Today's eurozone inflation report, which was very much emphasized, did not live up to expectations, and to be more precise, it completely coincided with analysts' forecasts, as a result of which the euro almost did not respond to statistics output, slightly losing against the US dollar. The main reason for the lack of demand for risky assets was core inflation, which has not changed at all, which is likely to force the European Central Bank to continue to take a wait-and-see attitude. I spoke in more detail about the actions of the European regulator in the first quarter of this year in today's review.

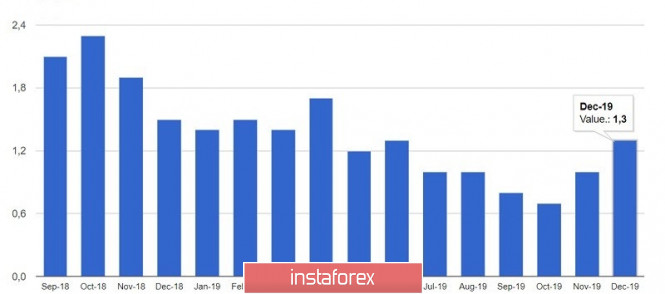

According to the report, the preliminary eurozone CPI increased by 1.3% in December 2019 after rising by 1.0% in November, which is a good indicator of a recovery in pressure. The data completely coincided with the forecasts of economists. On the other hand, the Core CPI preliminary basic consumer price index, which does not take into account volatile categories and energy sources, grew by the same 1.3% in December 2019 as that of December 2018.

The lack of growth in the base indicator once again suggests that the December surge in eurozone inflation was directly related to rising energy prices.

Could not surprise the market and data on retail sales in the eurozone. The report states that sales grew by 1.0% in November last year and by 2.2% compared to November 2018. Economists had forecast growth of only 0.6% and 1.7%, respectively. Let me remind you that, according to revised data, retail sales in the eurozone in October fell to 0.3% compared with September. Sales in November were boosted by black Friday sales.

Today, the inflation report in Italy is also higher, which grew by 0.2% in December 2019 compared to November and only by 0.5% compared to December 2018.

Summing up all this data, we can conclude that at the beginning of this year one should not expect any active action on the part of the European Central Bank. A gradual recovery in inflation is a good sign for the economy, but achieving sustainable growth will not be so simple as it will continue to require the European regulator to maintain interest rates at zero and negative levels, as well as additional stimulation of the economy through the purchase of bonds. The return of moderate economic growth even with such low inflation is possible, although none of the economists expect a sharp jump in GDP in 2020 in the eurozone.

As for the technical picture of the EURUSD pair, the data did not lead to serious changes. Resistance has shifted to the level of 1.1200, a breakthrough of which will provide the market with new buyers of risky assets that can throw the trading instrument higher, to the highs of 1.1230 and 1.1270. Pressure on the euro will return only after the breakout of intermediate support at 1.1165, which will open a direct road to the lower boundary of the side channel at 1.1125.

The material has been provided by InstaForex Company - www.instaforex.com