Economic calendar (Universal time)

In today's economic calendar, you need to pay attention to the following events:

9:30 (UK) - data on indexes of business activity in the services sector;

13:15 (USA) - change in the number of people employed in the non-agricultural sector;

15:00 (USA) - Procurement Managers Index for the non-manufacturing sector;

15:30 (USA) - crude oil reserves.

EUR / USD

The strength of the resistance that was met yesterday (area 1.1082 daily Kijun + weekly Fibo Kijun + upper border of the daily cloud) managed to delay the further development of players to the upside. As a result, there has been inhibition, which can lead to the formation of rebound. In this case, support can be 1.1055-61 (weekly Tenkan + daily Fibo Kijun) and 1.1030-37 (lower boundary of the daily cloud + daily Tenkan). Now, breaking through the encountered resistance (1.1082) and the liquidation of the daily cross (1.1102), as noted earlier, will open the way to the most significant resistance of this area at 1.1145 (monthly Tenkan + weekly Kijun).

On the other hand, both key levels of low halves (1.1080 central pivot level + 1.1033 weekly long-term trend) are currently reinforced by important milestones from high halves (1.1082 congestion of levels of different halves + 1.1030 lower border of the daily cloud and daily short-term trend) Thanks to this, conditions are now in place that can rely on the strengthening of the bears when consolidating and staying at 1.1080 (central pivot level). Today, the main reference point in case of decline will be 1.1033 (weekly long-term trend). With the resumption of bullish activity, exit from the correction zone (maximum 1.1093) and the restoration of the upward trend, 1.1107 (R2) - 1.1121 (R3) can appear as resistance within the day.

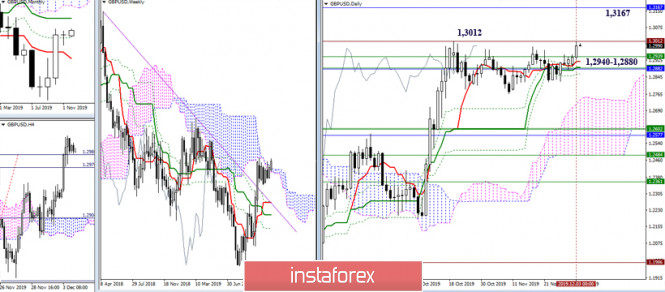

GBP / USD

At the same time, players on the upside tested the maximum extreme of October (1.3201) and are close to leaving the zone of long confrontation, which led to the sideways movement in November. The tasks to strengthen the bullish moods are now reduced to breaking through the resistance of the maximum extremum (1.3201) and fixing in the bullish zone relative to the weekly cloud, with subsequent advancement to the monthly medium-term trend (1.3167). In the case of a rebound from 1.3012, the accumulation of supports under the current conditions continues to remain in the zone of 1.2940 - 1.2880.

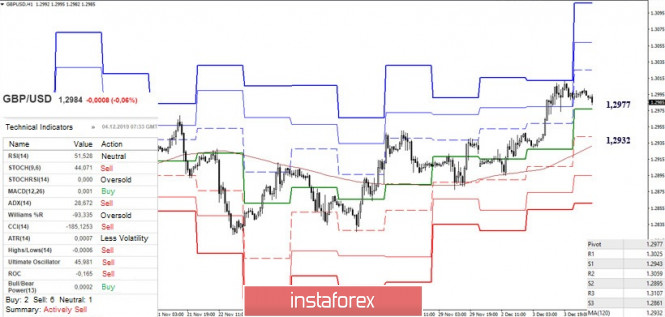

Yesterday's rise allowed the classic pivot levels to expand the boundaries of bullish opportunities to 1.3025 (R1) - 1.3059 (R2) - 1.3107 (R3) today. However, there is a development of a downward correction in the lower halves at the moment, which most technical indicators have already set up to support. Today, key support for the development of the decline on H1 is located at 1.2977 (central pivot level) and 1.2932 (weekly long-term trend).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com