The single European currency can not escape from an incredibly narrow range for several days in a row. Even fairly good real estate market data in the United States could not budge it and there is no doubt that this is due to the expectation of today's meeting of the Board of the European Central Bank. It is worth paying attention to the fact that the pound has been much more active lately and is showing quite strong movements unlike the single European currency. Therefore, the single European currency resembles more and more a compressed spring, which can fire at any moment. The only question is in which direction and what will be the reason for this?

It is awesome that the occasion will be the outcome of today's meeting of the Board of the European Central Bank, around which countless rumors and speculations revolve. At the same time, the European Central Bank itself raises the level of nervousness and tension, which becomes the reason for all kinds of speculation. The single European currency, in fact, froze after it became known that Christine Lagarde had almost forbidden the representatives of the European Central Bank to give any comments on the upcoming meeting, as well as on issues of the monetary policy pursued by the regulator. Why was this done? Does the European Central Bank plan to make significant changes to its policies? Will there be a turn towards monetary tightening? Should we expect a reduction in the refinancing rate to a negative value in the near future? Investors have no answers to these and many other questions and there is not even an understanding of the direction in which everything will move. So one can only guess.

Probably, the only thing in which there is no doubt is that no changes in the current parameters of the current monetary policy will follow according to the results of today's meeting of the European Central Bank. From today's meeting, only the announcement of the path along which the European Central Bank intends to move forward is expected and there are not so many options. There are only two of them.

The European Central Bank may continue to pursue its current policy, the logical development of which is to lower the refinancing rate to negative values. In fact, this is not just an overly soft monetary policy, it is precisely a movement towards a further reduction in interest rates. At the same time, the currently dominant economic theory says that if the economic situation worsens, it is necessary to reduce interest rates. So, if we look at this very economic dynamics, then it does not cause any other feelings except sadness. Moreover, only inflation can probably at least somehow please, while all the main macroeconomic indicators look extremely weak. What is the cost of industrial production which has been declining for more than a year? Even retail sales show extremely low growth rates and this is in conditions of incredibly low inflation. Also, based on these facts, it is quite possible that the European Central Bank will not only announce the continuation of the current policy, but even announce some approximate terms for further reduction of interest rates.

Refinancing Rate (European Central Bank):

On the other hand, the same inflation suggests that there is no point in lowering the refinancing rate, since it is growing steadily. Although weak, but still, this is growth. In addition, many years of conducting superfluous monetary policy have not produced the desired results. Rather, on the contrary, you may get the feeling that it is precisely this policy of real negative interest rates that causes the stagnation of the general economic situation. Therefore, you need to somehow change the monetary policy. But, you can change it only in one direction - towards a gradual tightening. And if today, Christine Lagarde declares that the European Central Bank is working on an option to gradually normalize monetary policy in the foreseeable future, then this will produce the effect of an exploding atomic bomb.

Deposit rate (European Central Bank):

So, there are two options for the development of events. Moreover, one will lead to a further gradual weakening of the single European currency, and the other, its sharp rise up. After all, the progressive easing of the parameters of monetary policy and the European Central Bank has been spending almost a decade, during which the single European currency weakened step by step. A change of course in monetary policy will lead to the exact opposite, that is, a long-term strengthening of the single European currency. However, the very fact of a policy change, if it happens, will lead to panic at first, which will cause the explosive growth of the single European currency. And given the diametrically opposite scenarios, the risks are simply off the scale, so it is better to remain cautious, and first wait for the outcome of the meeting of the Board of the European Central Bank.

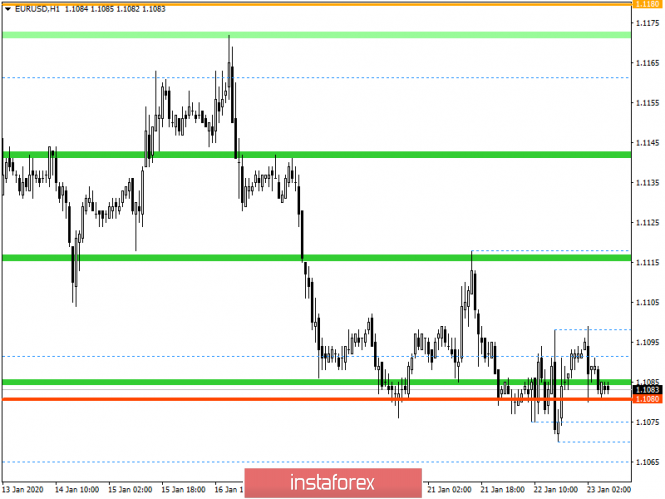

From the point of view of technical analysis, we see a kind of accumulation, along the range of 1.1080, the amplitude of which is slightly more than 30 points. In fact, the process of slowdown has been observed since the beginning of the trading week, which signals the indecision of market participants to action, forcing them to temporarily take a waiting position. This kind of behavior of quotes often signals an impending surge in activity, which many expect.

In terms of a general review of the trading chart, we see that downward interest prevailed in the market from the beginning of the year, having a rebound from a local maximum of more than 150 points. This current development is actually a minimum, which reflects the regularity of the period 12/20/19-26/12/19.

It is likely to assume that the amplitude fluctuation in the range of 1.1070 / 1.1100 will still persist for some time, but with the slightest change in the mood of market participants, a surge in activity will occur, which will be expressed by pulsed candles. Tactics work selected by the method of breakdown of control values of accumulation.

Concretizing all of the above into trading signals:

- Long positions are considered in case of price fixing higher than 1.1120.

- Short positions are considered in case of price fixing lower than 1.1070, not a puncture shadow.

From the point of view of complex indicator analysis, we see a kind of neutral interest caused by the horizontal course. At the same time, indicators are still more likely to decrease than to increase, possibly having a residual signal.