week will be marked by a report on inflation in Germany, which is likely to remain unchanged and will be +1.7% y/y. What can we say in general? Given the fact that the euro is firmly increasing and non-stop, the reasons for this growth are not statistics, a correction is inevitable, the euro's fall is also inevitable, but everything will now depend on the coronavirus, which is terrible for the markets with the panic that it can cause. If you remove the epidemic factor, what are the reasons for the European currency to show growth against the US dollar? Yes, the Fed lowered the rate by 0.5%, but this is clearly not enough for the euro to grow for two consecutive weeks at a record pace. Yes, stock markets in the United States have collapsed, oil has fallen in price, and business activity has declined, but these factors affect both the European Union and the euro. Thus, we believe that even with the presence of the Chinese virus, the euro did not have sufficient grounds for such a strong growth. Thus, after the markets calm down, we will again expect a strong decline in the quotes of the euro/dollar pair.

Recommendations for short positions:

To sell the euro on a 24-hour timeframe, we recommend waiting for the quotes to consolidate below the Kijun-sen line. To do this, the pair should go down to at least 1.1100. The first target for shorts is the support level of 1.0838.

Recommendations for long positions:

Euro-currency purchases with the target of the resistance level of 1.1470 can be held until the MACD indicator moves down on this chart or until the price consolidates below the Kijun-sen line on the 4-hour chart. We recall that European statistics remain extremely weak and are not the reason for the strengthening of the euro.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

The material has been provided by InstaForex Company - www.instaforex.com