Iran's missile attack on US military bases led to the renewal of maximum oil quotes and gold for the first time since March 2013, exceeding the level of $ 1,600 per ounce. The flight from risk does not yet show signs of panic, but is becoming more pronounced. The military escalation of the conflict in the Middle East will support the demand for defensive assets, primarily gold. On the other hand, Asian stock indexes declined on Wednesday morning by an average of more than 1%. Thus, the opening of Europe will be negative and the probability of panic increases.

In addition, the service industry continues to restrain the US economy from falling into recession, the ISM index rose to 55p in December, not allowing panic to intensify. At the same time, the employment index fell by 0.3p, which will not allow the dollar to resume growth due to concerns about a relatively weak non-farm report, which will be published next Friday.

The employment report will be the key economic driver of the markets in the coming days, since the sharp contrast between the ADP reports and nonfarm a month earlier should lead to a leveling out. In connection with which, ADP is expected to grow relative to November values, and decrease in nonfarm today.

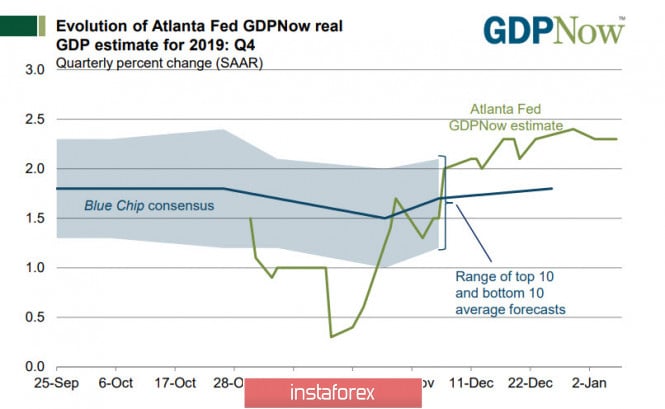

In any case, there is no threat of recession in the near future. The Atlanta Federal Reserve Bank predicts US GDP growth in the 4th quarter at 2.3%, which is even slightly higher than the forecast of the Fed.

Thus, fears that the service sector will not be able to grow forever in isolation from the physical economy will restrain the strengthening of the dollar even against the backdrop of risk aversion.

NZD/USD

The New Zealand dollar remains on the border of activity due to the lack of macroeconomic data and a large number of days off. A 2.8% rise in prices for dairy products as of January 7 restrained the correctional decline, growing concerns about the ability of the world economy to avoid a new crisis limit the activity of bulls.

Meanwhile, the likelihood of another wave of growth and renewal of a maximum of 0.6752 is reduced. A correction is likely to develop to support 0.6550, however, long-term technical indicators are still bullish, so the end of the correction will facilitate the resumption of purchases.

AUD/USD

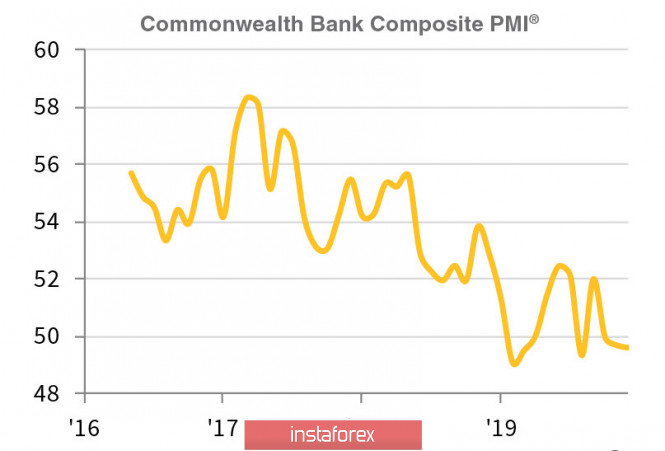

Business activity in December both in production and in the service sector was reduced, which was accompanied by a decrease in employment - the indices remained below 50p, slightly changing compared to November, while the composite index slightly increased from 49.4p to 49.6p.

Respondents attributed the slowdown to temporary factors such as drought. Thus, the "Aussie" did not respond significantly to signals about a slowdown in the economy. The Future Output Index is significantly higher than 50p, which indicates expectations of positive changes in the next 12 months and in the long term helps to strengthen the AUD.

Nevertheless, the Australian is declining at the moment, and the reasons for this decrease both in the good ISM report in the service sector and in a number of published second-level data, which, although they do not directly affect the AUD rate, still confirm the existence of problems in the Australian economy. The employment index from ANZ fell in December by 6.7%, and this is the second largest monthly decline since 2009. Moreover, weekly consumer sentiment also turned out to be weak, -1.7% to 106.2 a week before January 5, compared with the previous week.

Due to this, NAB Bank notes that consumers are increasingly worried about the state of the economy, fearing a large-scale slowdown, which increases the probability of a rate cut at the next RBA meeting on February 4. If the probability of a 0.25% decline was at 38% before Christmas, then it had increased to 60% as of Wednesday morning, which inevitably puts pressure on the Australian currency.

On Thursday, data on activity in the construction sector and the trade balance in November will be published, from which forecasts are negative. Most technical indicators suggest a further decrease in AUD, support of 0.6837, and a breakdown will open the direction to 0.6799. Otherwise, a reversal and growth to 0.6925 / 40 is likely, after which the decline will resume.

The material has been provided by InstaForex Company - www.instaforex.com