Earlier this year, after a slight correction, euro continued to recover against the US dollar. Yesterday, good data on the services sector helped the pair in regaining a number of positions against the US dollar, however, short-term positive factors alone are not enough to form a more stable trend. Most likely, the Euro zone economy will start the year with stagnation. The active persistence of Germany against increasing fiscal spending, as well as the probability of the European Central Bank reviewing its attitude regarding the target inflation rate and monetary policy will create problems to the buyers of risky assets at the beginning of this year. We can talk about the formation of a stable demand for euro only after solving the problems in the economy, as well as after the European regulator talks again about tightening the monetary policy. Let me remind you that such conversations at the end of 2018 resulted in another economic downturn. Time will tell how it will be this time, however, it is still too early to think about it.

As I said above, only the change of Germany's course in increasing fiscal spending will help euro to form a medium-term upward trend against several currencies. According to a number of economic agencies, only such an approach will quickly support the German economy's problem of being on the verge of a recession. All that was required of the European Central Bank was done last year, including the deposit rates's reduction to a new negative level, as well as the return to the bond repurchase program. Now, much will depend on the positions of the central banks of the leading European economies. The European Central Bank's head, Christine Lagarde, has repeatedly drawn attention to this. Experts note the possibility of creating a banking or fiscal union as one of the options for increasing budget expenditures,

Another important problem for the European currency at the beginning of this year is ECB's option of changing the approach to its strategy on monetary policy and inflation. Last year, there were hints from the regulator on the probability of changing the target inflation rate in the Eurozone, which is now about 2.0%. If the ECB reacts differently to inflation and interest rates, it will provoke tensions within the Eurozone, and will lead to a disagreement among central bankers, particularly Germany, as it has long been an opponent of the soft exchange rate-monetary policy.

And so, the exchange rate of the European currency in the first quarter will directly depend on the changes that will occur or will not occur in the minds of the European Central Bank leaders.

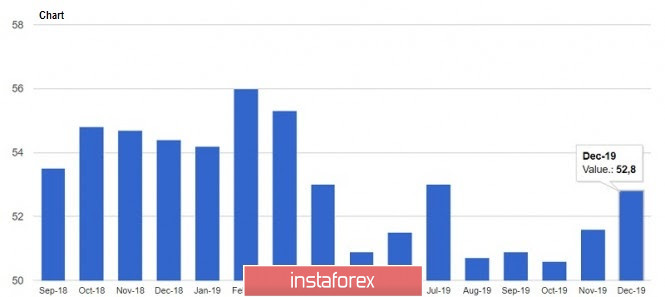

As for the fundamental data on the US economy, yesterday's report from Markit regarding the services sector led to only a slight strengthening of the US dollar against a number of world currencies. According to the report, the purchasing managers' index (PMI) for the US services sector rose to 52.8 points in December this year, which is slightly higher than economists' forecasts who expected that in December, it will remain unchanged at 52.2 points, similar to that of November last year.

During an interview yesterday, the former president of the Federal Reserve Bank of New York, William Dudley, said that the current system of control over interest rates, such as the REPO mechanism that the Fed conducts to eliminate the lack of liquidity in the market, is working very well and can take its place on a permanent basis. The rationality of this approach really helped keep short-term interest rates from excessive fluctuations that occurred against the background of a sharp lack of liquidity during the early autumn of 2019. It is likely that the Fed may seriously resort to longer-term REPO operations to maintain the balance sheet. Still, it is better than the other asset buyback program, through which the economy was pumping billions of dollars.

As for the technical picture of the EUR/USD pair, the level of 1.1210 remains in front of the bulls. The upward trend, which is aimed at the highs of 1.1240 and 1.1270, will only continue if a breakthrough of this area will take place. If buyers of risky assets do not get on with their task, it is likely that a downward correction will happen in the area of support levels 1.1175 and 1.1150.

USD/CAD

The Canadian dollar continues to strengthen its position against the US dollar on the background of rising oil prices and yesterday's report of a rise in producer prices in November last year. According to the National Bureau of Statistics of Canada, the price index in the Canadian industry increased by 0.1% in November, as compared to the previous month. The increase in prices was directly related to the rise of the price of dairy and meat products. Meanwhile, producer prices fell by 0.4% in November, as compared to the same period of the previous year.

As for the technical picture of the USD/CAD pair, the upward trend of the Canadian dollar, which was formed at the beginning of December last year, may continue, however, dealing with important levels is quite necessary. We are talking about the price in 1.2900 and the larger range of 1.2780 in particular, as the strengthening of oil prices will only contribute to the movement of the USD/CAD pair to these levels.

The material has been provided by InstaForex Company - www.instaforex.com