4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 168.1668

For the EUR/USD pair, the new trading week begins with a hint of the beginning of a downward correction. The upward movement as a whole is still maintained, and it is quite strong and recoilless. Traders continue to ignore any macroeconomic statistics. This conclusion is easily made based on the events of the past week when there was no reaction to the ADP and Nonfarm Payroll reports in the US. When there was no reaction to weak inflation in the EU. Thus, until the period of ignoring the macroeconomic background is completed, it is difficult to say what will happen in the market at all. At any time, new information about the "coronavirus" may arrive from the governments of the largest countries in the world that must fight the epidemic. Thus, what will be the reaction of the stock and currency markets to these messages? It is impossible to predict. That is, sharp turns and even stronger movements are possible. However, no one can predict these events either. Therefore, the only thing left for traders is to follow the trend and track of technical factors. On Monday, March 9, the only macroeconomic publication will be in Germany - industrial production for January with low annual forecasts. However, we believe that it is unlikely that traders will note this report. No more planned economic events are scheduled for tomorrow.

Since the market is not governed by macroeconomic events, we offer traders to understand the more global issues of the current time. Although several of the world's largest central banks have already lowered their key rates, we still believe that the US economy remains the strongest economy in the world and, judging by current indicators, it does not need to be stimulated at all. And if you compare it with the European one, there is absolutely no doubt whose in advantage. However, last week, the Fed very abruptly and unexpectedly decided to ease monetary policy at an emergency meeting, with just 0.50%. This did not have much effect on the dollar, as it continued to depreciate against most currencies. The US stock market was affected and key stock indices began to adjust after a strong collapse. However, the main question is why the Fed was in such a hurry to cut the rate? Why did you do it now? Why couldn't it wait for the March meeting? Why 50 basis points at once? As you know, "coronavirus" was first detected in the Chinese province in December 2019. That is exactly 3 months ago. Distribution outside of China began about a month ago. In China itself, we can say that we managed to localize the epidemic. The number of newly infected people decreases, and the number of recovered people increases. At the same time, the US economy showed no signs of slowing down due to the "coronavirus" or at all. That is we can't say that the economy started experiencing problems and, to support it, the Federal Reserve went for a rate cut. Further, the drop in the stock market. Perhaps the Fed wanted to play ahead of the curve to avoid the 2008 crisis. However, first of all, the future of both the world and American economies will now depend on medicine. Since if the Chinese virus continues to spread, then even if we lower the rate, it will not help the stock market and the economy. Second, why cut the rate by 50 basis points at once?

We believe that Donald Trump, who believes that rates should be zero or even negative, either convinced Jerome Powell of this or found some ways to pressure the Fed. Recall that in America, the Central Bank does not obey the President or Congress. Thus, Trump cannot issue an order. However, in the last three years, it was Trump who "read the mantra" about lowering rates and that the Fed is America's main enemy and not China. It seems that now the Fed has just found a great opportunity to "save face" in front of the public and at the same time meet the requests of the US President. The rate has been lowered. But since the virus has not been defeated, the Fed will still have plenty of opportunities to reduce it even more, again justifying these decisions with a "coronavirus", reinsurance, or a stock market crash. As a result, Trump gets what he needs ahead of the November 2020 presidential election. If this hypothesis is correct, the Fed will continue to cut rates in 2020, and the US dollar now really has the opportunity to complete a long-term upward trend, at least in conjunction with the euro.

From a technical point of view, a strong upward movement is maintained. The lower channel of the linear regression, the moving average line, and the Heiken Ashi indicator are directed upwards. Therefore, it is recommended to consider trading for an increase. The pair has worked out the Murray level of "5/8" - 1.1353, which gives some chances for a downward correction.

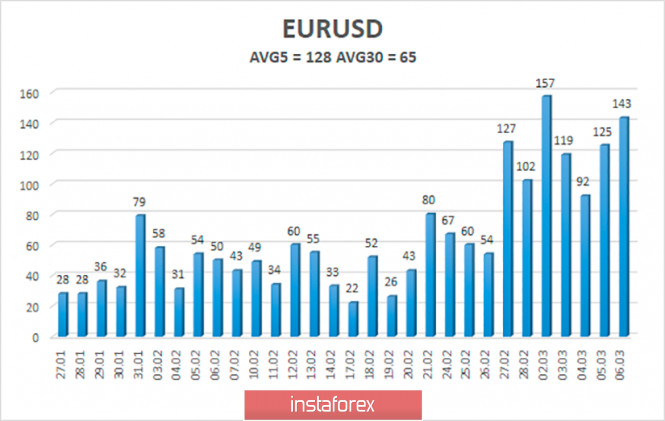

The average volatility of the euro/dollar currency pair remains at record values for the euro currency and has increased to 128 points per day. And these values only once confirm that the markets are now excited and can move unexpectedly and sharply in any direction. Thus, on Monday, we again expect a decrease in volatility and movement within the channel, limited by the levels of 1.1156 and 1.1412.

Nearest support levels:

S1 - 1.1230

S2 - 1.1108

S3 - 1.0986

Nearest resistance levels:

R1 - 1.1353

R2 - 1.1475

R3 - 1.1597

Trading recommendations:

The euro/dollar pair continues its upward trend. Thus, now it is still recommended to trade "on trend". That is, to remain in the purchases of the European currency with the targets of 1.1353 and 1.1412 until the Heiken Ashi indicator turns down. It will be possible to return to sell positions no earlier than fixing the price below the moving average line with the first target of 1.0986, which is still not expected in the near future.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com