The weekend was overshadowed by alarming statistics on the spread of COVID-19 outside of China and the strong increase in infections in South Korea, Japan, and Italy. So, the panic sales are intensifying, European stock exchanges will begin the week in the red zone, as the first data begins to appear, which indicate a much stronger slowdown in the global economy in the last month than previously thought.

Both the PMI Markit index in the US went below expectations, with the service sector index falling to 49.9p in March against the expected 53.4p. The composite index, usually ignored by the ISM-oriented market, declined almost 4 points to 49.6 points, and this is the lowest level in 6 years. As a result, US stock indices lost from 1 to 2%, bond yields fell sharply, and demand for gold scares even experienced traders.

EUR/USD

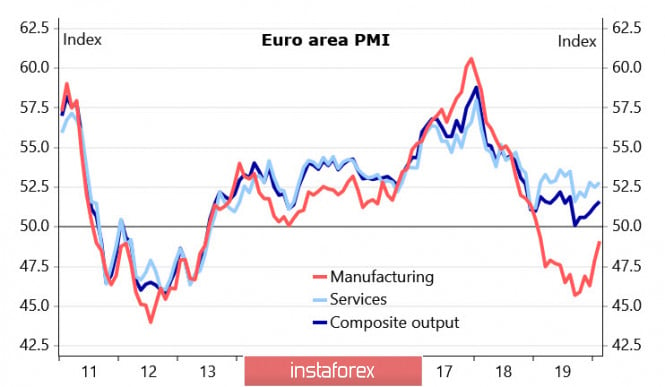

The February Eurozone PMI Markit indices came out with significantly higher forecasts. The activity index in the manufacturing sector slowed down from 47.9p. to 49.1p, the service sector increased from 52.5p to 52.8p, and it seems that companies are still managing to cope with the consequences of the spread of COVID-19 across Europe.

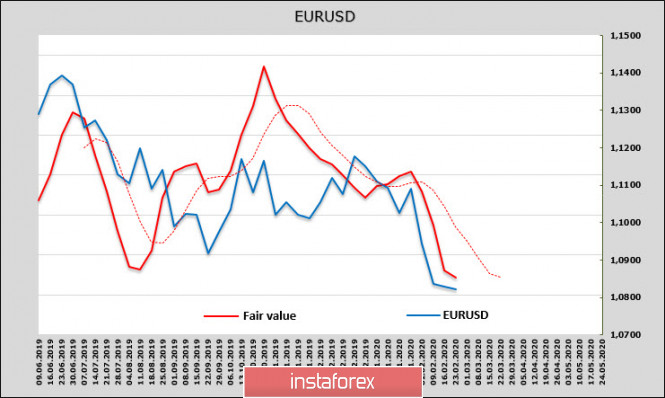

At the same time, the long-term picture of the euro so far looks unclear. According to the CFTC's Friday report, the net short position in the euro increased and reached 91.5 thousand contracts. The dynamics of the current price are negative, and even some of its lag from the current spot price should not be misleading - the euro continues to be under serious pressure.

There were good chances for EUR/USD growth In September-October, but the crisis in the US repo market led to a sharp reaction by the Fed and the measures taken did not allow the upward movement to develop. Since then, investors are skeptical of the European currency, and it is highly likely that the decline will continue.

On the other hand, Ifo German indices for February will be published today. The forecasts are neutral, however, given that Germany's PMI turned out to be worse than the average level of the eurozone, especially in the manufacturing sector, it is likely that Ifo will also come out worse than forecasts.

The decline of EUR/USD on Friday was held back by the weak in the US, but it is unlikely to take long. The Euro remains under strong pressure and is set to decline further. The long-term target of 1.0338 will not move quickly, but it seems inevitable in the current conditions, as capital is preparing to flee Europe before the threat of economic slowdown due to the spread of the coronavirus.

GBP/USD

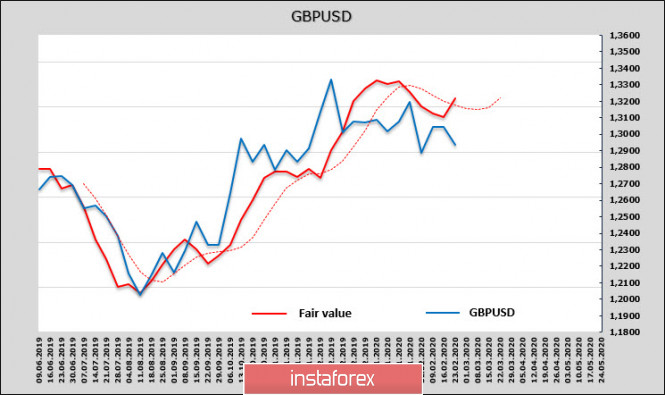

The pound, unlike the euro, feels much more confident. Retail sales in January rose above forecasts, the CBI report on industrial orders showed signs of improvement, the PMI Markit in the manufacturing sector, instead of the forecasted drop, rose from 50p to 51.9p, and the decline in the services sector was insignificant.

In addition, a CFTC report showed that the pound was the only one who was more likely to buy than the dollar. The outlined correctional decline was called into question, since the estimated current price turned up, which means a positive cash flow direction for the pound and growing demand, which can lead to an increase in GBP/USD on the spot.

Tomorrow, the EU should agree on its final goals before the trade negotiations between the EU and the UK, which are expected to start after March 2. The tensions between the EU and the UK are growing as the UK continues to rule out EU compliance, while the EU says it cannot offer a deal similar to the EU-Canada trade deal.

The probability of updating the low of 1.2848 and moving to a wide support zone of 1.2768 / 85 seems to be low, attempts to reduce it is more logical to use for purchases with the expectation of breaking a short-term downward trend that began in December. The nearest goal is the resistance zone 1.3035 / 65, and in case of successful passage, we can expect attempts to increase to 1.3203.

The material has been provided by InstaForex Company - www.instaforex.com