4-hour timeframe

Amplitude of the last 5 days (high-low): 148p - 83p - 179p - 135p - 106p.

Average volatility over the past 5 days: 131p (high).

The British pound followed the example of the European currency and jumped on the first trading day of the new week. At the moment, the GBP/USD pair has worked out a critical line and is now preparing to either bounce off this line or overcome it. In the first case, the downward trend will resume, which, from our point of view, is most fundamentally justified at this time. In the second case, the bulls will get a chance to form an upward trend, which has very little fundamental support. One way or another, and Monday, January 6, was held in fairly active trading and not without macroeconomic reports, which played an important role, determining the mood of traders.

First, consider macroeconomic statistics, which in the UK were expressed by only one report - the index of business activity in the service sector for December. This indicator unexpectedly increased and amounted to 50.0. Thus, the first of three indexes of business activity in Britain left the area of decline and this is certainly optimistic news. It was against this background that the British currency began to grow, which, however, continued at the US trading session, despite the strong business activity indexes published in America. Okay, write off the fact that market participants ignored these indices due to their weak significance. More important are the ISM business activity indices, the first of which has already been published (in the industrial sector) and failed. Tomorrow the second will be published, in the services sector.

Meanwhile, a month after the parliamentary elections in the UK took place, we would like to analyze their results in more detail. Indeed, the future of Great Britain in the next few years will depend precisely on these results. I would immediately like to note the fact that these were the most paradoxical and most unusual elections in the last few decades. The defeat of Jeremy Corbyn and the Laborites was associated with the lack of a clear position on Brexit among them. However, we believe that such an interpretation in itself is ambiguous. How should any parliamentary election be held? Voters should study the election promises of each party and vote for one or another politician, based on the closeness of party principles. How was the last election in Britain? In fact, the question was whether Brexit (the struggle between Labour and the Conservatives) would take place, the smaller political forces were elected on the principle of "we want or do not want to stay in the European Union". As a result, we have a Conservative victory, not because over the past few months Boris Johnson has sharply gained several tens of percent of popularity, but because most of the British people are simply tired of the incomplete Brexit, of uncertainty. Therefore, almost everyone in a row voted for the Conservatives, who simply wanted the Brexit issue to be completed as quickly as possible.

By the way, official voting results say that Conservatives won in the largest number of districts, but in these districts themselves their advantage over competitors is low. For example, Conservatives gained about 40% of the vote in many districts, which was enough to win. That is, it is easy to guess that Laborites in such districts gained 30-35% each. Hence the conclusion: the popularity of the Conservatives has slightly grown, the Labour Party has decreased, and the Liberal Democrats, Scottish Nationalists and Greens have increased. Such a mess led to the result expected by all, since he was the only one that gave a definite answer to the question "how long will the country be in limbo?" Experts also note that a sufficiently large number of votes previously given to the Labour Party did not go to the Conservatives, but to other political forces, which supported ... the Conservatives, thanks to the essence of the current electoral system in the UK.

Now Britain is still facing the same "hard" Brexit, the loss of Scotland, the riots on the island of Ireland, questions about Gibraltar and many other charms. But now the fate of the United Kingdom is tightly squeezed in the hands of Boris Johnson, who has full power in the country and can, in fact, do whatever he wants. All opposition forces combined will not be able to stop Johnson, even if they want to. This is the main danger to the British people and the whole country. In fact, there will not be any democracy in Great Britain now. Any bill proposed by Johnson will be approved almost automatically. Such a monarchy could lead Britain to a standstill, completely change its foreign policy course and in general it is not clear how to end.

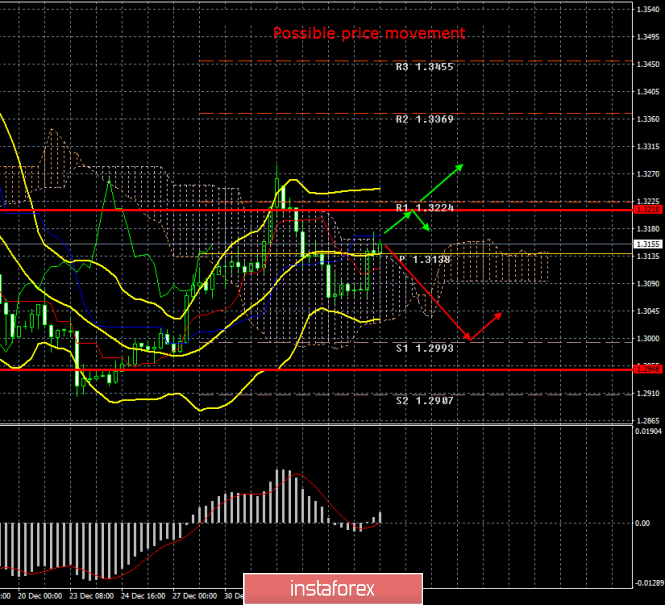

From a technical point of view, the pound/dollar currency pair is now being adjusted. We expect the upward correction to complete near the Kijun-sen critical line and the resumption of the downward trend.

Trading recommendations:

The GBP/USD pair started a correction. Thus, traders are advised to wait for the price to rebound from the Kijun-sen line and resume trading with lower lots for the purposes of 1.2993 and 1.2948. It is recommended that purchases of British currency be returned no earlier than when the price consolidates above the Kijun-sen line with the first target at 1.3210.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com