24-hour timeframe

The week just ended and the EUR/USD currency pair continued to move down for most of the week. The upward correction sharply began on Friday, February 21, which was facilitated by macroeconomic statistics from across the ocean. At the moment, we can say that the next stage of the downward trend is completed. Thus, the pair can now be adjusted for several weeks, but what are the prospects for the European currency in the future? Has the fundamental background changed dramatically for the pair to expect an upward trend now? From our point of view, no. The situation remained approximately the same as it was. The decline in business activity indices in the services and manufacturing sector Markit in the United States does not mean anything but a local slowdown. The growth of business activity in industrial production in Germany and the European Union is pointless, given the fact that both indicators remained below the level of 50.0. What else could traders pay attention to during the week? There were no important publications in the EU and the US on Monday and Tuesday. The US producer price index was released on Wednesday, which was insignificant. Nothing interesting was published on Thursday. Only Friday remains. Indices of business activity in the US, the EU and Germany, we have already analyzed and made conclusions on them. The consumer price index in the EU remains, which accelerated to 1.4% in January y/y ...

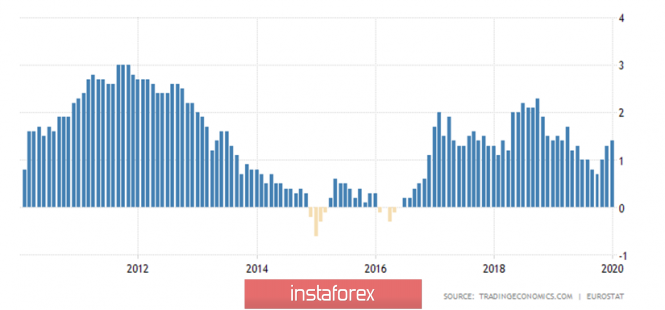

Firstly, it should be noted right away that acceleration to as much as 1.4% y/y is very small. The European Central Bank pays a lot of attention to inflation. Thus, as long as inflation in the eurozone is not stable at 2% or higher, there will be no talk of any tightening of monetary policy. Accordingly, one has to rely on long-term strengthening of the euro. If we analyze the data for the last ten years, we see that there were periods when deflation was generally observed in the EU, and there were periods with inflation between 2% and 3%. But in general, we can say that the ECB was not able to achieve stable 2% inflation, so now Christine Lagarde intends to make structural changes to the ECB, and the monetary committee is considering a proposal to lower the inflation target.

Based on the foregoing, we can conclude that no particular positive changes for the EU economy happened last week. In fact, only one indicator really deserved attention - this is inflation, while the rest (business activity indices) were inconclusive. There were no important publications at all in the United States. The same business activity indexes on Friday were also preliminary. Thus, we believe that nothing has changed in the balance of power between the dollar and the euro, between the ECB and the Fed, between the eurozone and the United States. And what growth of the European currency can we talk about now, if in total it has lost 250 points over the past three weeks?

In addition to the small number of macroeconomic events last week, we also note the complete absence of fundamental events. There was not a single speech by a high-ranking official like Jerome Powell, Christine Lagarde, Stephen Mnuchin or Donald Trump. Even the US president has recently been openly in the shadows after the impeachment procedure has ended. There is no new information on US-China trade talks, although the parties should have already embarked on a "second phase", which, according to many experts, would be much more complicated than the first. Even new information on the topic of presidential elections in the United States is not available. Although not so long ago, various media and analytical agencies regularly published information about political ratings and the chances of winning a particular candidate.

From a technical point of view, an upward correction has begun on the 24-hour chart, but the downward trend remains, since the price is below the critical line. However, the correction may last a long period of time.

Trading recommendations:

The trend for the euro/dollar pair remains downward. Thus, it is recommended that the 4-hour timeframe continue to consider short positions after the formation of new Dead Crosses. The pair began to adjust on the 24-hour timeframe, so short positions will become relevant after its completion.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

The material has been provided by InstaForex Company - www.instaforex.com