4-hour time frame

Amplitude of the last 5 days (high-low): 44p - 45p - 57p - 25p - 38p.

Average volatility over the past 5 days: 42p (average).

The third trading day of the week ends with an absolute flat for the EUR / USD pair. The daily volatility of the currency pair is minimal again - only 28 points and no distinct upward movement or downward movement was observed during the day. At the same time, the calendar of macroeconomic events is completely empty. Well, traders seem to have decided to wait for tomorrow's results of the meeting of the European Central Bank. Today, we will not repeat once again that the fundamental and macroeconomic background remains entirely on the side of the American currency. Perhaps, these moments will change tomorrow, when the results of the meeting become known and a press conference will be held with representatives of the ECB. In addition, another speech by ECB President Christine Lagarde is scheduled for Friday, so we will definitely find out any new information from the lobby of the European regulator by the end of the week.

Most experts agree that no change in the parameters of the monetary policy of the ECB should be expected. A number of factors speak in favor of this. Firstly, the easing of monetary policy in September 2019 yields certain results (then the regulator lowered its key rate and resumed redemption of assets from the open market). Although inflation remains at low values far from the target, it has accelerated in recent months from 0.7% y / y to 1.3% y / y. Secondly, there were no hints of possible changes from members of the ECB's monetary committee. However, from our point of view, the first factor is absolutely ambiguous, and it can be interpreted in different ways. It turns out that the ECB went on easing monetary policy in September, and we saw the absolutely minimal inflation rate in October while inflation dropped to 0. 7% y / y which is already at ultra-low rates on deposits and loans. However, the ECB lowered the rate to -0.4% even earlier, respectively, respectively, past measures to soften monetary policy had only a temporary positive effect and it could be exactly the same this time. Moreover, inflation will be at more or less decent levels for some time, but all the factors that negatively affect it have not disappeared. The United States-China trade war continues, and it is not known whether it will escalate during 2020. On the other hand, US President Donald Trump openly stated at the international economic forum in Davos that he was preparing to impose sanctions on products of the European Union's engineering industry if "Europeans do not want to sign a trade agreement." The European Union, of course, answered Trump that he would introduce mirror duties on imports from the US. However, absolutely everyone understands that the EU-US trade war will put new pressure, primarily on the economy of the European Union. It turns out that the rate has been reduced and inflation has "risen", but a new blow may be dealt to the EU economy in the near future, and inflation and other macroeconomic indicators may fall down again. Furthermore, the industrial sector is now in extremely poor condition in the eurozone even if you do not take into account the potential trade war. Business activity in all EU countries is at extremely weak values, industrial production is declining. Thus, this phenomenon itself already requires additional stimulation of the economy, additional investments in the economy. We believe that the ECB, approximately, like the Bank of England, may not go for another easing of monetary policy right tomorrow, but the fate of the key rate is almost decided. The only question is when will the regulator go for another reduction?

Separately, it is worth noting the speech of Christine Lagarde, as it is she who can confirm the market concerns or, conversely, dismiss them or at least it can bring market participants up to date, as it previously announced structural changes to the ECB. According to Christine Lagarde, the ECB can revise its policy, which has not changed since 2003. Accordingly, its new goals will be set, and depending on ways to achieve them will be evaluated through all the same monetary policy instruments. Thus, in essence, it is Christine Lagarde's speech on Thursday and Friday that will become the key events of the week for the euro / dollar pair.

Based on the previously mentioned, we believe that the euro can fall under the pressure of traders again, since nothing optimistic is simply not expected. Of course, more accurate conclusions should be drawn after the speech of the head of the ECB, but now, it is becoming clear that even hypothetical positive points may be few.

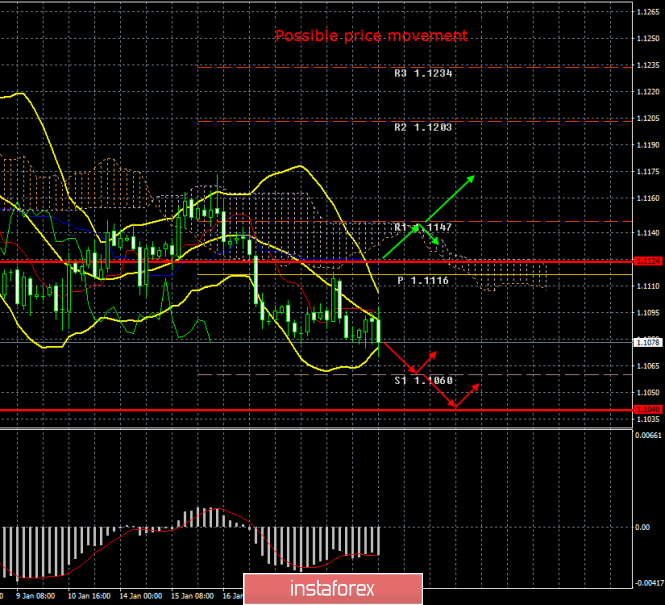

The technical picture of the pair shows a downward trend. Therefore, we believe that sell orders remain relevant. All indicators are directed downward, only the average volatility remains low, and it has completely dropped to its minimum values in recent days.

Trading recommendations:

EUR/USD continues to move down. Thus, it is recommended that you either hold open shorts with targets 1.1060 and 1.1040, or open new ones with new signals (MACD turn down or a rebound from the Kijun-sen line). It will be possible to consider purchases of the euro / dollar pair not earlier than the traders of the Senkou Span B line break through the first goal - the resistance level of 1.1203.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dashed lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com