Geopolitics remains the main driver of markets on Tuesday morning. Iran announced a decision to withdraw from the nuclear deal and not comply with any restrictions on uranium enrichment, the Iraqi parliament voted to expel American troops, and Trump promises the most severe measures to everyone who entered into an in-depth discussion with him.

Moreover, retaliation from Iran will in fact be very restraine, while the markets assess the probability of military escalation as low. The markets react as expected, but there is no increase in panic. Meanwhile, gold updated a 6-year high, the yield on 10-year US Treasuries fell to 1.8%, and EUR/USD is trading at the lower end of the range. In turn, oil remains in the region of half-year highs, supporting commodity currencies, but the first emotional reaction of the market turned out to be generally not very strong and has already partially won back, that is, markets are looking for new levels of equilibrium and are not ready to develop panic movement.

EUR/USD

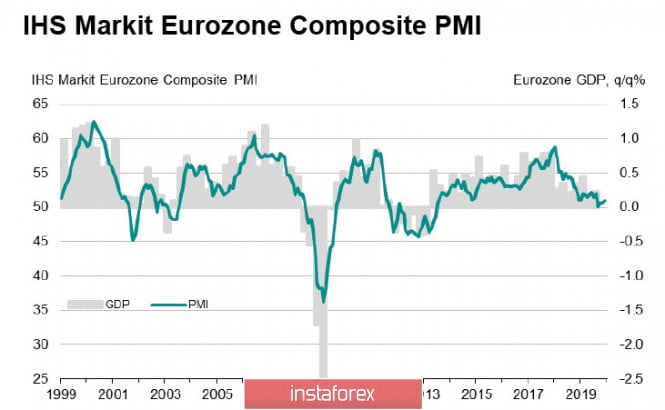

The euro is on a growth wave after the publication of revised PMI data. According to which, the German economy finally resumes growth for the first time since August, the combined PMI was 50.2p against 49.5p, the data for Spain and Italy also exceeded expectations, and the fact that the eurozone summary PMI did not fall below 50p. As a result, it looks like a clear addition for the euro.

The leading indicator of the business climate in the Eurozone, Sentix grew in January to 7.9p against 0.7p a month earlier, while a fall was forecasted, rather than an increase.

On the other hand, short-term EUR/USD remains weak bullish. The nearest support is 1.1160 / 80, and below which, a decrease is unlikely. At the same time, resistance is consistently 1.1215, 1.1225, 1.1240. The maximum is unlikely to increase, since the growth of geopolitical risks will not contribute to the sale of the dollar.

GBP/USD

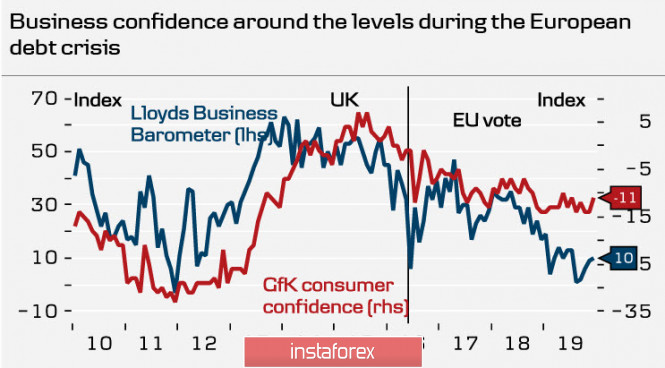

The first data from the UK this year looks mixed. The decline continues in the manufacturing and construction sectors: with PMI indices of 47/5 and 44.4 in December, which is close to November levels. Moreover, there is a slight recovery in the services sector - the index has grown from 49p to 50p, however, we are not talking about a long-term reversal in sentiment.

In connection to this, Brexit's theme remains dominant on news feeds, but its importance is gradually declining. The UK is about to leave the EU by January 31, but the process is still far from over by law. After this period, EU leaders should agree on an agenda for negotiations. On February 25, approval of the mandate at the EU summit is expected, and the negotiations themselves will begin in March.

The terms are extended, which means that the emphasis at this time will be shifted to the economy and the Bank of England, which remained in the background for quite some time. Two out of 9 BoE members voted in favor of a rate cut at the last two meetings. The economy looks weak, and therefore, a 0.25% rate cut will become quite likely in the near future. This is possible even in January, but rather, the Bank of England will announce the need to collect more data, so the decline will be postponed to the spring, and the pound will accordingly be under pressure in the coming months.

Meanwhile, business conditions go into the stabilization zone, so investors will wait for signals to resume activity in long-term projects. However, inevitable future difficulties in the negotiations (negotiations began in March, and after July 1 extension of the transition period is excluded, which will inevitably lead to time pressure) will not allow to count on the completion of the period of uncertainty.

Thus, the pound still looks weak for a long time. The EUR/GBP rate will continue to recover and will move to the level of 0.87 as problems are voiced in the negotiation process. Against the dollar, the pound will look a little stronger, so consolidation is the most likely scenario for the next two days. Support is found at 1.3120 / 30, while further decline to the next support 1.3040 / 50 is unlikely. The border of the channel is 1.2980 / 90. Growth is limited by the zone 1.3230 / 60 and the chances of testing the December maximum 1.3512 are extremely small.

The material has been provided by InstaForex Company - www.instaforex.com