Yesterday's statistics on the US economy supported the demand for the US dollar, which managed to strengthen against a number of risky assets including euro. Reducing the US trade deficit is a direct credit to Donald Trump, who has imposed trade duties on everything that is possible. Yesterday's report indicated a reduction in imports and an increase in exports, which led to a sharp reduction in the deficit to the lowest level in the last three years.

According to the US Department of Commerce, the foreign trade deficit decreased by 8.2% in November 2019, as compared to the previous month, which has to 43.09 billion dollars. This is in contrast to economists' expectation of a $ 43.6 billion deficit in November. A sharp drop of 5.3% in imports of capital goods, mainly computers and mobile phones, led to an overall reduction of 2.0% in imports in November. Most likely, this is directly related to the additional duties on Chinese goods, which were introduced by the White House administration in September last year. The trade deficit with China decreased by 7.9% in November, as compared to the previous month, which dense to 25.71 billion dollars.

Meanwhile, exports increased by 0.7% in November, as compared to that of the previous month. Growth was seen in consumer and capital goods, as well as the exports of cars and machinery, after the end of the strike at General Motors Co.

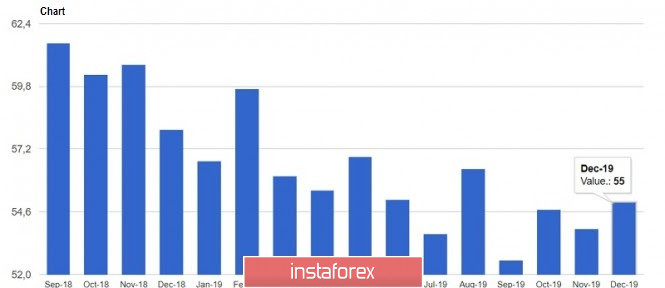

A good report on growth in the US services sector from the Institute for Supply Management (ISM) also led to the rise of dollar against the euro in the afternoon. The current figure once again confirms the strength of the country economy. According to the data, the non-manufacturing index rose to 55 points in December 2019, against 53.9 points in November. Let me remind you that the index values above 50 points indicate the growth of the sector. Economists had expected the index to be 54.3 points in December.

However, problems in the production sector remain. Yesterday, a report indicating a decrease in orders for industrial goods in the United States in November last year was released. The US Department of Commerce notes, however, that the decline was mainly due to the reduction of defense industry goods, since at that time, defense spending had not yet been approved by the US Congress. According to the data, production orders fell by 0.7% to 493 billion US dollars in November, while economists had expected a 0.8% fall. Orders for defense goods also fell immediately by 35.6%, as compared to October.

Data from The Retail Economist and Goldman Sachs, as well as Redbook, were not of great interest to the market.

According to a report by The Retail Economist, the US retail sales index from the week of December 29 to January 4 fell by 0.8%, whereas over the same period in 2018-2019, it increased by 3.5%. Redbook noted that US retail sales fell by 2.6% in the first 4 weeks of December, as compared to November, and the 6.1% rise in the same period in 2018.

As for the technical picture of the EUR / USD pair, euro buyers still have a chance to correct the situation and resume the upward trend. It just needs a return to the level of 1.1180, which will strengthen the lower border of the new upward channel from the lows of January 3 and 7, and will lead to a larger upward correction of risky assets in the area of the highs of 1.1210 and 1.1240. If there is no demand for euro at the lows of yesterday, pressure will remain, which will lead to an update of support at 1.1110 and 1.1070.

The material has been provided by InstaForex Company - www.instaforex.com